Banks and financial institutions in Türkiye sold a record ₺63.3 billion ($1.47 billion) worth of non-performing loans (NPLs) in 2025, up 55.4% from the previous year amid a tight monetary policy that continues to strain Turkish households' budgets.

In the final quarter of the year alone, NPL sales totaled ₺19.4 billion, driven largely by commercial banks and setting a new quarterly record.

The record sales came as Türkiye’s central bank maintained a tight monetary stance throughout 2025 to combat inflation, leading to elevated borrowing costs and tighter credit conditions.

Weighted-average interest rates on consumer loans remained above 50% in 2025, even as the policy rate ended at 38%, as a 2% credit growth cap prompted banks to tighten lending.

The sharp rise in both the volume and ratio of overdue loans prompted lenders to accelerate asset sales to bad debt collection agencies, known as asset management companies in Türkiye, in an effort to clean up balance sheets and improve financial ratios.

The bulk of the portfolios consisted of consumer loans and credit card debt that had fallen into prolonged delinquency, according to data compiled from public disclosures submitted to Türkiye’s Public Disclosure Platform by business-focused ekonomim.com.

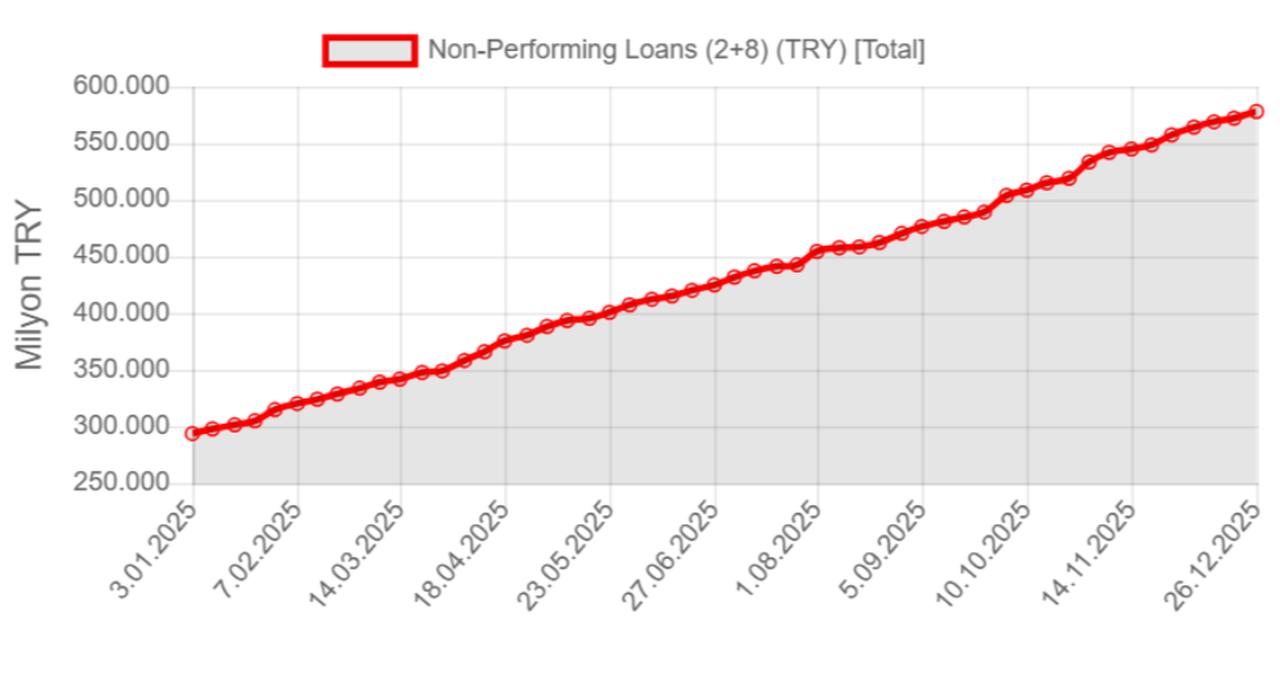

The total volume of overdue loans in the banking sector more than doubled over the year, rising 101.1% to ₺578.1 billion, data from the Banking Regulation and Supervision Agency (BRSA) showed.

Within this, consumer loan delinquencies climbed 100.1% to ₺112.5 billion, while non-performing balances on individual credit cards jumped 127.5% to ₺122.5 billion.

Commercial and small business lending also showed sharp deterioration. Non-performing commercial loans increased by 93.4% year-on-year to ₺341.7 billion, while delinquent small and medium enterprise (SME) loans surged 130.4% to ₺195.7 billion.

The banking sector’s overall NPL ratio, which compares non-performing loans to total cash loans, also rose from 1.8% in 2024 to 2.53% in 2025.

In the sectoral breakdown, the NPL ratio rose to 5.22% for general-purpose consumer loans, 4.60% for individual credit cards, 3.18% for SME loans, and 1.97% for commercial loans.