A large majority of central banks expect global gold reserves to increase over the next year, reflecting a growing trend among monetary authorities to diversify away from the U.S. dollar, according to the latest survey by the World Gold Council.

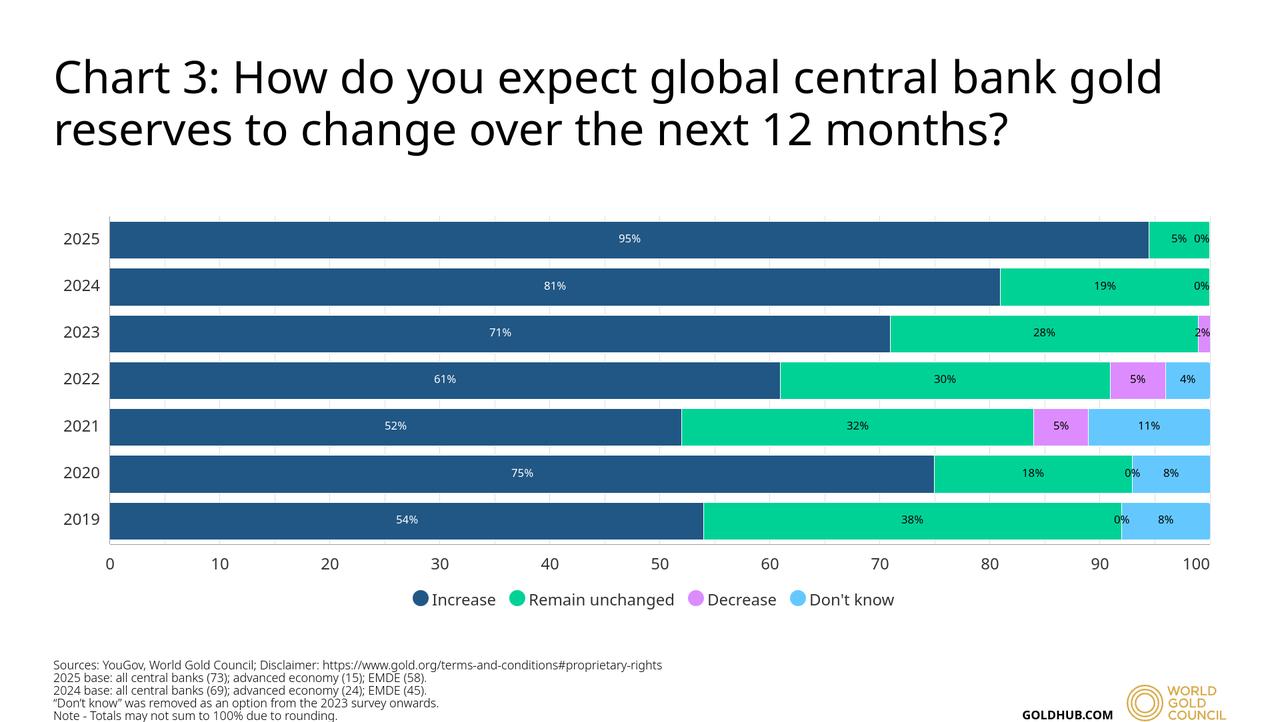

The annual report, based on responses from 73 central banks, reveals that 95% of respondents anticipate an expansion in global official gold holdings within the next 12 months. This marks the highest level recorded since the survey began in 2018 and reflects strengthening confidence in gold’s role as a strategic reserve asset.

Respondents cited gold’s strong performance during periods of financial instability, its immunity to default risk, and its function as an effective hedge against inflation as key motivations behind their reserve strategies.

