Global markets rebounded on Tuesday as investor confidence grew that the U.S. Federal Reserve will proceed with a third consecutive interest rate cut in December, following dovish remarks by senior Fed officials who indicated that mounting labor market weakness now presents a greater risk than persistent inflation.

The comments pushed equities, cryptocurrencies, and precious metals broadly higher, lifting major stock indices and digital assets, while oil prices moved in the opposite direction, slipping modestly.

Despite stronger-than-expected labor force data and ongoing inflationary pressures, several senior Federal Reserve officials issued dovish statements this week, shifting the focus toward employment-related risks.

Fed Governor Christopher Waller stated that inflation was no longer his primary concern, emphasizing the central bank’s dual mandate to promote both job growth and price stability. "I’m advocating for a rate cut at the next meeting," Waller said.

San Francisco Fed President Mary Daly echoed a similar view, noting that she was less confident in the labor market’s resilience. She added that inflation risks had eased, partly due to the limited impact of tariffs imposed by the Trump administration.

New York Fed President John Williams also signaled support for a policy move, stating that there was still "room for a further adjustment," reinforcing expectations for a rate cut at the December meeting.

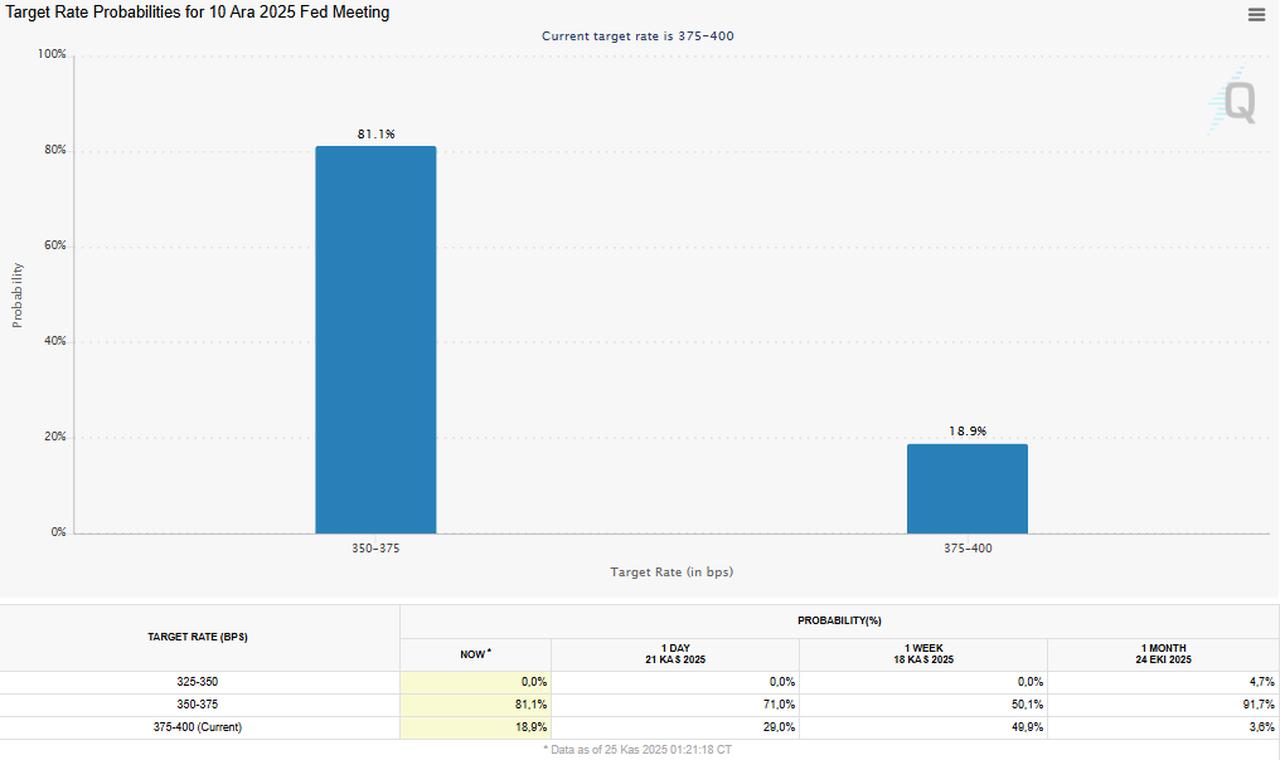

The remarks were widely interpreted as reflecting the broader sentiment within the Fed leadership, in the absence of any rebuttal from Chair Jerome Powell. Traders are now pricing in a roughly 81% chance of a rate cut at the Fed’s upcoming policy meeting on December 9–10, compared to only 35% last week, CME Group's FedWatch Tool showed.

After implementing its first rate cut of the year in September, the Fed lowered the benchmark range to 3.75–4.00% at its October meeting, and the next cut would bring it down to 3.50–3.75%.

U.S. markets extended their gains for a second straight session on Monday, led by tech stocks. The S&P 500 closed up by approximately 1.6%, while the tech-heavy Nasdaq surged 2.7%, driven by strong performances from Alphabet, Meta, Amazon, Apple and Tesla.

Google’s parent company, Alphabet, jumped 6.3% after receiving favorable reviews for its latest artificial intelligence product.

The recent rally comes despite lingering concerns over the long-term profitability of AI investments and warnings of a potential market correction.

Investor fears had intensified in previous weeks as valuations soared and the impact of U.S. President Donald Trump’s tariffs appeared less severe than initially expected.

In New York, trading volumes are expected to thin ahead of the Thanksgiving holiday. Markets will be closed on Thursday and will operate for a half session on Friday.

Asian markets posted modest gains on Tuesday in response to Wall Street’s rally. Japan’s Nikkei edged up 0.04%, China’s Shanghai Composite gained 0.9%, Hong Kong’s Hang Seng rose 0.1%, and South Korea’s KOSPI climbed 0.4%.

Cryptocurrencies, which had experienced sharp declines in recent weeks, also staged a broad recovery. Bitcoin rose to $87,856.65 after a sharp downturn last week that had erased its gains for 2025, while Ethereum reached $2,920.

Other digital assets, including XRP and Solana, climbed to $2.23 and $137.11, respectively. The surge lifted the total cryptocurrency market capitalization back above the $3 trillion mark.

On the precious metals side, gold prices reached their highest level in over a week, trading at $4,140 per ounce after briefly touching $4,155.83. Silver rebounded above the $51 mark, while palladium and platinum rose to $1,400 and $1,549, respectively.

In contrast to gains in equities and commodities, oil prices declined, with Brent crude down 0.7% to $62.80 per barrel and WTI falling to $58.47.