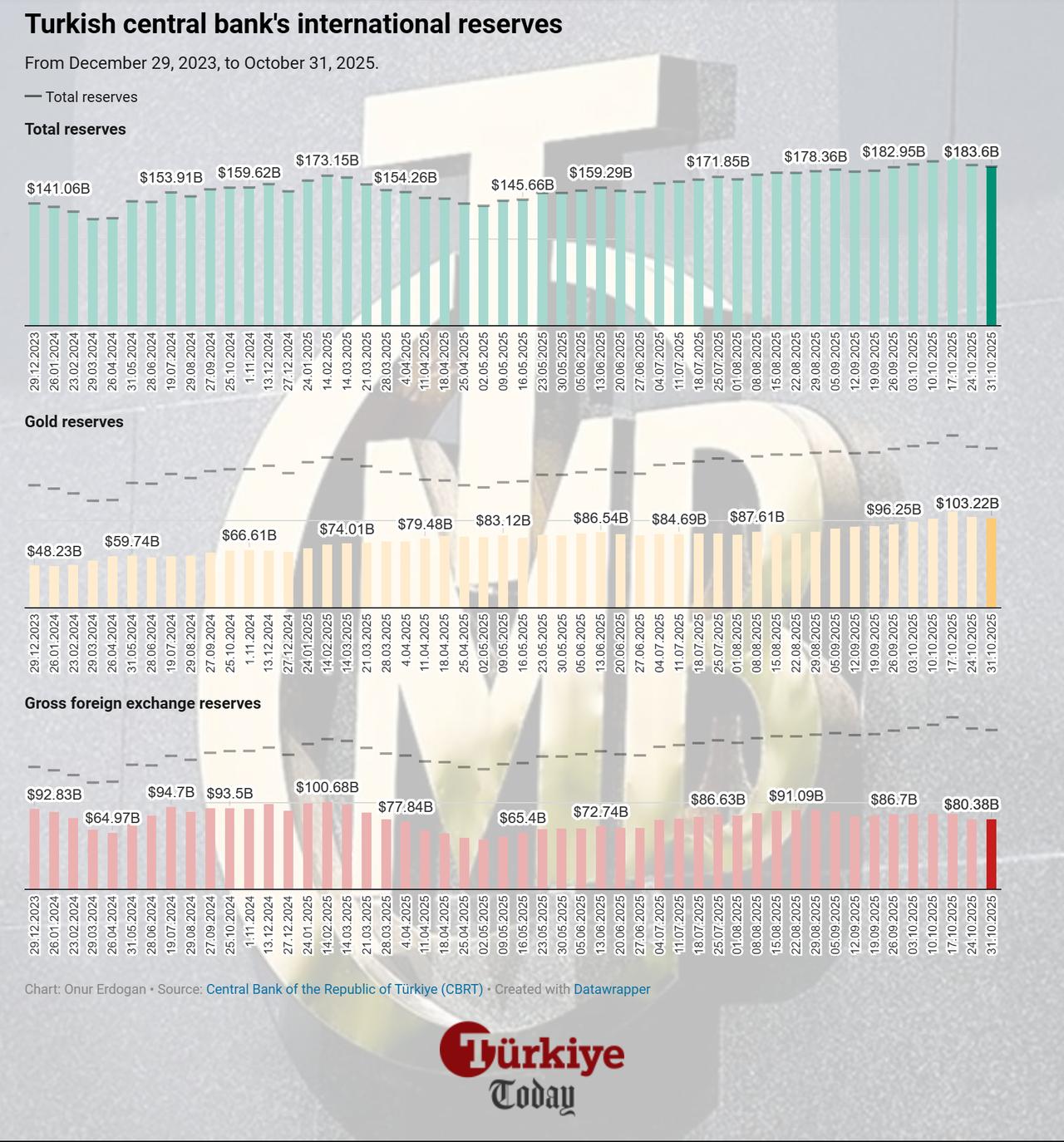

The Central Bank of the Republic of Türkiye’s (CBRT) total reserves declined by $1.9 billion in the week ending Oct. 31 to $183.6 billion, while foreign investors returned to local equities after a month of withdrawals, official data showed.

Gross foreign exchange reserves declined by $456 million to $80.38 billion, while gold holdings fell by $1.45 billion to $103.22 billion as spot prices retreated toward the $4,000 level at the week’s close.

Despite the fall in total holdings, net reserves increased from $67.8 billion to $69.3 billion. Swap-adjusted net reserves — which exclude the central bank’s short-term currency swap liabilities — also improved slightly, rising from $52.1 billion to $52.7 billion.

After four consecutive weeks of selling, foreign investors turned net buyers of Turkish equities in the week ending Oct. 31, purchasing $242.8 million worth of shares. The previous week, foreigners had sold a net $118.5 million in equities.

During the same week, they also bought $486.6 million in government domestic debt securities (GDSs) while selling $40.2 million in non-government sector assets.

The total value of their equity holdings fell slightly from $32.32 billion to $32.30 billion due to market fluctuations, despite the weekly inflow.

In fixed income, foreigners’ holdings of GDSs increased by $671.1 million to $15.68 billion, while their non-government sector securities holdings declined from $564.3 million to $524 million.

Total deposits in Türkiye’s banking sector increased by ₺115.4 billion ($2.74 billion) during the same week, rising from ₺26.49 trillion to ₺26.60 trillion ($631.58 billion).

Foreign-currency deposits across the banking system stood at $249.45 billion, of which $211.1 billion belonged to domestic residents. When adjusted for exchange-rate effects, residents’ foreign-currency deposits rose by $800 million during the same week.

Consumer lending also continued to expand, with household loans increasing 2.3% week-on-week to ₺5.28 trillion ($125.36 billion), reflecting ongoing borrowing demand within the domestic market.