Central Bank of the Republic of Türkiye (CBRT) policymakers expressed growing concern about inflation trends and implied they may slow the pace of interest rate cuts during meetings with investors in Washington, D.C., last week, according to several foreign participants.

Reuters reported that the discussions took place on the sidelines of the annual International Monetary Fund (IMF) and World Bank meetings, where CBRT Governor Fatih Karahan and his two deputies met with global investors holding Turkish bonds. Participants said the policymakers refrained from offering direct guidance on how much the bank might ease rates this week but emphasized that recent data point to persistent price pressures.

Karahan and his team reportedly told investors that they would monitor market expectations closely ahead of Thursday’s Monetary Policy Committee (MPC) meeting.

Turkish central bank Governor Fatih Karahan and senior policymakers held investor meetings in Washington last week while attending the annual IMF and World Bank gatherings alongside Treasury and Finance Minister Mehmet Simsek. In an address at the Atlantic Council earlier this month, Karahan publicly acknowledged that the pace of disinflation had slowed, saying, "The downward trend has slowed down a little bit recently, which we are taking note of as important."

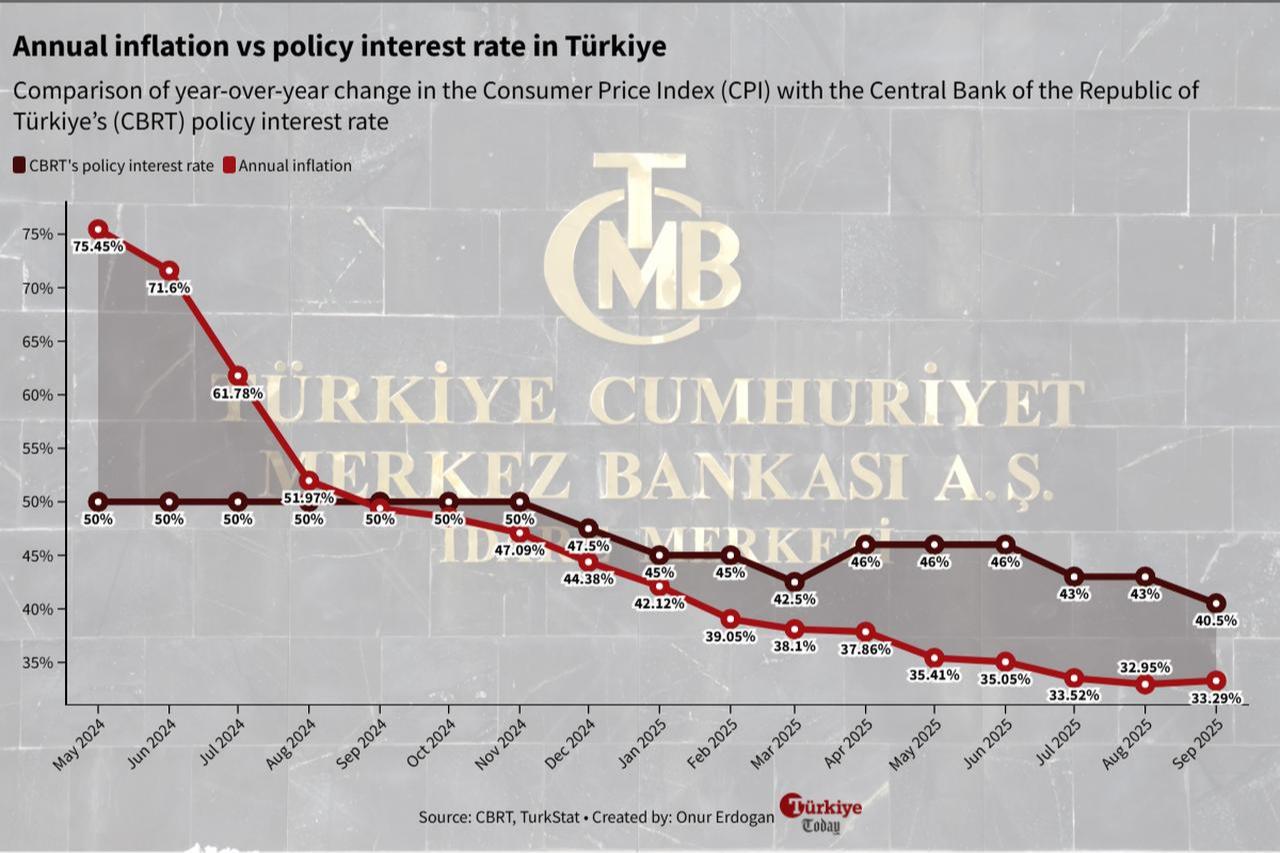

Türkiye’s annual inflation rose to 33.3% in September, exceeding forecasts and marking the first uptick since the May 2024 peak of 75.4%. Data from the Turkish Statistical Institute (TurkStat) indicated that seasonal increases in education and food prices drove the rise, while criticism mounted over the size of the last two consecutive interest rate cuts.

The central bank resumed monetary easing in July with a 300-basis-point reduction, followed by another cut in September, bringing the policy rate down to 40.5%.

According to the CBRT’s latest Survey of Market Participants, which gathers expectations from 68 representatives across the financial and real sectors, the policy rate is projected to decline to 39% in October—its lowest level since October 2023. Market participants foresee additional cuts in the coming months, with policy rate expectations at 37.66% in December and 36.17% in January.

However, the one-year-ahead policy rate forecast rose slightly to 28.26%, suggesting that investors anticipate a measured pace of monetary easing as inflationary pressures gradually subside.

The central bank’s next MPC meeting on Oct. 23 will be closely watched by both domestic and foreign investors for signs of how policymakers plan to navigate Türkiye’s delicate balance between supporting growth and containing inflation.