Oil prices spiked at the start of the week following U.S. airstrikes on Iranian nuclear facilities, triggering fears of a broader conflict and potential disruption to global energy supply chains, as Iran's parliament authorized the government to shut the Strait of Hormuz.

Brent crude climbed above $80 per barrel, while U.S. benchmark WTI reached $77, both gaining over 4% during early Asian trading on Monday. Although prices later eased slightly to $77.87 and $74.62, respectively, markets remained on edge amid intensifying geopolitical uncertainty.

The U.S. Dollar Index also rose by 0.3% to 98.592 on Monday as investors sought safe-haven assets in the face of growing uncertainty. However, gold began the week slightly lower, down 0.3% to $3,356 per ounce.

Iran, which produces around 3.3 million barrels of oil per day, exports nearly half of that amount. Any disruption to its shipments—or interference with vessels in the Strait—could unleash a broader energy crisis with far-reaching economic consequences.

The strategic Strait of Hormuz—a narrow waterway linking the Persian Gulf with the Arabian Sea—has come into sharp focus. Around one-third of the world’s seaborne oil and one-fifth of global liquefied natural gas (LNG) pass through this chokepoint daily. It plays a vital role in the energy exports of Gulf nations, particularly Saudi Arabia and the United Arab Emirates.

While shipping activity in the Strait continues for now, Iranian officials have made pointed remarks that suggest a change may be imminent. On Sunday, Esmail Kowsari, a member of Iran’s parliamentary National Security Commission, told domestic media that the legislature had concluded the strait should be closed. However, he added that the final decision rests with Iran’s Supreme National Security Council. Kowsari emphasized that the closure remains a strategic option and would be carried out "whenever necessary".

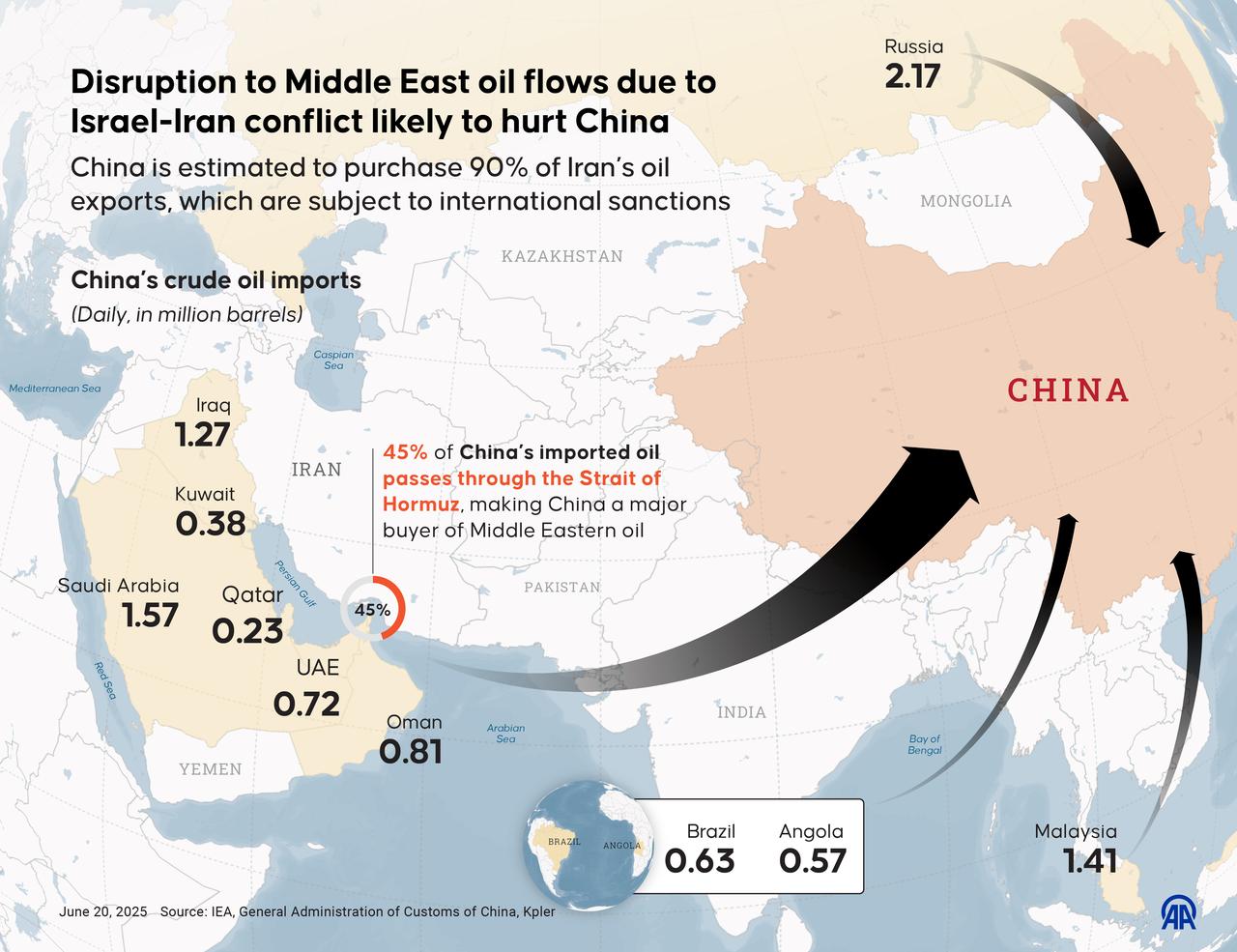

In Washington, U.S. Secretary of State Marco Rubio addressed the matter during an interview with CBS’s “Face the Nation,” noting that the potential closure of the Strait of Hormuz would reverberate far beyond the United States. He stated that such a move would primarily hurt China, given its heavy reliance on oil shipped through the strait, but warned that it would carry global consequences.

“If Iran closes the strait, it will be economic suicide for China. And we retain options to deal with that, but other countries should be looking at that as well. It would hurt other countries' economies a lot worse than ours,” Rubio said, describing the scenario as an act of economic self-sabotage. He argued that such a decision could unite the international community against Tehran, with severe repercussions for the Iranian regime.

China, the world's largest oil importer, relies heavily on the Strait of Hormuz, with imports from the region accounting for 90% of its total oil supply. Meanwhile, China is also the largest buyer of Iranian oil, making up 90% of Iran’s total oil exports, according to commodity intelligence firm Kpler.

China's Permanent Representative to the United Nations Fu Cong stated on Sunday that the U.S. strikes on Iran's nuclear facilities constituted a serious violation of the U.N. Charter and Iran's sovereignty, adding, "Peace in the Middle East cannot be achieved through the use of force."

Financial institutions are preparing for further turbulence. Goldman Sachs noted that although it currently assumes no immediate disruption to energy flows, the likelihood of a supply shock has increased. It said that if Iran alone cuts output by 1.75 million barrels per day, Brent prices could rise to $90 per barrel. In a more extreme scenario involving a 50% drop in Hormuz traffic for one month—followed by an 11-month period with a 10% decline—Brent could temporarily spike to $110.

JPMorgan has previously projected that Brent prices could reach as high as $130 in the worst-case scenario involving sustained regional instability. Meanwhile, natural gas markets are also beginning to react, with Dutch TTF futures approaching €74 ($85) per megawatt-hour, or roughly $25 per million British thermal units.