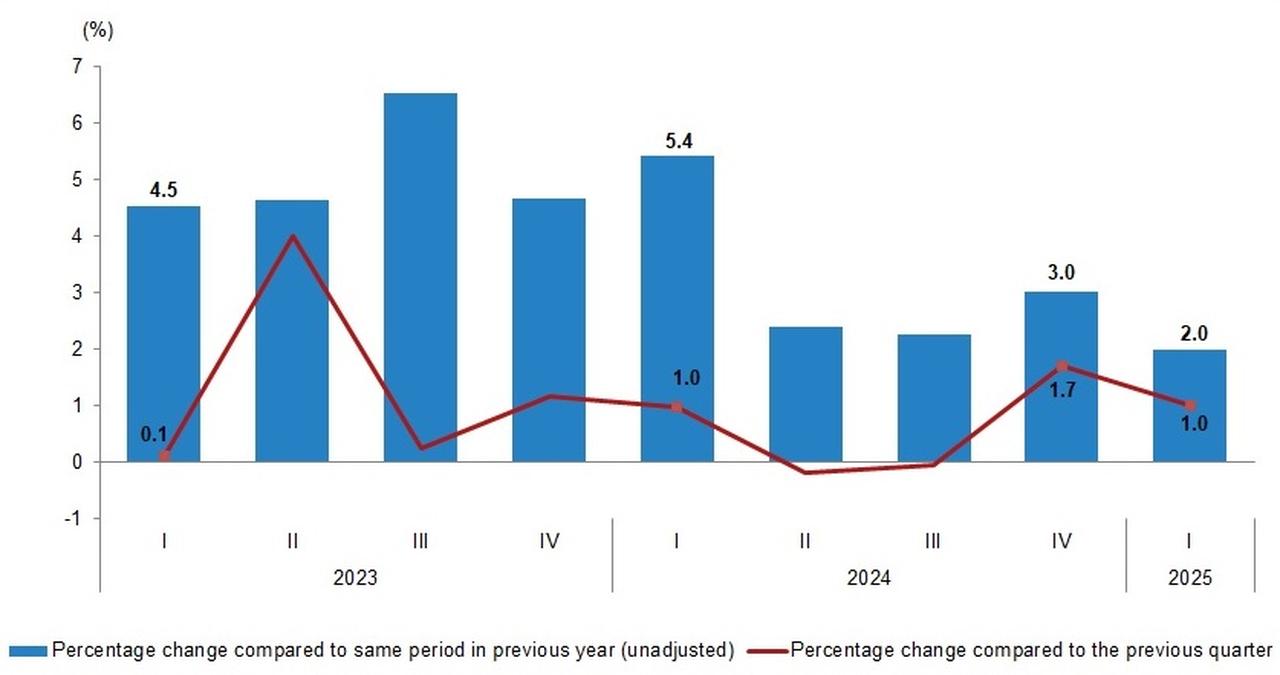

Türkiye’s economy expanded by 2% year-over-year in the first quarter of 2025, easing from 3% in the previous quarter, according to data released by the Turkish Statistical Institute (TurkStat) on Friday.

The country’s gross domestic product (GDP) at current prices rose 36.7% compared to the same period previous year to ₺12.12 trillion ($335.5 billion) in the January–March period. In the fourth quarter of 2024, the Turkish economy expanded by 3% year-on-year.

The main driver of the slowdown is attributed to weakening export volumes and rising imports, driven by tight monetary policy, as the Turkish lira’s real effective exchange rate stood at its highest level since 2021 as of April, according to central bank data. This situation has made it more difficult for exporters and manufacturers to access credit, while the appreciation of the Turkish lira has eroded their competitive edge.

Commenting on these figures, Treasury and Finance Minister Mehmet Simsek said in his post on X that the Turkish economy remains on track for stable, sustainable growth, supported by a disinflation trend. He underlined that the government’s economic program is built on a policy mix focused on fiscal discipline, structural reforms, and targeted support for production and exports.

“We are swiftly implementing the necessary measures to address the potential effects of the disinflation process through a comprehensive approach,” he said. Simsek added that Türkiye is enhancing its long-term resilience by promoting investment, boosting employment, and strengthening macroeconomic fundamentals.

Despite rising global protectionism and weakening demand abroad, Simsek noted that Türkiye’s external balances remain solid, with the current account deficit-to-GDP ratio holding at 0.9%..

In its newly released Financial Stability Report, the Central Bank of the Republic of Türkiye (CBRT) reviewed recent trends in credit markets, banking sector dynamics, and broader financial risks. The report emphasized that tight monetary policy remains essential to guiding inflation lower, with credit growth now broadly aligned with the disinflation trajectory.

The central bank noted that both commercial and consumer lending have slowed, particularly in foreign currency-denominated loans, following a series of macroprudential measures aimed at reinforcing monetary transmission. Although access to financing has become more selective, especially for export-driven industries, the report underlined that financial intermediation remains functional and stable.

According to the CBRT, its timely and decisive policy steps have helped contain the effects of recent financial volatility on Türkiye’s risk premium. The banking sector, it added, continues to benefit from high capital adequacy and prudent provisioning practices, which provide a buffer against external shocks and domestic tightening.

Türkiye's annual inflation declined to 37.86% in April, marking the 11th consecutive month of a downward trend. To reinforce the disinflation outlook, the central bank raised its policy rate by 350 basis points during the same month and signaled that it would maintain its tight stance until inflation expectations are firmly anchored.