Türkiye’s export-focused manufacturing sectors lost further ground in early 2025 as the country’s cost-based competitiveness index fell to its lowest level in a decade.

This staggering deterioration also heavily reflects on Türkiye’s trade balance and investment flows, with the import-driven trade gap continuing to widen and both foreign direct investment inflows and outward direct investment by Turkish firms accelerating.

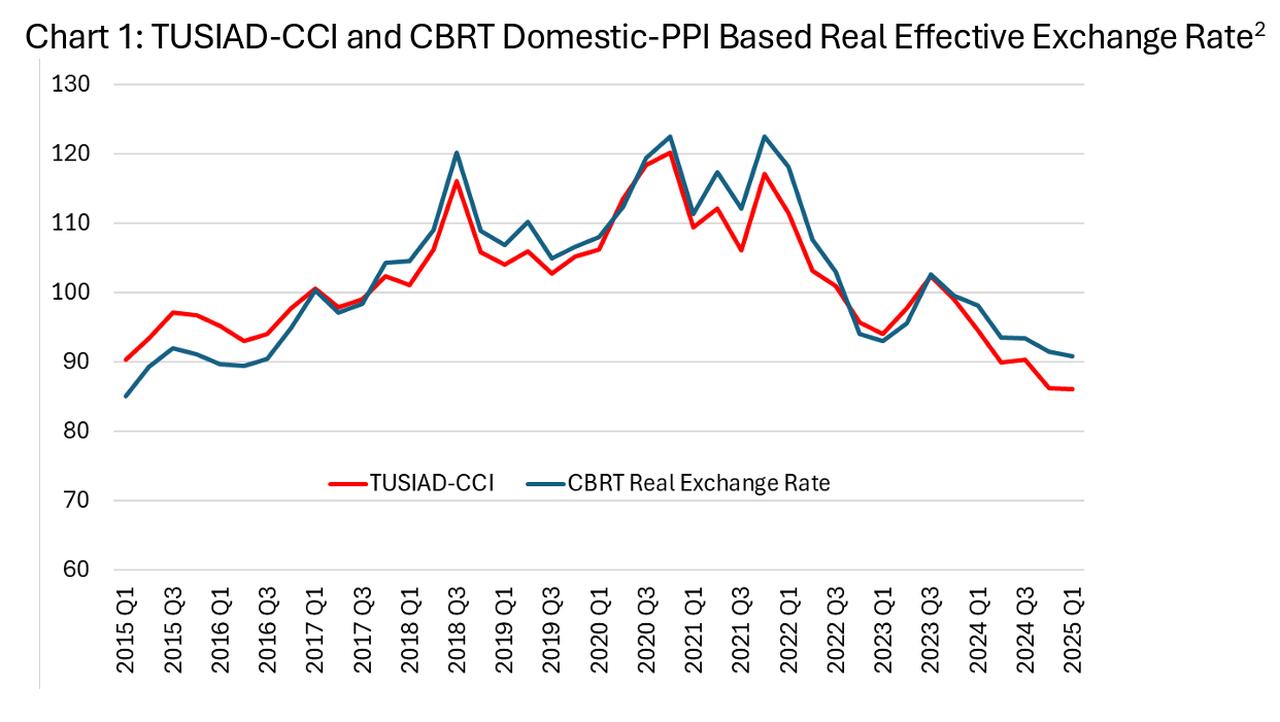

According to the Turkish Industry and Business Association (TUSIAD), the Competitiveness Index (CCI) stood at 86.15 in the first quarter of 2025, down from 90.3 in the same quarter of 2015 and significantly below the 2020 peak of 120.23.

The index, which compares Türkiye’s domestic production costs with those of key competitor countries, has now declined for six consecutive quarters, illuminating sustained pressure on exporters stemming from rising input prices and wage inflation when measured in U.S. dollars.

