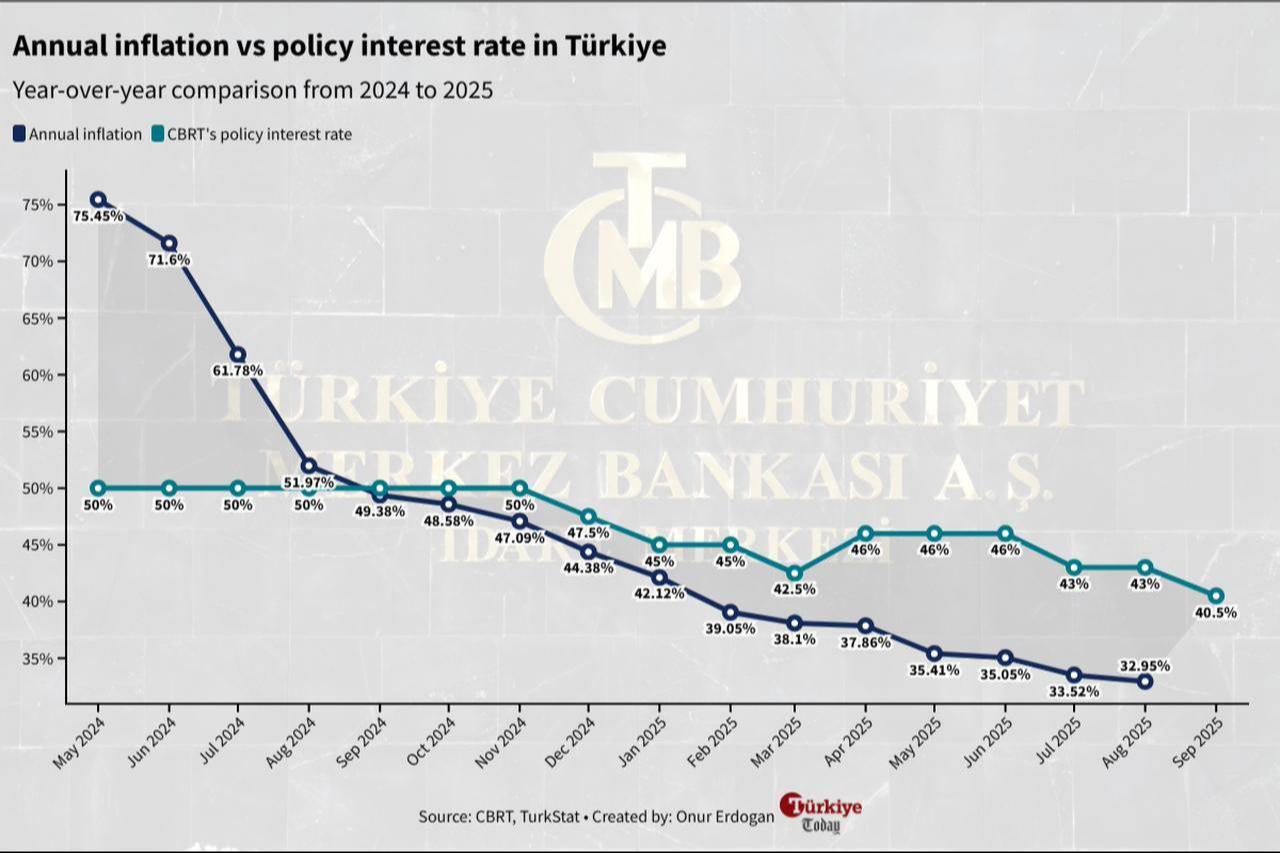

Central Bank of the Republic of Türkiye (CBRT) reduced the policy rate by 250 basis points to 40.5% after July’s 300-basis-point cut, continuing its cautious easing amid rising political tensions nationwide and weaker inflation figures in August.

The overnight lending rate was reduced from 46% to 43.5%, while the overnight borrowing rate was lowered from 41.5% to 39%.

Prior to the meeting, the CBRT’s regular survey of market participants in August indicated that investors and analysts had expected at least another 300-basis-point cut in September.

