Silver prices have soared nearly 35% year-to-date, surpassing gold’s 28% gain, as investor demand rises amid ongoing U.S.-Mexico trade tensions and a tightening physical market due to a prolonged supply deficit.

On Monday, spot silver climbed as much as 1.8% in early-week trading, reaching approximately $39.04 per ounce—its highest level in nearly 14 years.

The latest rally builds on last week’s 4% increase, reflecting heightened interest in the metal both as a safe-haven asset.

Concerns surrounding U.S. trade policy have contributed to the flight to silver, as U.S. President Donald Trump threatens Mexico—the world’s largest silver producer and a primary supplier to the U.S.—with a potential 30% tariff. Although the U.S.-Mexico-Canada Agreement currently exempts silver from the new levies, there are concerns that these exemptions could be reversed.

The surge in demand has put pressure on the physical silver market, particularly in London, where large volumes are held by exchange-traded funds (ETFs), limiting their availability for lending or purchase.

Since February, silver-backed ETF volumes have increased by an estimated 2,550 tons, according to Bloomberg calculations.

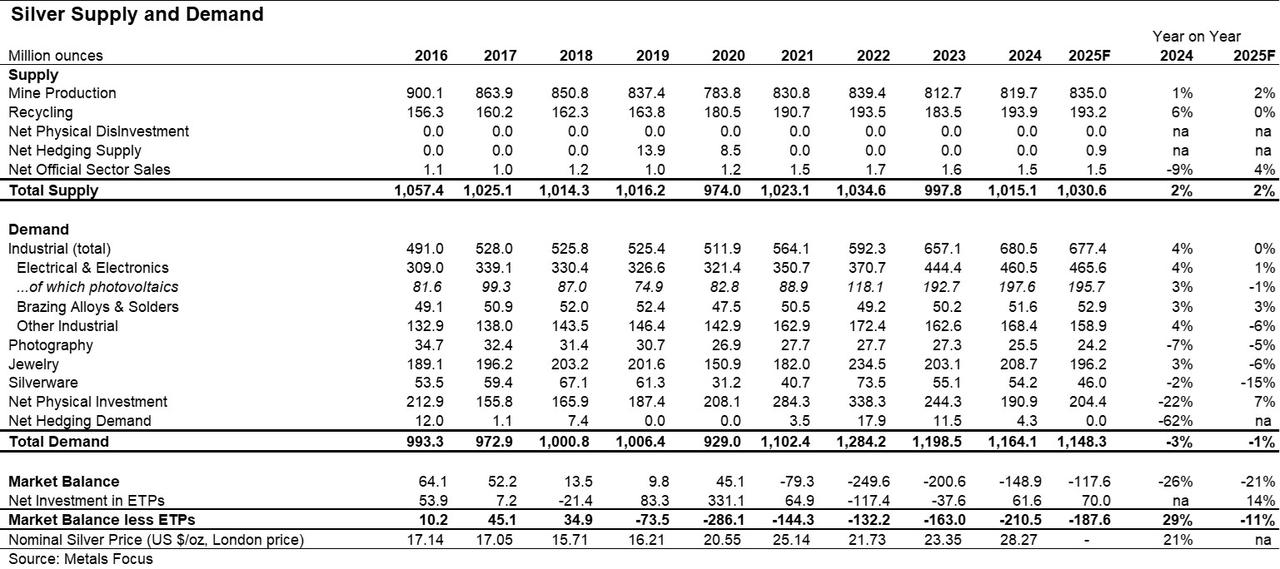

According to The Silver Institute, the global silver market is expected to record its 5th consecutive annual deficit in 2025, as total demand continues to exceed supply.

Industrial use—driven by sectors like solar energy and electronics—is set to remain high, while mine production and recycling show limited growth.

The projected shortfall for 2025 stands at over 117 million ounces, based on data from Metals Focus.

Despite silver’s recent gains, it remains relatively cheap compared with gold. The silver-to-gold price ratio currently stands at about 86 ounces of silver to one ounce of gold.

This is slightly above the 10-year average of 80, suggesting silver still has room to appreciate relative to gold.

Gold continues to hover near record highs, trading at around $3,371 per ounce, supported by geopolitical tensions and strong central bank purchases.