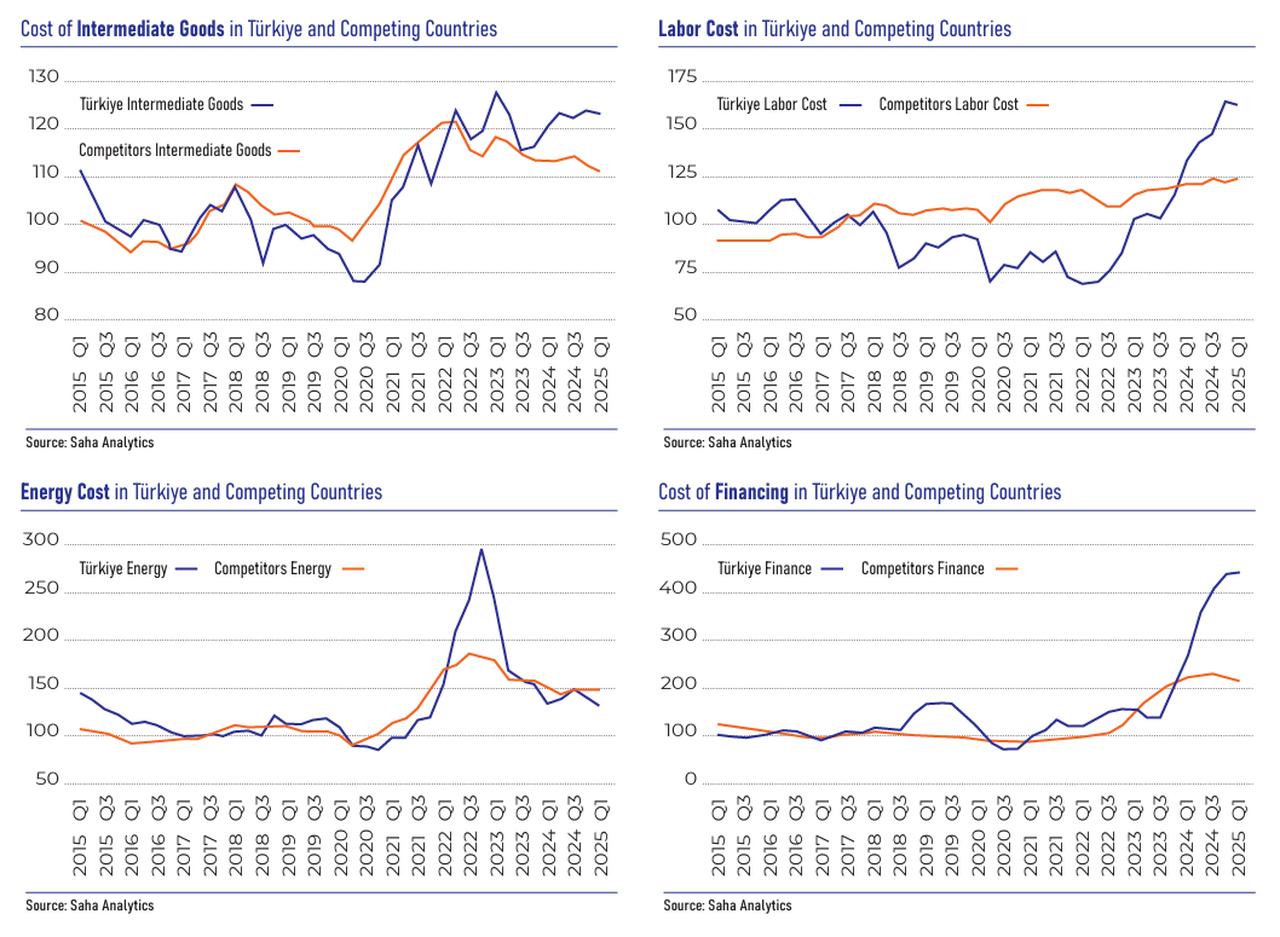

Increased costs for intermediate goods and labor mainly drove the latest annual decline of 8.9% in the TUSIAD-CCI. According to the underlying data, 4.8 percentage points of the drop came from intermediate input prices, 3.2 points from labor costs, and 0.9 points from financing costs. Energy, by contrast, had a marginally positive effect, as domestic prices fell 6.3% from the previous quarter.

Although intermediate goods costs decreased slightly in Türkiye, the decline was less pronounced than in competitor countries. The resulting relative cost disadvantage contributed directly to the deterioration in the competitiveness index. Labor costs also eased marginally by 1% quarter-on-quarter but remained elevated in real terms after earlier surges. Financing costs increased again by 0.8%, albeit at a slower pace.