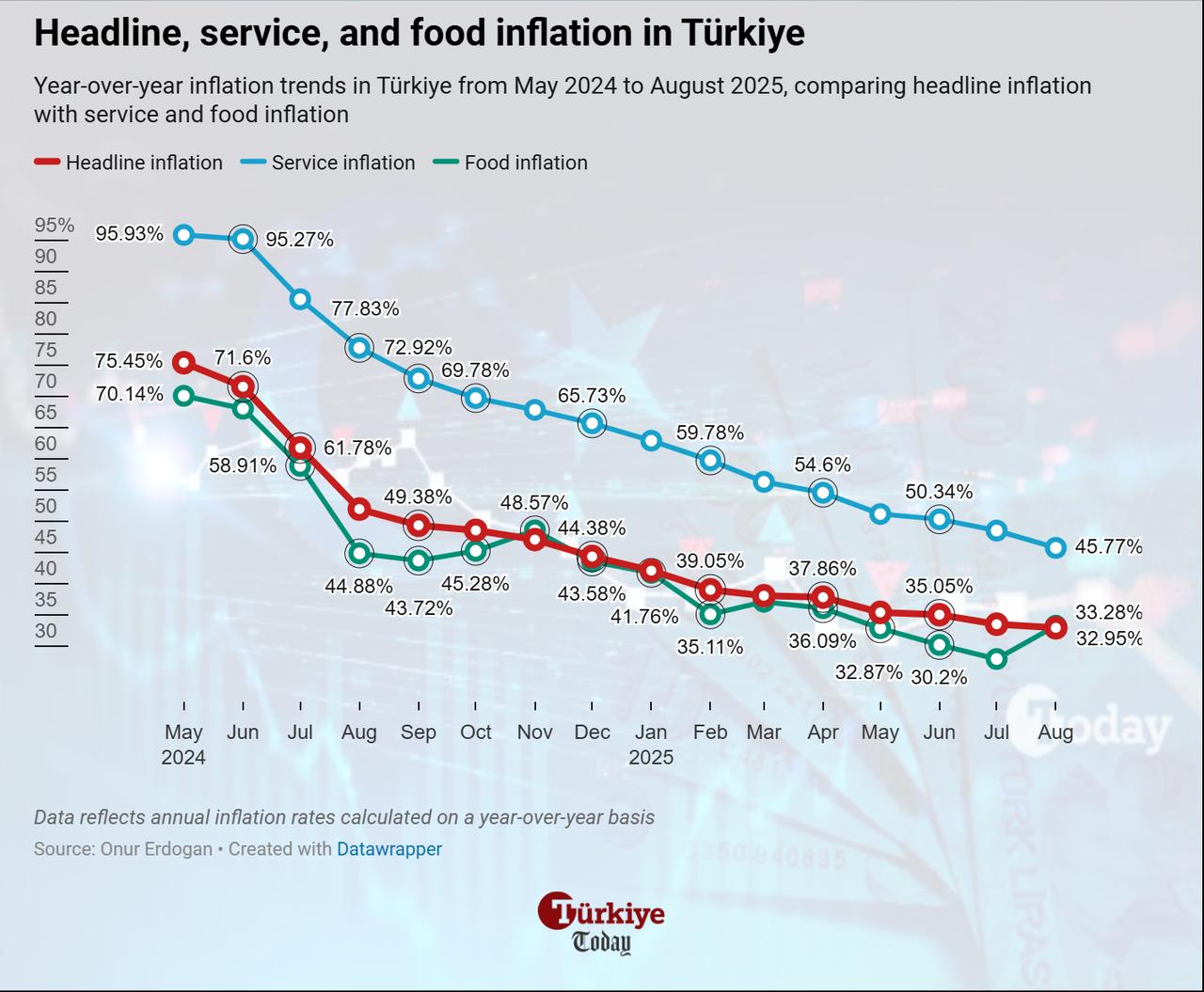

In its statement, the bank noted that the underlying trend of inflation slowed in August, while Türkiye’s economy expanded above projections in the second quarter but final domestic demand remained weak.

In its statement, the bank noted that the underlying trend of inflation slowed in August, despite continued upward pressures from food and services inflation. "Food prices and service items with high inertia are exerting upward pressure on inflation," it said. "Inflation expectations, pricing behavior, and global developments continue to pose risks to the disinflation process."

Reiterating its stance, the CBRT said it would maintain a tight monetary policy until price stability is achieved. It emphasized that the restrictive policy framework would reinforce disinflation through demand, exchange rate, and expectation channels. The statement was built on earlier wording but placed greater emphasis on these transmission mechanisms.

After the decision, Türkiye's benchmark stock index, BIST 100, fell from its intraday high above 10,700, where it was up more than 1%, to below 10,600, turning negative.

Exchange rates remained steady, with the U.S. dollar at 41.29, up 0.1%, and the euro at 48.36, up 0.24%.

Local lender Yapi Kredi Bank's analysts said in a note that the CBRT’s move was broadly in line with expectations, reflecting a dovish stance. It added that no signal was given on the next step in the easing cycle, with the central bank reiterating that decisions are taken on a meeting-by-meeting basis.

The assessment also highlighted a shift in the policy statement, where the previous reference to "coordination with fiscal policy contributing to disinflation" was revised to "the Medium-Term Program will contribute to the process."

On market impact, Yapi Kredi observed that expectations had recently shifted from a 200-basis-point cut to 250 basis points, meaning the decision did not surprise investors. The bank said markets would continue to price assets based not only on the economic agenda but also on domestic political developments.

"While the continuation of the easing cycle is positive in the broader framework, the absence of signals on the interest rate path may limit the upbeat sentiment," the note said, adding that the immediate market impact was "slightly positive," with optimism for the medium term.