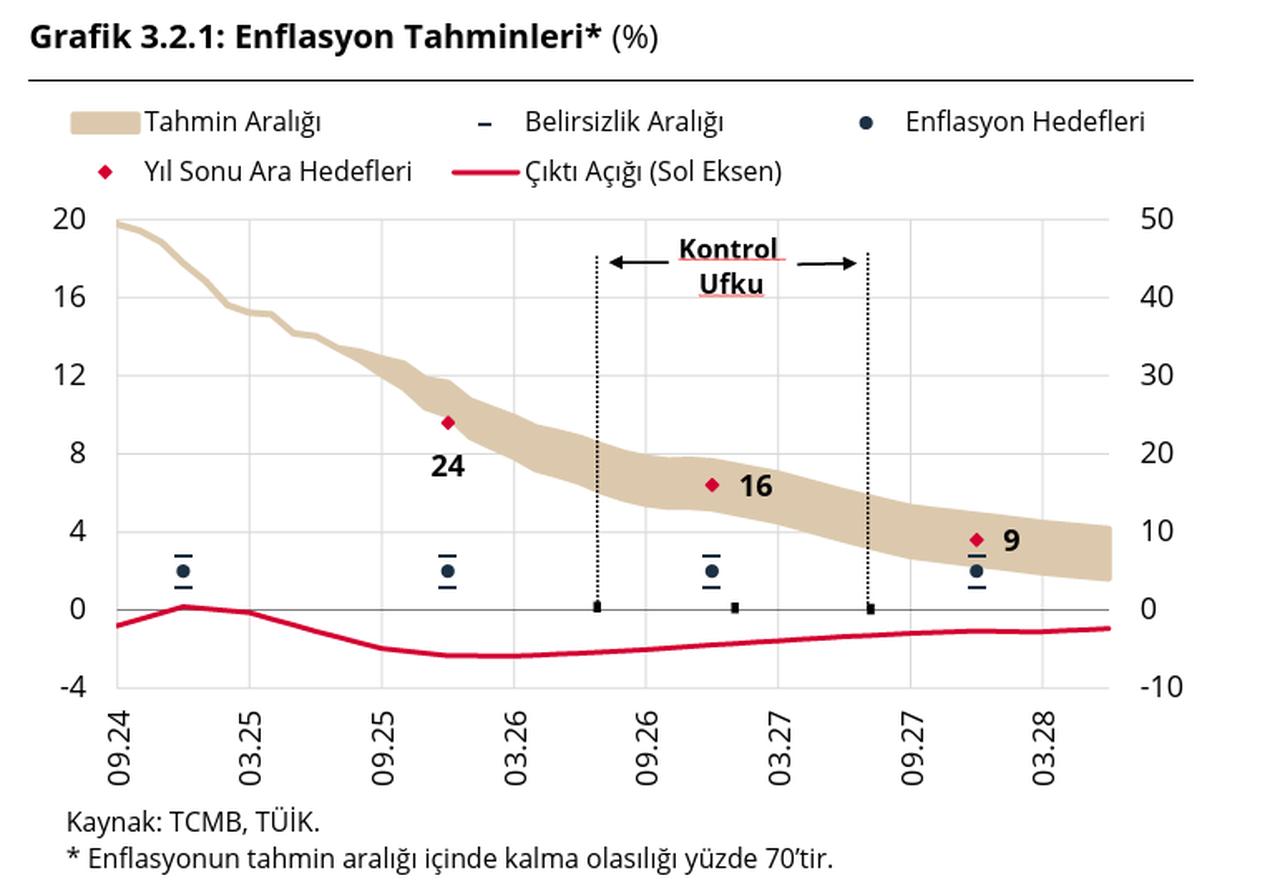

The Central Bank of the Republic of Türkiye (CBRT) left its year-end inflation forecast for 2025 unchanged at 24%, Governor Fatih Karahan announced on Thursday.

Speaking at a press conference held at the Turkish central bank's headquarters in the Istanbul Financial Center, Karahan added that the bank expects inflation to end 2025 in a range of 25% to 29% with a 70% probability and to close 2026 in a range of 13% to 19%.