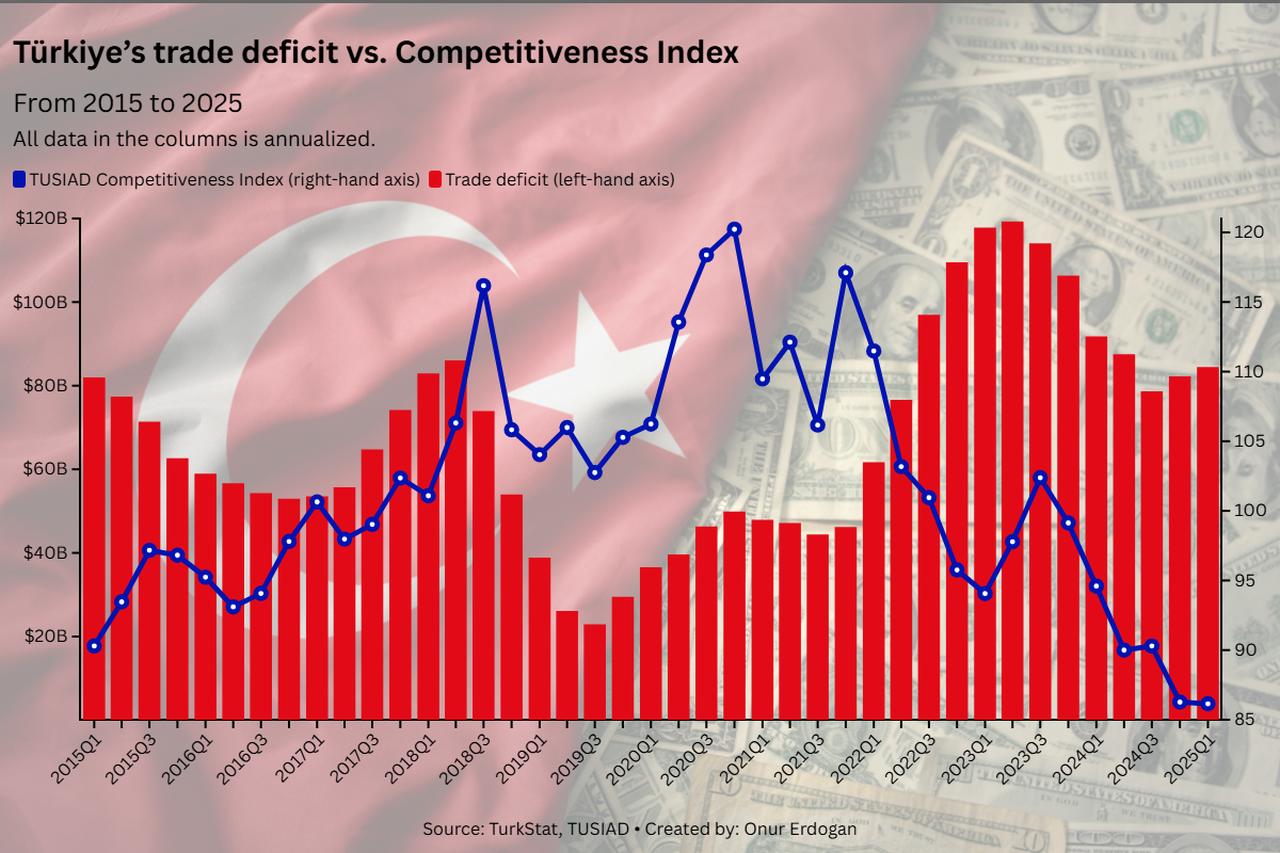

Shrinking competitiveness has also been clearly reflected in Türkiye’s macroeconomic trends, particularly in its trade balance. The country’s annualized trade deficit reached $84.46 billion in the first quarter of 2025, according to the Turkish Statistical Institute (TurkStat).

Over the past decade, the steady erosion in cost-based competitiveness has directly contributed to the widening of this gap. Despite export volumes reaching an all-time high in May, domestic producers continue to struggle with cost efficiency compared to global peers—mainly due to their reliance on imported intermediate goods.

The structural nature of this imbalance is evident: as the competitiveness index fell from over 120 in 2020 to 86 in 2025, the trade deficit more than doubled from the low levels recorded in 2020. Türkiye’s industrial sector remains heavily dependent on imported intermediate goods, which accounted for 71.2% of inputs during the same period. The cost of these goods has continued to rise due to global pricing trends and exchange rate fluctuations.

