German lender Deutsche Bank adjusted its forecast for Türkiye's year-end policy rate, lowering it from 37.5% to 35%, adding that the Turkish central bank is expected to resume interest rate cuts in July with a 350 basis point reduction.

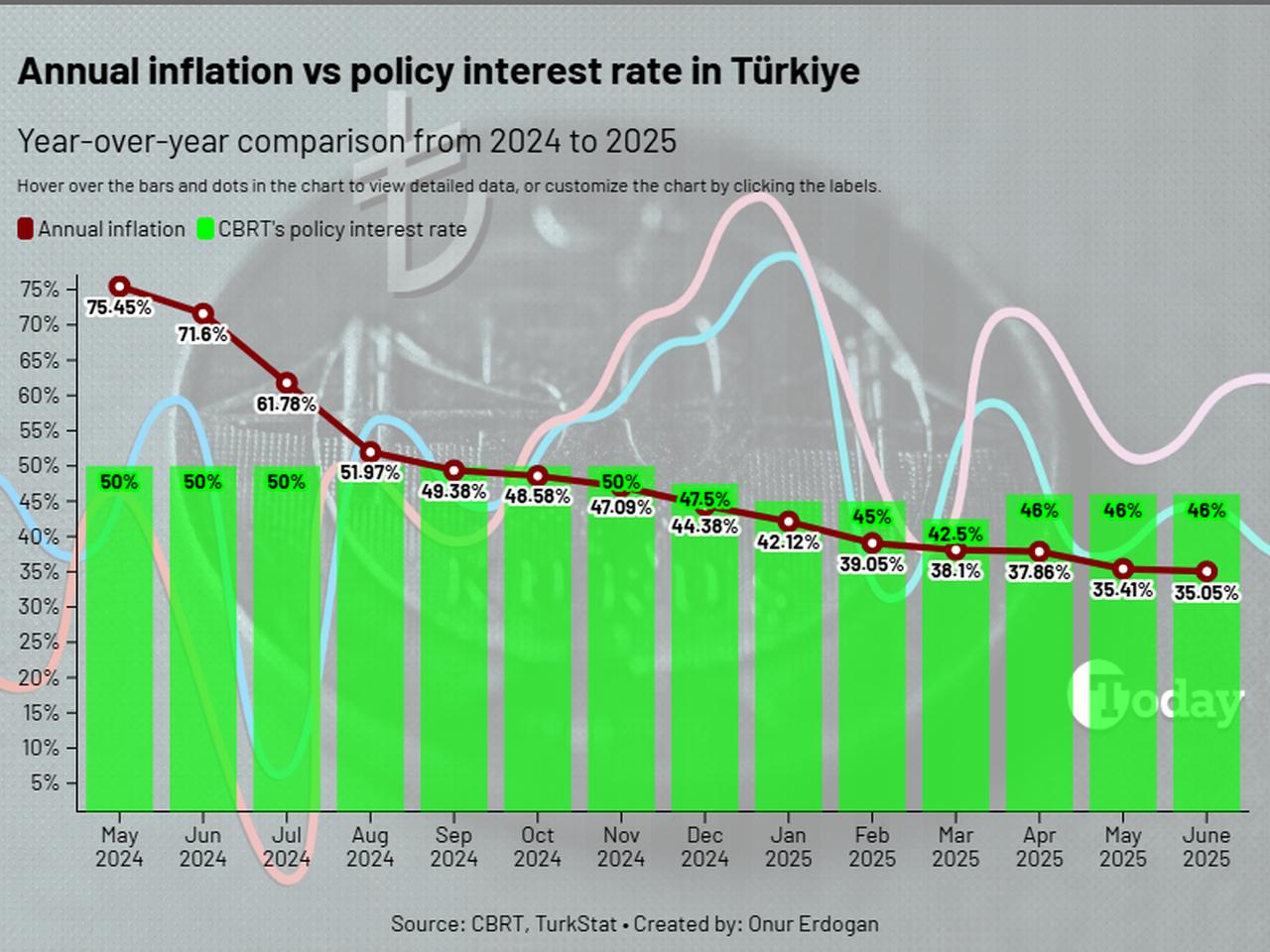

The Turkish central bank held its policy rate at 46% in its latest meeting in June, alongside a 49% overnight borrowing rate.

According to the bank's Europe, Middle East and Africa 2nd Half Outlook report, the bank anticipates Türkiye's consumer inflation to stand at 29.5% by the end of 2025, notably above the Central Bank of the Republic of Türkiye’s (CBRT) projection of 24%.

Analysts believe the downward trend in inflation will continue gradually, reaching 21.7% by the end of 2026—provided that the current economic program remains intact.

In light of improving global risk sentiment, a reversal in oil prices, and easing short-term political uncertainty, Deutsche Bank projects additional rate reductions totaling 250 basis points over the remaining three monetary policy meetings of the year. This path would bring the policy rate to 35% by year-end.

Despite these anticipated cuts, the bank does not foresee a more aggressive easing cycle due to risks related to exchange rate stability and inflation expectations.

The bank noted that a swift economic recovery in 2025 is unlikely due to diminished real wages, tight monetary policy, and sluggish external demand. However, global growth is expected to benefit from increased fiscal spending in Europe.

Assuming continued commitment to orthodox policies that prioritize inflation control, Deutsche Bank forecasts 3% growth for Türkiye in 2025 and 4% in 2026.