Deutsche Bank anticipates a steady pace of interest rate cuts by the Central Bank of the Republic of Türkiye (CBRT) throughout 2026, projecting a 100 basis point reduction at each monetary policy meeting, the German lender's Türkiye economist Yigit Onay said Wednesday.

That would amount to a total reduction of 800 basis points if the central bank were to hold eight Monetary Policy Committee (MPC) meetings throughout the year, as it did in 2025, bringing the policy rate down to 30%.

The bank also expects headline inflation to continue declining to 24% by the end of the year.

Speaking during a broadcast on CNBC-e, Onay said that stronger-than-anticipated domestic demand has slowed the pace of disinflation in the country, making price stabilization more challenging.

Addressing the expectations regarding the central bank’s official inflation projections, Onay stated that the CBRT is not expected to revise its inflation forecasts hastily in its upcoming reports.

"The CBRT is unlikely to act quickly when updating its forecasts," he said, adding that no significant revisions are expected in the first inflation report of the year.

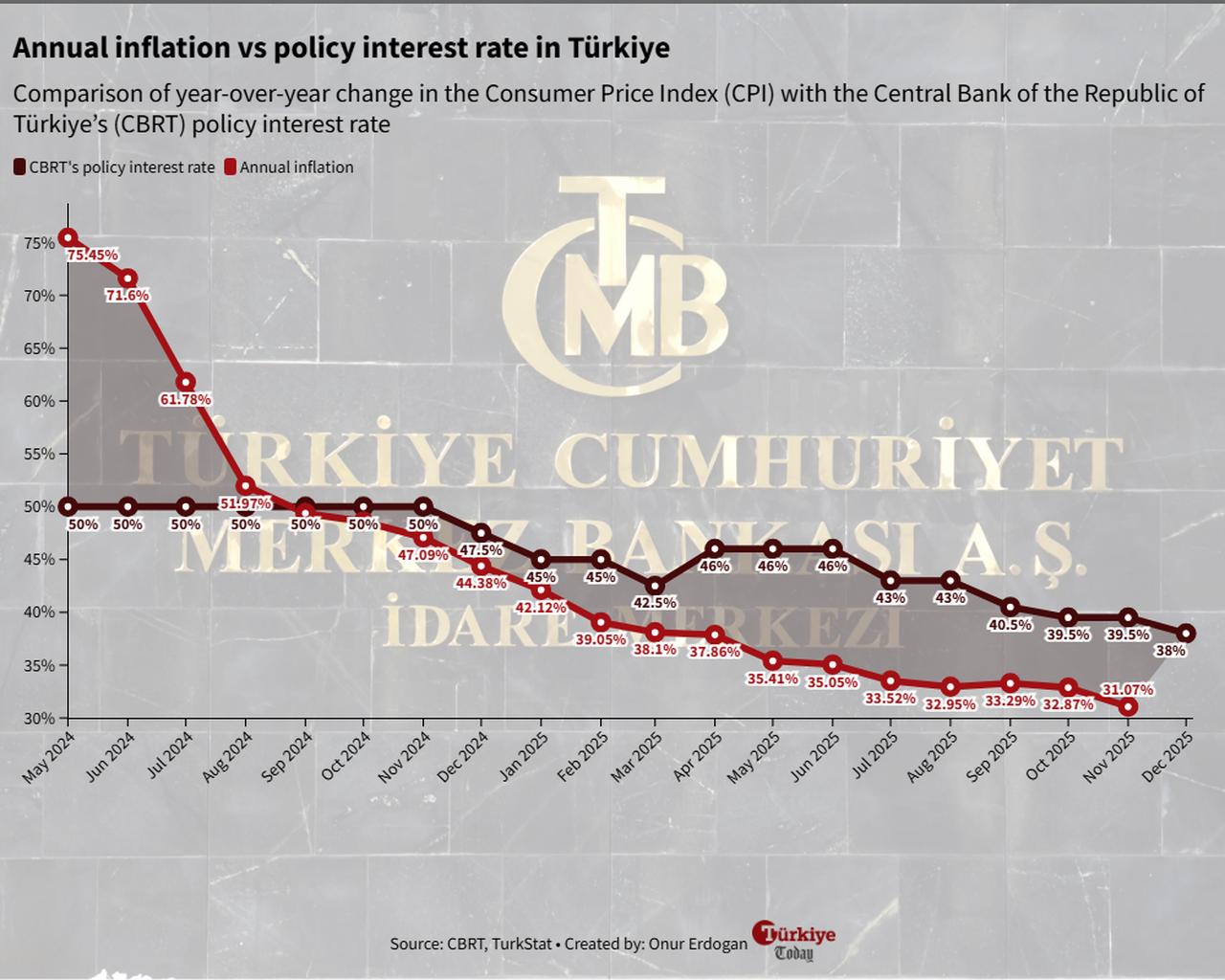

Türkiye's inflation dropped to 31.07% in November and is likely to remain around 31% in December, representing a year-over-year decline of 13 percentage points.

The Turkish central bank first resumed the easing cycle in December 2024, delivering 250 basis points of cuts until March 2025, lowering the policy rate to 42.5% from 50%, which had been in force since late 2023. However, this pace was interrupted by March's political tensions and heightening global trade tensions in April, leading the policymakers to hike the rate to 46%.

Since beginning the easing cycle in July, the central bank has implemented a total of 800 basis points cut, with the size of the reductions trimmed over the last two meetings.

"The step size is reviewed prudently on a meeting-by-meeting basis with a focus on the inflation outlook," the central bank said following its last MPC meeting. "The monetary policy stance will be tightened in the event of a significant deviation in the inflation outlook from the interim targets."

According to the latest inflation report of the year, the central bank projects inflation to remain in the range of 31% to 33% by the end of 2025 and 13% to 19% by the end of 2026, while maintaining interim targets of 24% and 16%, respectively.