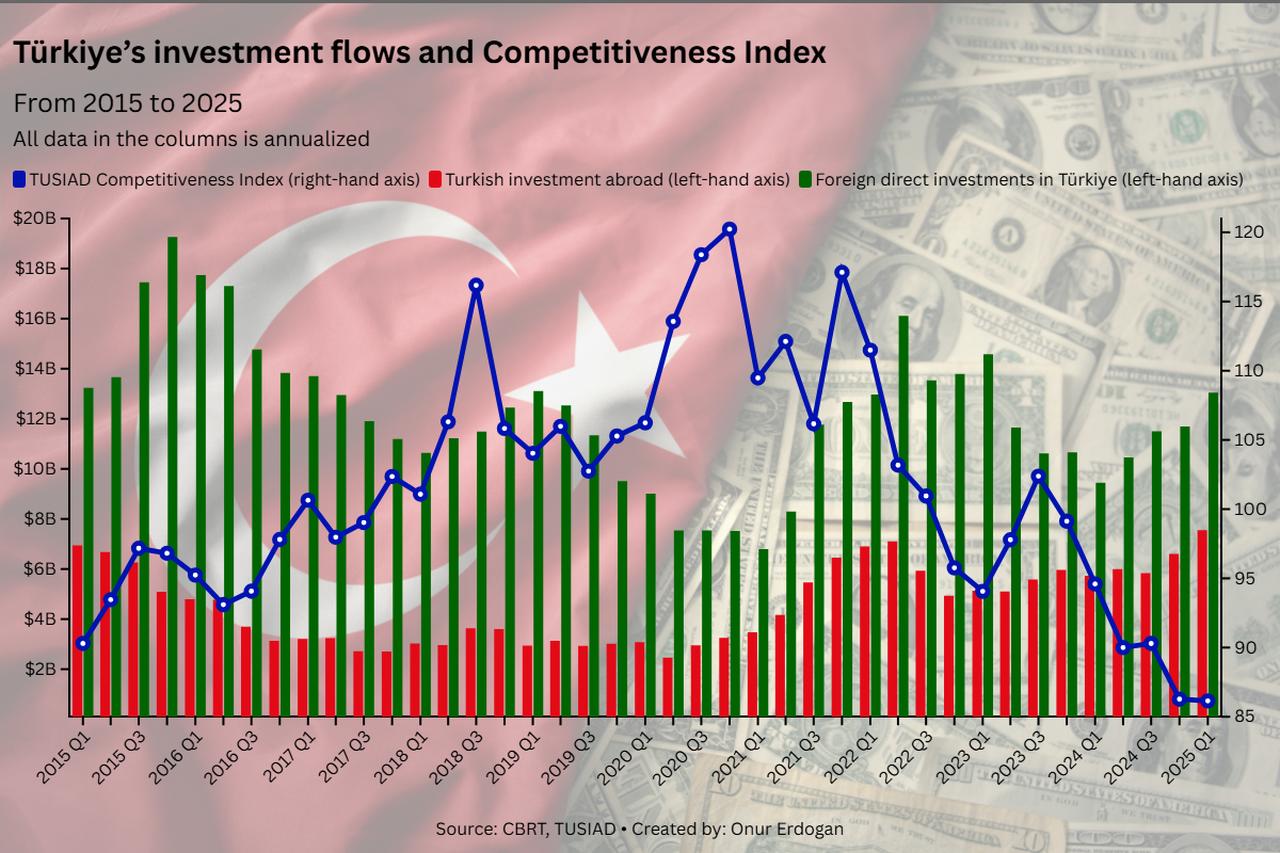

Outward investment by Turkish firms reached $7.56 billion in the first quarter of 2025, compared to $13.04 billion in foreign direct investment (FDI) into Türkiye during the same period, the Turkish central bank data showed.

Inward investment remains strong, largely driven by favorable asset valuations and short-term return prospects created by the weaker lira. The significant rise in outbound capital indicates that Turkish firms are increasingly shifting operations or capital to more cost-effective or stable markets abroad.

Compared to the first quarter of 2020, when Turkish investment abroad was $3.08 billion, the latest figure marks a 145.6% increase. In relative terms, outward investment now equals 58% of inbound FDI, up from approximately 31% in the same period of 2020. This sharp rise in both volume and proportion suggests that rising input costs and declining competitiveness at home are prompting a strategic reallocation of investment by the private sector.

Despite public debate over the impact of exchange rates on exports, the TUSIAD report emphasized that Türkiye’s competitiveness challenge is primarily tied to inflation in input costs, especially in intermediate goods. The exchange rate has fluctuated over the years, but the rising dollar-based cost of production has had a more consistent and detrimental impact.

Commenting on the report, Hakan Kara, the former chief economist of the Central Bank of the Republic of Türkiye (CBRT) and the academic consultant behind the index, warned that currency devaluation alone cannot restore competitive strength. “Depreciation may offer temporary relief, but without structural changes and inflation control, exporters remain at a disadvantage,” he stated.

