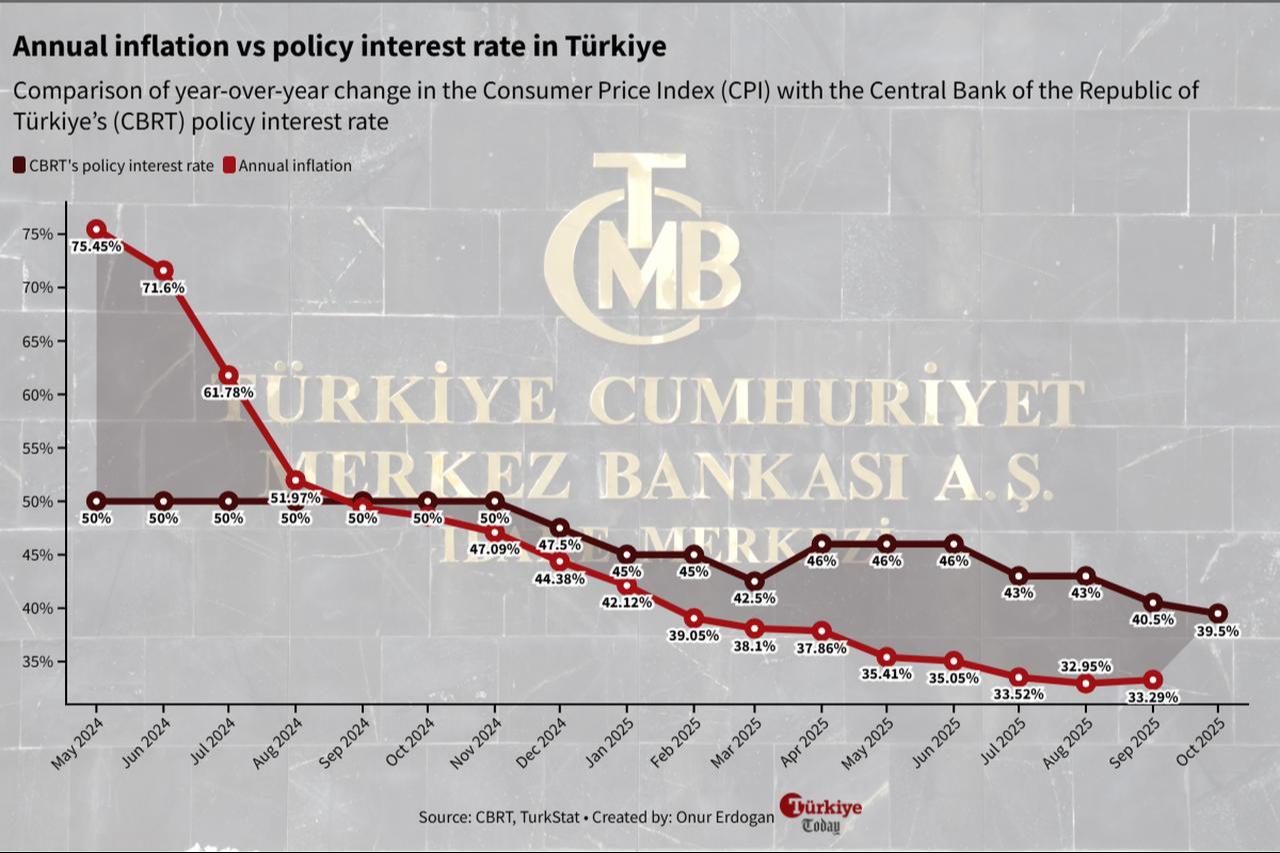

The Central Bank of the Republic of Türkiye (CBRT) continued its easing cycle with a more cautious approach at its October meeting, trimming the size of the rate cut to 100 basis points to bring the policy rate down to 39.5% following elevated upside risks to inflation in September.

This marks the third consecutive reduction by Turkish policymakers and reflects a softer dovish tone, amounting to less than half of September’s 250-basis-point cut.

The Turkish market was expecting a 150-basis-point cut in October, according to the latest Survey of Market Participants.

Other key rates, which define the upper and lower bounds of the CBRT’s interest rate corridor and influence short-term liquidity in the banking system, include the overnight lending rate—lowered to 42.5% from 43.5%—and the overnight borrowing rate—reduced to 38% from 39%.

In its statement, the CBRT noted that the underlying trend of inflation increased in September, although recent data indicated that demand conditions remained consistent with a disinflationary outlook; it added, however, that the pace of disinflation had slowed.

"The risks posed by recent price developments, particularly in food, to the disinflation process through inflation expectations and pricing behavior have become more pronounced," the statement read.

Türkiye’s inflation rose for the first time since May 2024, increasing from 32.9% to 33.2% due to higher prices in key expenditure groups with heavier weights in the inflation basket—particularly food, education, and transport—driven by drought-related food supply disruptions, rising education costs at the start of the new academic season, and higher transport expenses.

Monthly overall consumer prices increased by 3.2%, while food prices rose 4.6%, education 17.9%, and transport 2.8%.

The central bank said it would maintain its tight monetary policy stance until price stability is achieved, emphasizing that such a stance would strengthen disinflation through demand, exchange rate, and expectations channels.

The Committee said it would continue to determine policy rate decisions in line with inflation outcomes, underlying trends, and expectations, ensuring that the level of tightness remains consistent with interim targets for reducing inflation.

It added that the magnitude of policy steps was being assessed cautiously on a meeting-by-meeting basis, focusing on the inflation outlook.

"Monetary policy stance will be tightened in case of a significant deviation in inflation outlook from the interim targets," the CBRT said.

The bank also stated that if developments in credit or deposit markets diverge from projections, the transmission mechanism would be supported with additional macroprudential measures.

Liquidity conditions, it added, would continue to be closely monitored and managed effectively through available policy tools.

Reaffirming its policy framework, the CBRT said its monetary decisions would continue to be guided by the objective of establishing monetary and financial conditions that would bring inflation to the 5% target over the medium term.

In its assessment of the central bank’s decision, the local brokerage Integral Yatirim said that the CBRT’s limited rate cut indicates a cautious continuation of its easing cycle while remaining alert to upward inflation risks.

"The gradual pace of rate cuts shows that the policy stance remains tight," the brokerage noted, adding that the slower tempo also "reflects the bank’s awareness of moving away from its inflation target."

Analysts pointed out that the shorter and more focused policy statement signals a "change in tone," with the central bank now acknowledging renewed signs of deterioration in inflation after previously emphasizing a slowdown. It highlighted that volatility in food prices and stickiness in services inflation are "pushing risks to the upside in the disinflation process."

The brokerage added that despite the rate cut, the CBRT’s message remained cautious, suggesting that each policy meeting will be evaluated separately while the bank continues to manage expectations through careful communication.

The Turkish central bank will convene its next Monetary Policy Committee (MPC) meeting on Dec. 11, with another rate cut expected.