U.S. President Donald Trump is expected to name a new Federal Reserve chair before the end of the year, according to Treasury Secretary Scott Bessent, who is overseeing the selection process, as current Chair Jerome Powell’s term ends in May 2026.

"There’s a very good chance that the president will announce before Christmas," Bessent said Tuesday during an interview with financial network CNBC, adding, however, that the timing ultimately rests with the president and could extend into the new year.

Serving as the central bank of the United States, the world’s largest economy, a change in Fed leadership is seen as a pivotal development that could shape the trajectory of global markets.

Bessent confirmed that he had one final interview to conduct this week before presenting his shortlist to the president. He described all five candidates as "strong," saying they had each made a favorable impression.

The final decision will reflect not only monetary policy expertise but also broader economic priorities.

"The Fed has become a very complex structure and is no longer solely responsible for setting monetary policy," Bessent explained, emphasizing that leadership should be based on the ability to safeguard both the economy and the American public.

"I think it’s time for the Fed just to move back into the background, like it used to do, calm things down, and work for the American people."

The five individuals under consideration are Kevin Hassett, Director of the White House National Economic Council; Michelle Bowman, Fed Vice Chair for Oversight; Christopher Waller, a current Federal Reserve Board member; Kevin Warsh, a former Fed Board member; and Rick Rieder, Chief Investment Officer at BlackRock.

Bessent said he intends to deliver his recommendations to the president shortly after the Thanksgiving holiday. While the administration has not committed to a firm timeline, the remarks suggest a decision is close.

The next chair will assume responsibility for navigating inflation dynamics, employment targets, and a divided policy environment at the central bank—all while maintaining public confidence in the institution’s independence.

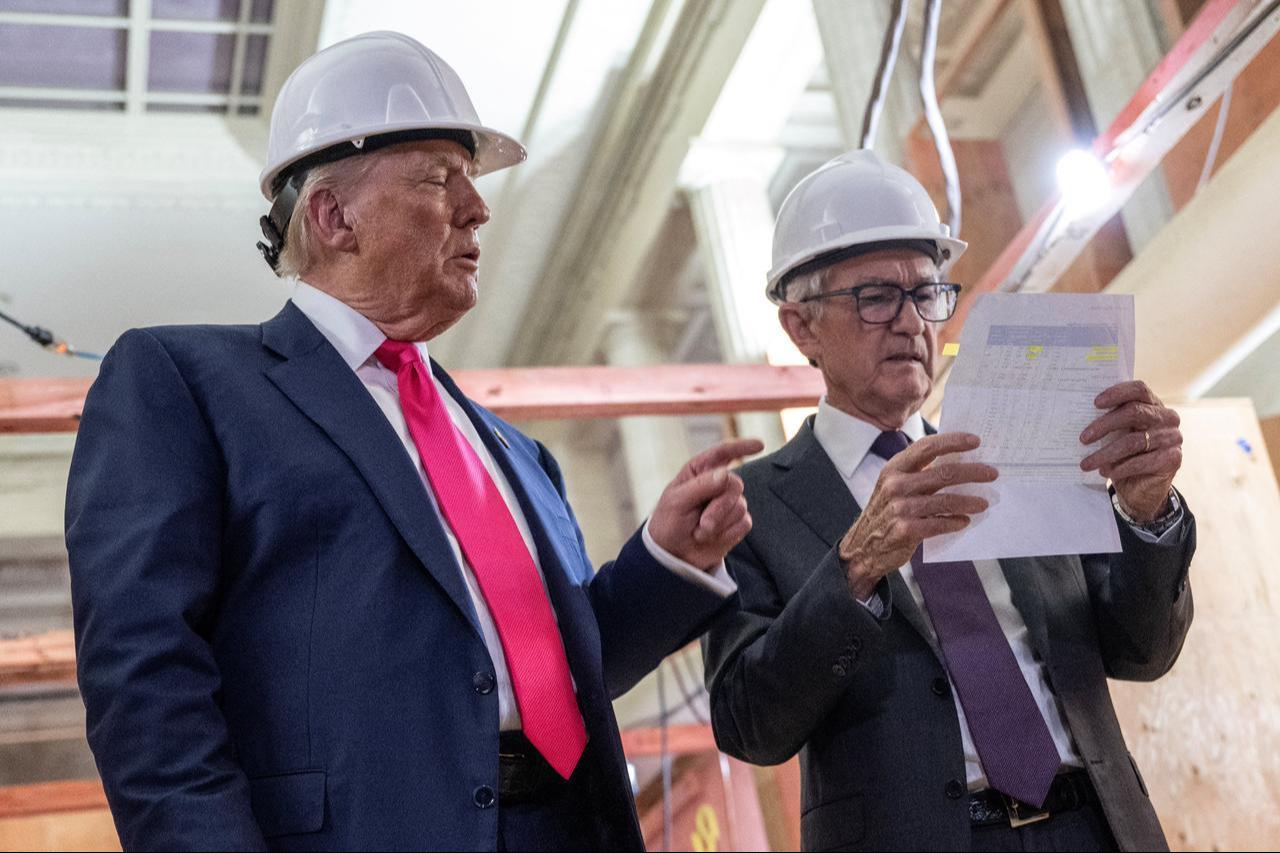

Appointed in 2018 during Trump's first term, Powell is set to complete his term in May 2026. Since taking office, he has frequently faced criticism from Trump, particularly over the Federal Reserve’s approach to interest rates.

Earlier this year, Trump remarked that Powell’s exit could not happen quickly enough, accusing him of failing to lower rates aggressively to support the economy.

Starting the easing cycle in September, the Fed cut its key interest rate for the second time this year last month, bringing it down to a range of 3.75% to 4%, while markets are now pricing in an 84.9% chance of another cut at the December 11 meeting, according to CME Group’s FedWatch Tool.