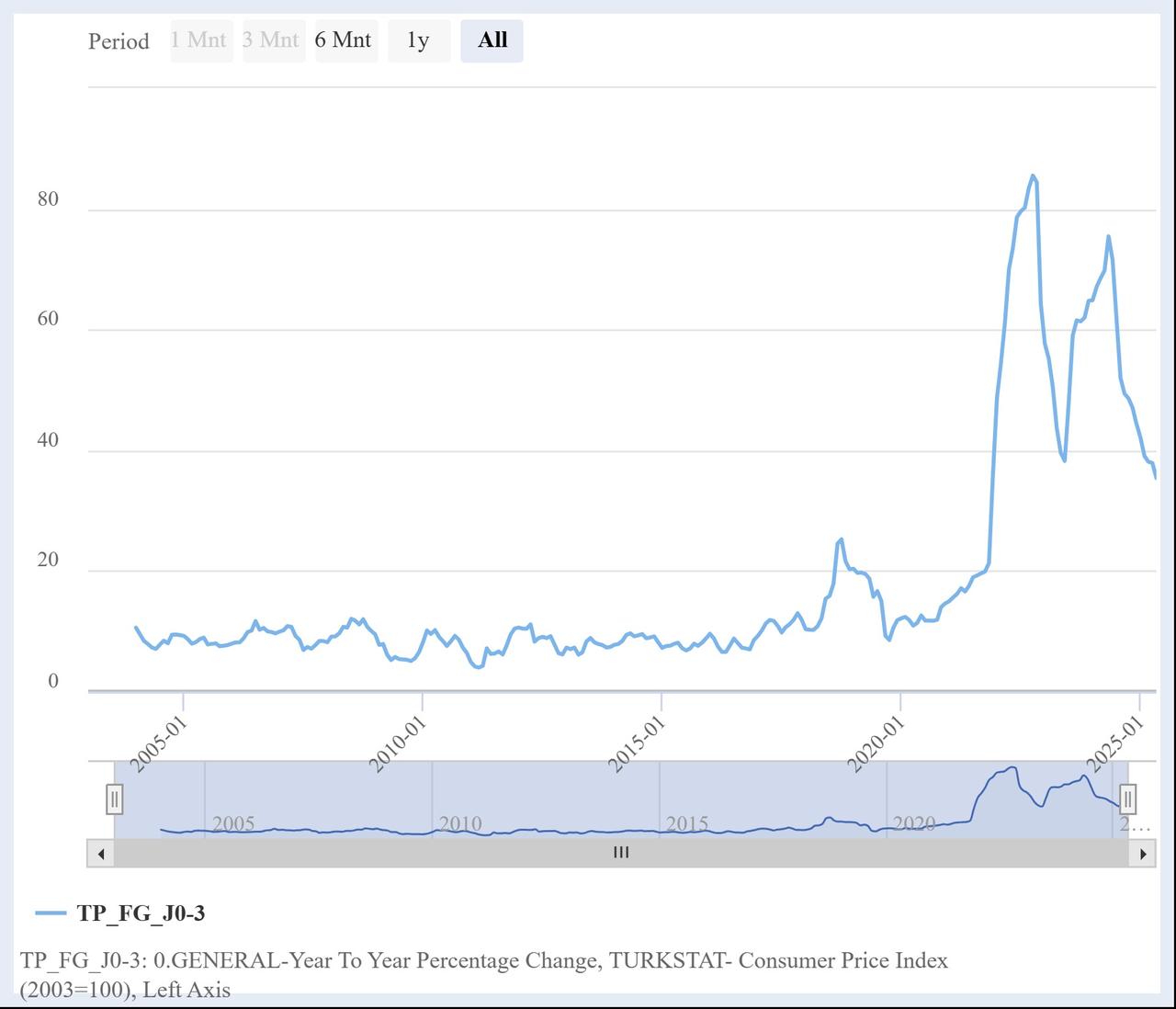

Türkiye has been grappling with high and persistent inflation for nearly a decade. It surged to a decade-high of 85.5% in 2022 and has been gradually declining since its peak of 75.5% in May 2024, reaching 35.4% in May 2025.

The TUSIAD-CCI, which tracks competitiveness across 10 key sectors—including automotive, machinery, textiles, and chemicals, all critical to Türkiye’s export base—reflected this trend. These sectors face similar structural challenges: they rely heavily on high-cost imported components and operate in a high-inflation environment. Even improvements in energy costs have not been enough to offset cost burdens in other areas, the report revealed.

TUSIAD President Orhan Turan stressed that the key to increasing Türkiye’s global trade share lies in controlling costs and understanding how peer countries manage their cost structure.

“It’s not enough to focus only on exports or currency policies. We must identify what makes our competitors more cost-effective and respond accordingly,” he said, emphasizing the need for a broader, data-driven approach.

Turan added that structural reforms, improved input efficiency, and smarter allocation of resources are essential for Türkiye to regain its competitive edge and secure a stronger position in global value chains.