The Central Bank of the Republic of Türkiye (CBRT) is set to present its Fourth Inflation Report of 2025 on November 7, which is expected to provide an update on the country's disinflation process for the end of 2025 and into the following year.

The presentation, to be made by CBRT President Fatih Karahan at 10.30 a.m. local time (GMT+3) in the Istanbul Financial Center, will be broadcast live across the bank’s digital platforms, including its official website, X, and YouTube.

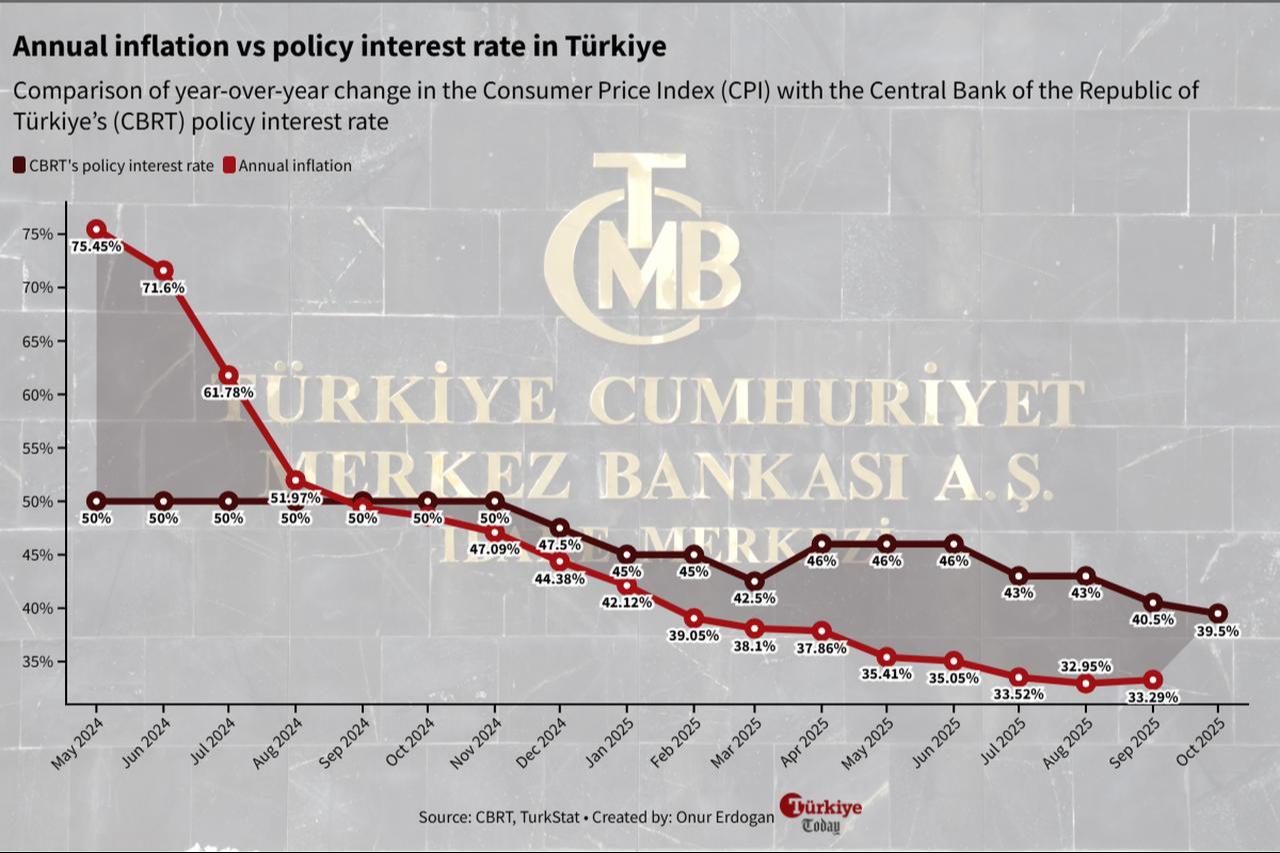

After the uptick that disrupted a 15-month streak of steady decline, Türkiye's inflation rose to 33.3% in September, with a 3.23% increase, mainly driven by a surge in food prices.

In October's Monetary Policy Committee (MPC) meeting, the bank scaled back the ongoing easing cycle, reducing it to a 100 basis-point cut after the 300 and 250 basis-point reductions in the previous two meetings, bringing the policy rate to 39.5%. In its press release, the bank attributed the smaller-than-expected rate cut to the inflationary pressures that reignited in September, adopting a more cautious stance.

The bank’s policy summary also noted a rising inflation trend as of September, stating that the main inflationary trend had been on the rise, albeit modestly.

"The risks posed by recent price developments, particularly in food, to the disinflation process through inflation expectations and pricing behavior have become more pronounced," it said.

The policymakers emphasized that their commitment to tight monetary policy will persist until price stability is achieved, noting that further tightening will occur if inflation deviates significantly from interim targets.

During the CBRT's third Inflation Report meeting in August, it was announced that future reports would feature interim inflation targets instead of a single rate projection, with added probability ranges that would provide a more flexible approach to managing inflation expectations.

The interim targets were set at 24% for the end of 2025 and 16% for the end of 2026, while the projection indicated that by the end of 2025, inflation would range between 25% and 29% with a 70% probability, and by the end of 2026, it would decrease to between 13% and 19%.

Looking ahead, the release of October’s inflation data is scheduled for November 3, with market participants expecting the monthly inflation rate to rise by 2.34%, bringing the year-on-year inflation rate to an estimated 32.59%, according to the CBRT's report. The figures will provide additional context for the CBRT’s monetary policy and whether the current trajectory will align with the Central Bank’s inflation targets.

In a recent address this week, Türkiye's Finance Minister Mehmet Simsek acknowledged that achieving the current inflation projection by year-end 2025 is "hard to reach" due to ongoing economic pressures, including external factors such as droughts and geopolitical tensions.