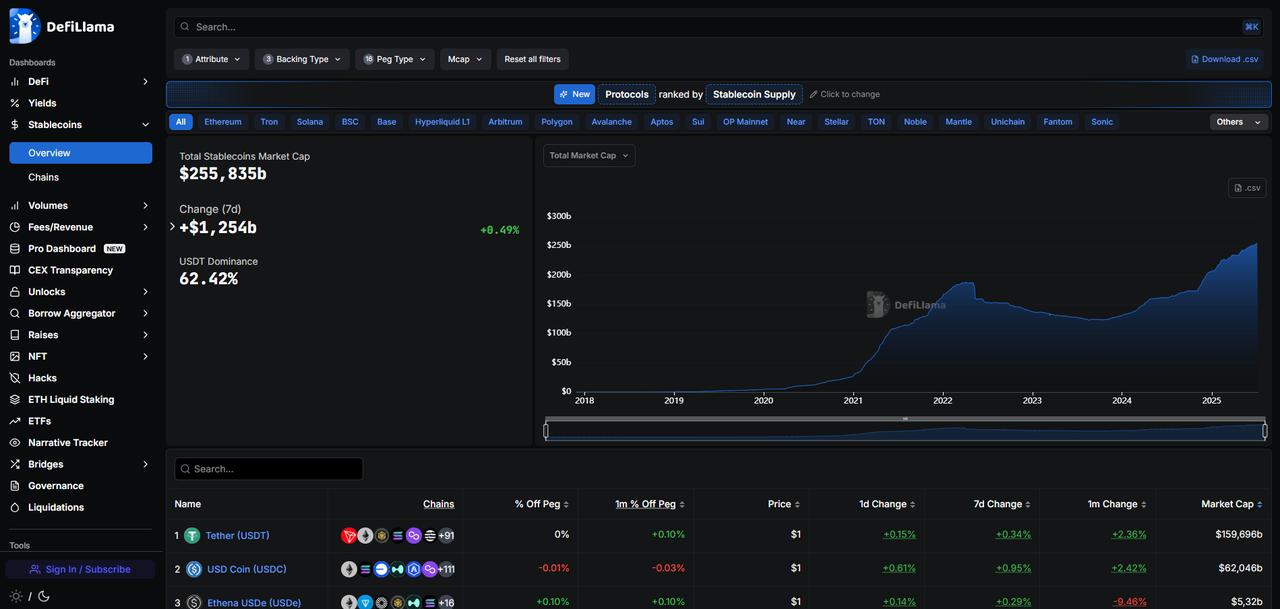

Stablecoin sector could grow from $250 billion to $2 trillion in value thanks to institutional momentum and evolving regulations, Ripple CEO Brad Garlinghouse said Wednesday.

Speaking on CNBC's “Squawk Box” program, the CEO highlighted that corporate regulations are key drivers for the market. He also stated that Ripple entered the stablecoin market late, largely due to the company's use of third-party stablecoins in its corporate payment processes.

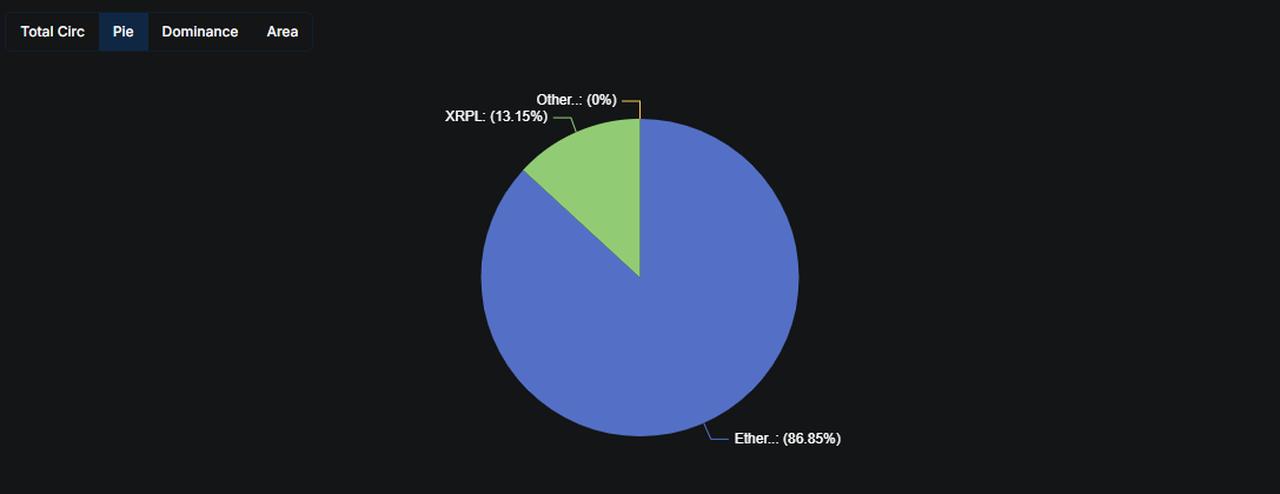

Ripple's own stablecoin, the dollar-indexed RLUSD, has allowed it to compete within the industry thanks to its compliance with current regulators. He added that RLUSD will also benefit from this rise, predicting that its market value will reach $2 trillion.

By signing an agreement with New York Mellon Bank for custody services, the company not only ensured security but also added 7% value to the price of XRP.

Comments from the industry also seem to support Ripple's optimistic outlook. Henrik Andersson, CIO of Apollo Capital, stated in an interview with Cointelegraph that this prediction was consistent with the company's own forecasts.

“We are seeing fintech companies, banks, social media platforms, and major retailers launching their own stablecoins,” he said, highlighting the increasing competition and adoption across industries.

Andersson highlighted the success of leaders like Tether, which has established dominance in the market with strong profitability. He also noted that the GENIUS Act, which would grant stablecoins legal tender status in the U.S., could be a significant driving force. The bill passed the Senate in June and is expected to become law by the end of July.

Ripple is also strengthening its ties with traditional finance. Garlinghouse stated that they aim to “build bridges between traditional finance and DeFi (decentralized finance).”

Ripple's new stablecoin, RLUSD, is rapidly gaining traction through its integration with the crypto payment platform Transak. RLUSD, which began trading just seven months ago, has already reached a market value of $500 million.

Ripple's cross-border payment token, XRP, gained 7% in value this week, reaching $2.42, its highest level in the last two months. Stablecoins, which are digital currencies with a fixed value, are attracting the attention of both companies and regulators. While giants like Amazon and Walmart are exploring such payments, stablecoin transaction volumes surpassed Visa for the first time in 2024.

Frank Combay of Next Generation stated that new regulations in Europe have reduced uncertainty in this area and that stablecoins could significantly reduce costs for both companies and consumers.