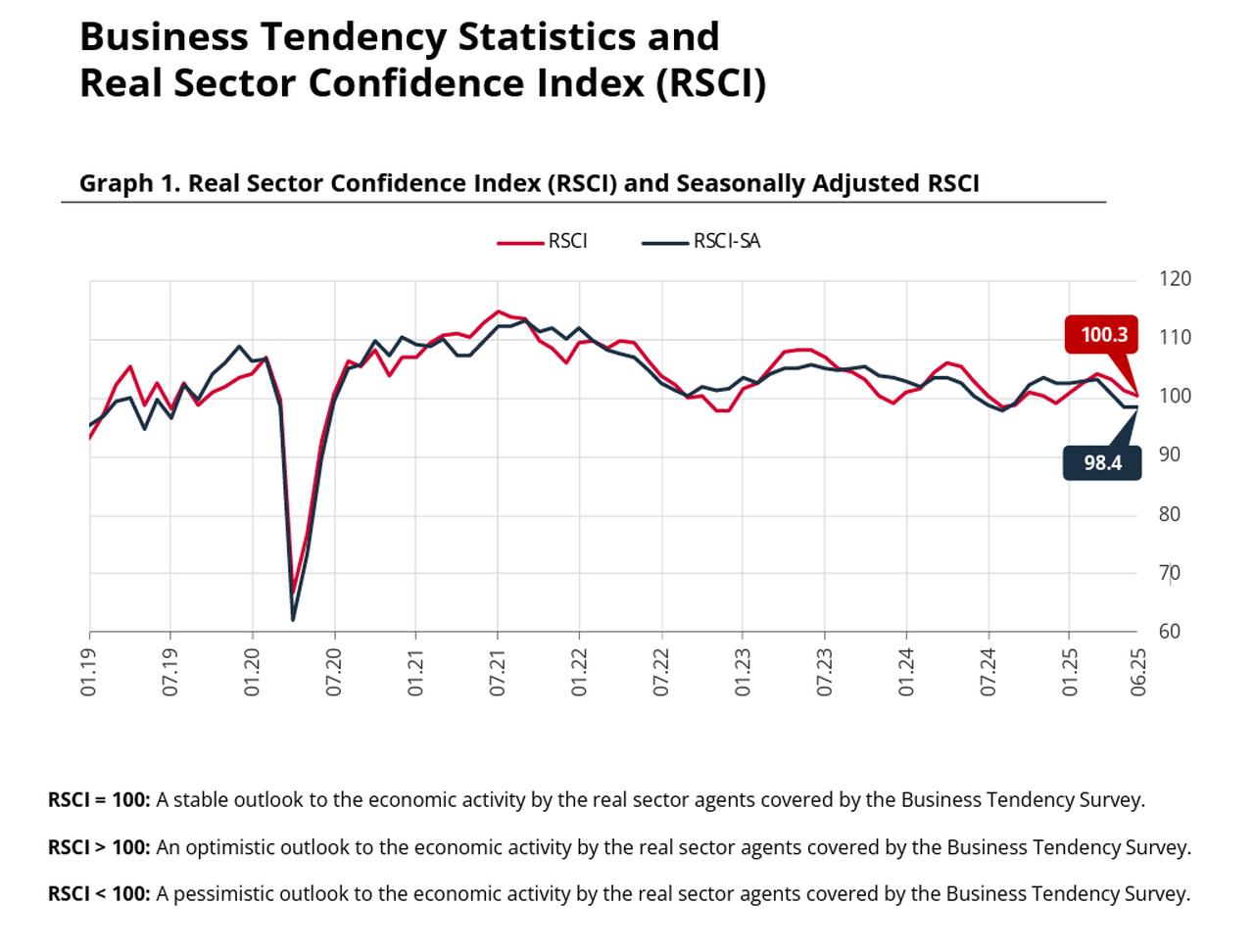

Türkiye’s real sector confidence weakened in June, falling by 0.2 points to 98.4 — the lowest level since the beginning of 2025, the Turkish central bank reported on Tuesday.

This downward shift signals that business sentiment remains in the pessimistic zone, as values below 100 indicate a generally negative outlook among manufacturers. The unadjusted index also declined, falling 1.1 points to 100.3.

According to the Central Bank of the Republic of Türkiye's Economic Tendency Statistics and Real Sector Confidence Index bulletin — based on a business tendency survey conducted among 1,842 manufacturing firms — expectations for exports, production volume, and fixed investment over the next three months provided upward support to the index. However, assessments regarding the general outlook, total orders in the past three months, and short-term employment expectations dragged the overall reading down.

While the trend still favored those expecting increases in production volume, export orders, and domestic demand, this positive momentum appeared to be losing strength compared to the previous month.

Expectations regarding employment over the next three months weakened slightly, whereas firms reported stronger intentions to boost fixed capital investment over the next year.

Survey respondents also reported a softening in expectations related to both input costs and output prices. Fewer participants anticipated an increase in average unit costs in the coming three months, and recent cost increases were also reported less frequently.

Price expectations for sales also declined. The year-ahead Producer Price Index (PPI) inflation forecast fell to 37.2%, down 1.2 points from the previous month’s projection, suggesting that inflation expectations in the real sector may be moderating.n

Separately, the Central Bank’s monthly survey on capacity utilization indicated a decline across the manufacturing sector. The overall capacity utilization rate decreased by 0.7 percentage point from the previous month, dropping to 74.4% in June.

Among industrial segments, the intermediate goods sector maintained the highest rate at 75.1%, while durable consumer goods trailed at 69.5%.

On a more granular level, the tobacco products subsector posted the highest utilization rate at 86.7%. In contrast, leather product manufacturing recorded the weakest usage at just 66%.