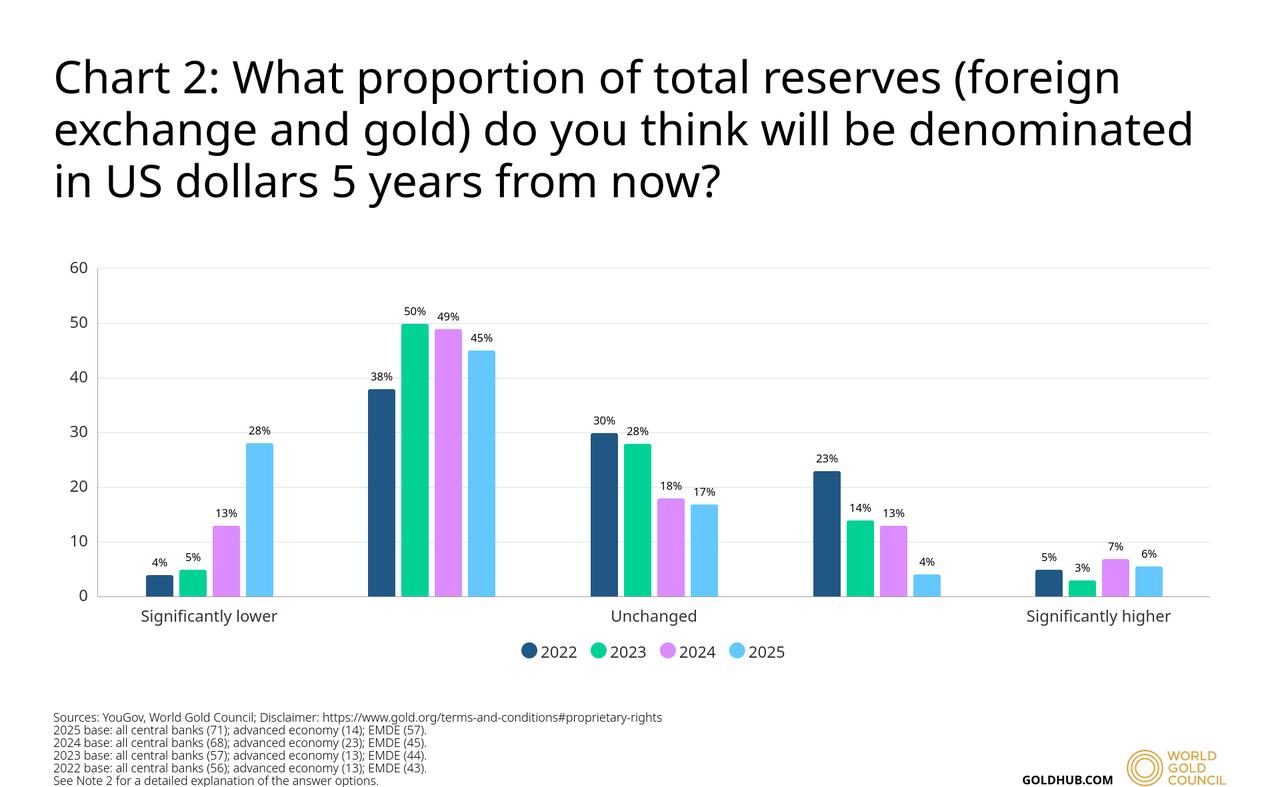

In addition to their short-term expectations for gold, central banks are also reassessing the long-term role of the U.S. dollar in their portfolios. Nearly three-quarters of respondents expect a decline in dollar holdings over the next five years. This trend accelerated following geopolitical disruptions in 2022, particularly the freezing of Russia’s foreign exchange reserves and exclusion from international payment systems.

The events underscored the potential vulnerabilities of dollar dependency and prompted emerging market central banks to adjust their reserve management strategies accordingly.

Alongside growing demand, central banks are increasingly opting to store gold domestically rather than relying on major storage hubs such as London and New York. This shift stems from concerns about access to reserves during crises or in the event of sanctions.

India, for example, repatriated more than 100 tonnes of gold from the Bank of England last year, while Nigeria also retrieved part of its holdings. The survey indicates that around 7% of central banks have boosted domestic storage plans since the COVID-19 pandemic.

Rising demand has helped gold surpass the euro as the world’s second-largest reserve asset as of early 2025, trailing only the U.S. dollar, according to the European Central Bank. This shift underscores gold’s renewed appeal as central banks look to rebalance their reserves amid global economic uncertainty.

Spot gold prices have responded to these developments, reaching an all-time high above $3,500 per ounce in April. As of June 17, prices remain elevated, hovering around $3,385, indicating continued investor and institutional interest in the metal’s stability and strategic value.