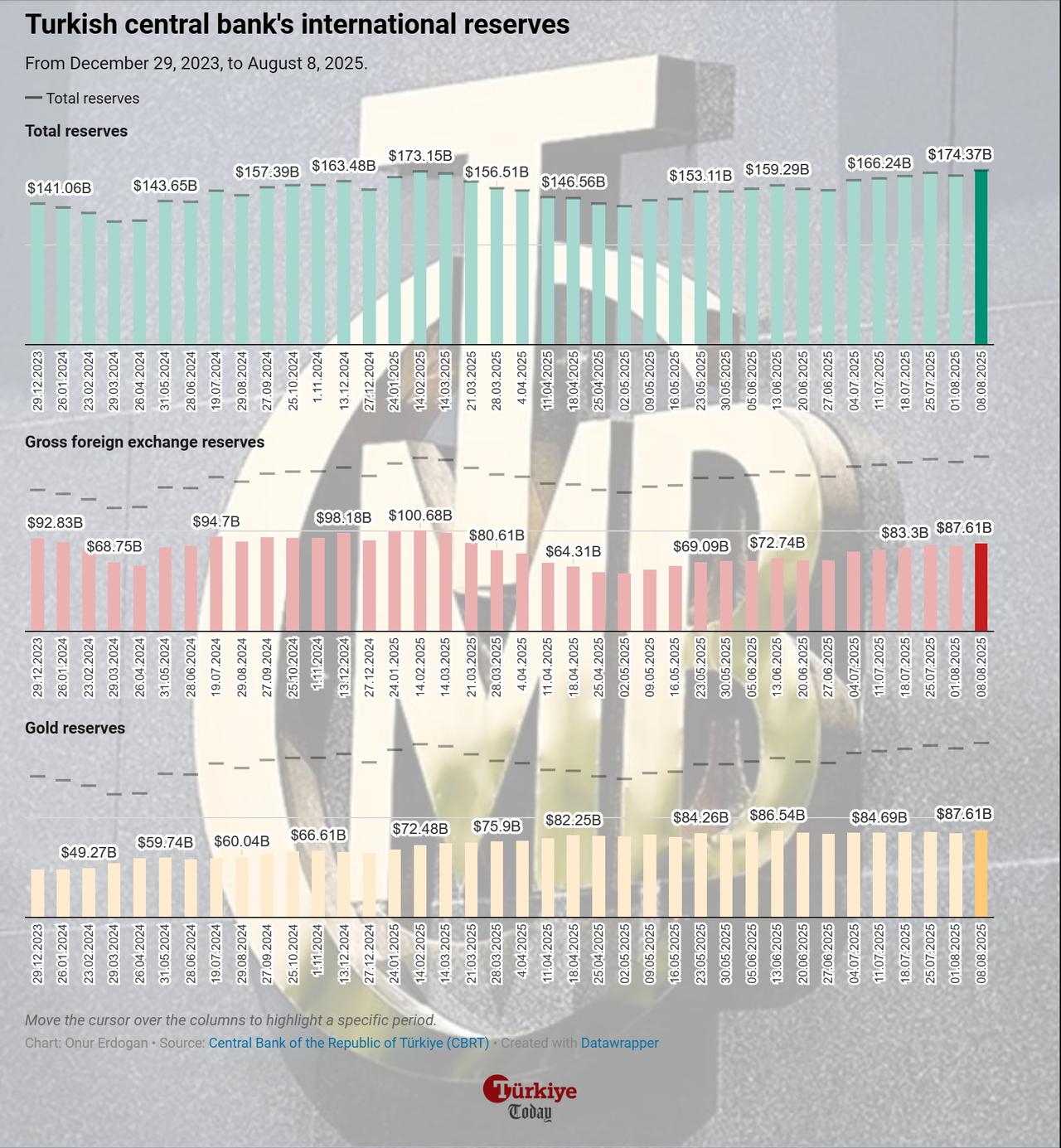

Central Bank of the Republic of Türkiye (CBRT) reserves climbed to an all-time high of $174.4 billion as of Aug. 8, the bank reported on Thursday.

The total reserves rose 3.2%, or $5.38 billion, from the previous week’s level of $168.99 billion.

Foreign currency reserves, which cover holdings in convertible currencies, increased by 3.4% to $79.9 billion. Gold reserves, which include deposits and swaps when applicable, rose by 3.2% to $86.8 billion during the same period.

The bank also reported that net reserves excluding swap agreements rose from $45.6 billion to $49.6 billion over the week.

Speaking at the presentation of the Turkish central bank’s third inflation report in Istanbul, Deputy Governor Hatice Karahan signaled that the bank would continue to accumulate reserves in the near future.

“Our priority is to ensure reserve adequacy,” Karahan said, adding that the bank does not have a specific target. “Our aim to accumulate reserves will continue so that other indicators can move upward.”

Weekly securities statistics showed that non-resident investors purchased $77.9 million worth of equities, extending the net buying trend to a seventh straight week. During the same period, they sold $417 million in government domestic debt securities.

As a result, the total stock of equities held by non-residents increased from $33.27 billion on Aug. 1 to $33.99 billion on Aug. 8. Their holdings in government debt fell from $14.28 billion to $14.01 billion, while holdings of other securities rose slightly from $836.9 million to $843.6 million.

The banking sector’s total deposits rose by ₺169.2 billion ($4.14 billion) to ₺24.65 trillion ($604.29 billion) during the week ending Aug. 8, compared with ₺24.48 trillion the previous week.

Deposits in Turkish lira declined by 0.2% to ₺13.54 trillion, while foreign currency deposits rose by 1.8%to ₺7.92 trillion. In dollar terms, total foreign currency deposits amounted to $234.7 billion, with $195.7 billion held in accounts of residents in Türkiye.

After adjusting for exchange rate effects, residents’ foreign currency deposits grew by $1.53 billion in the week ending Aug. 8.

Consumer loans issued to residents in Türkiye decreased by 0.2% to ₺4.81 trillion during the same week. Meanwhile, the total credit volume of the banking sector, including the Central Bank, increased by ₺86 billion to ₺19.56 trillion as of Aug. 8.