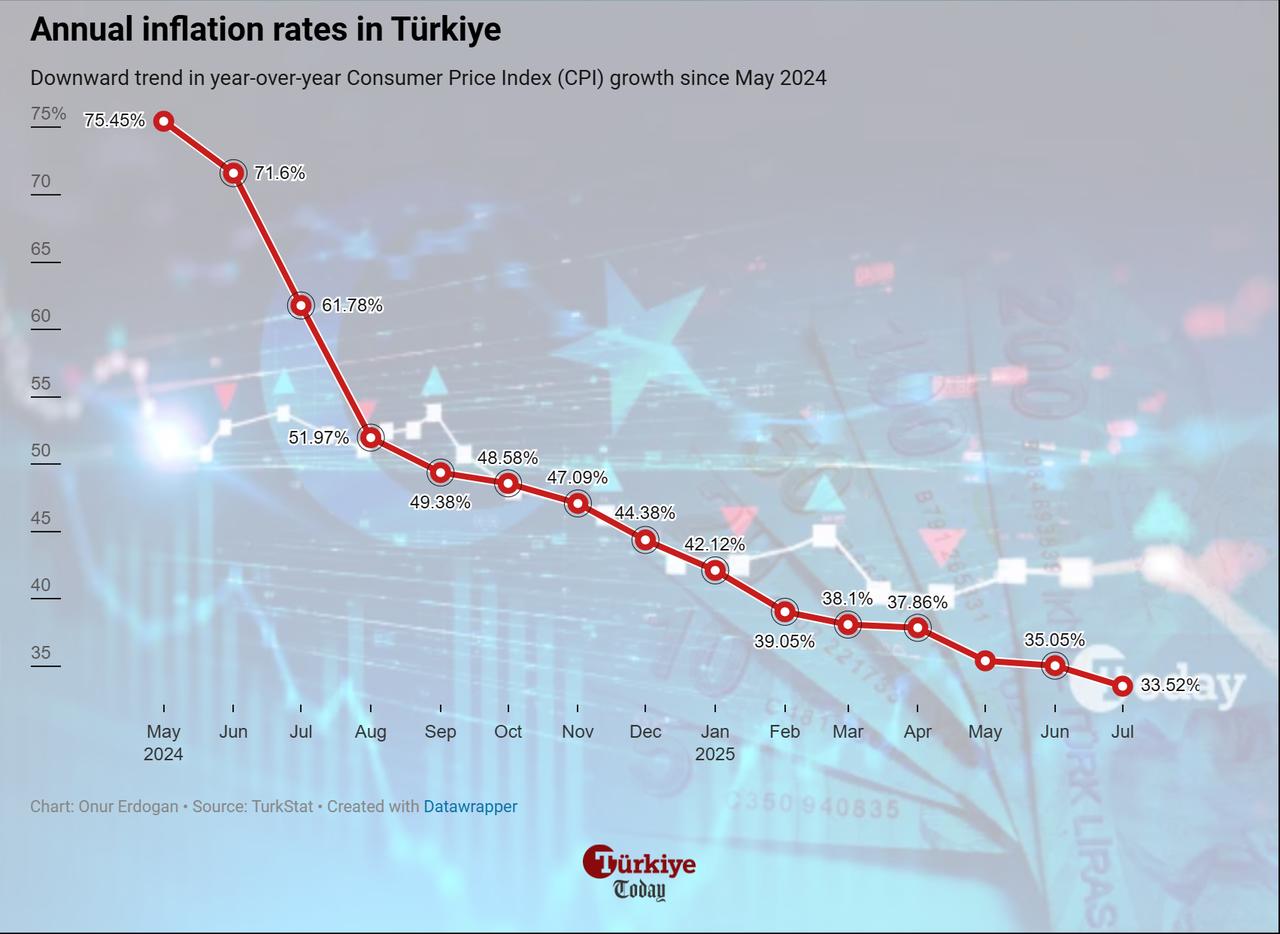

Türkiye’s annual inflation eased to 33.5% in July, the lowest level since November 2021, extending the downward trend from a peak of 75.5% in May 2024.

Karahan explained that, unlike in previous reports, the central bank has set the inflation forecast as an interim target and will apply this strategy going forward, noting that it will remain unchanged unless an extraordinary development occurs.

The interim targets for 2026 and 2027 year-end inflation are set at 16% and 9%.

The bank had previously revised its forecast upward from 21% to 24% in its first inflation report of the year and then maintained the estimate in its second report released in May, which projected inflation at 24% for 2025, 12% for 2026, and 8% for 2027.

After the presentation, Karahan argued that the change is an important shift in the Turksih central bank's communication strategy.

"Until now, interim targets acted as forecasts, but because of the high uncertainty around inflation, we often had to revise them," Karahan said. "Starting with this meeting, we have decided to separate the two."

Karahan reaffirmed the central bank’s determination to maintain a restrictive stance until price stability is firmly established.

“We have been receiving the results of our tight monetary policy gradually,” he said, stressing that domestic demand has slowed and that the disinflationary effect of weaker demand conditions has strengthened.

The Turkish central bank resumed interest rate cuts in July, reducing the policy rate by 300 basis points to 43%.

The policy rate in Türkiye, which is the benchmark rate for financing costs, has remained above 40% since 2023, while the latest market participants survey conducted by the bank forecasted the year-end rate at 36.2%.

Karahan highlighted that tight monetary policy has been gradually reducing inflationary pressures, with domestic demand showing a continued slowdown.

“Private consumption growth decelerated in the first quarter of 2025, and its contribution to growth declined markedly compared to the pre-tightening period,” he said.

Net exports, meanwhile, have shown a more balanced impact on overall economic activity.

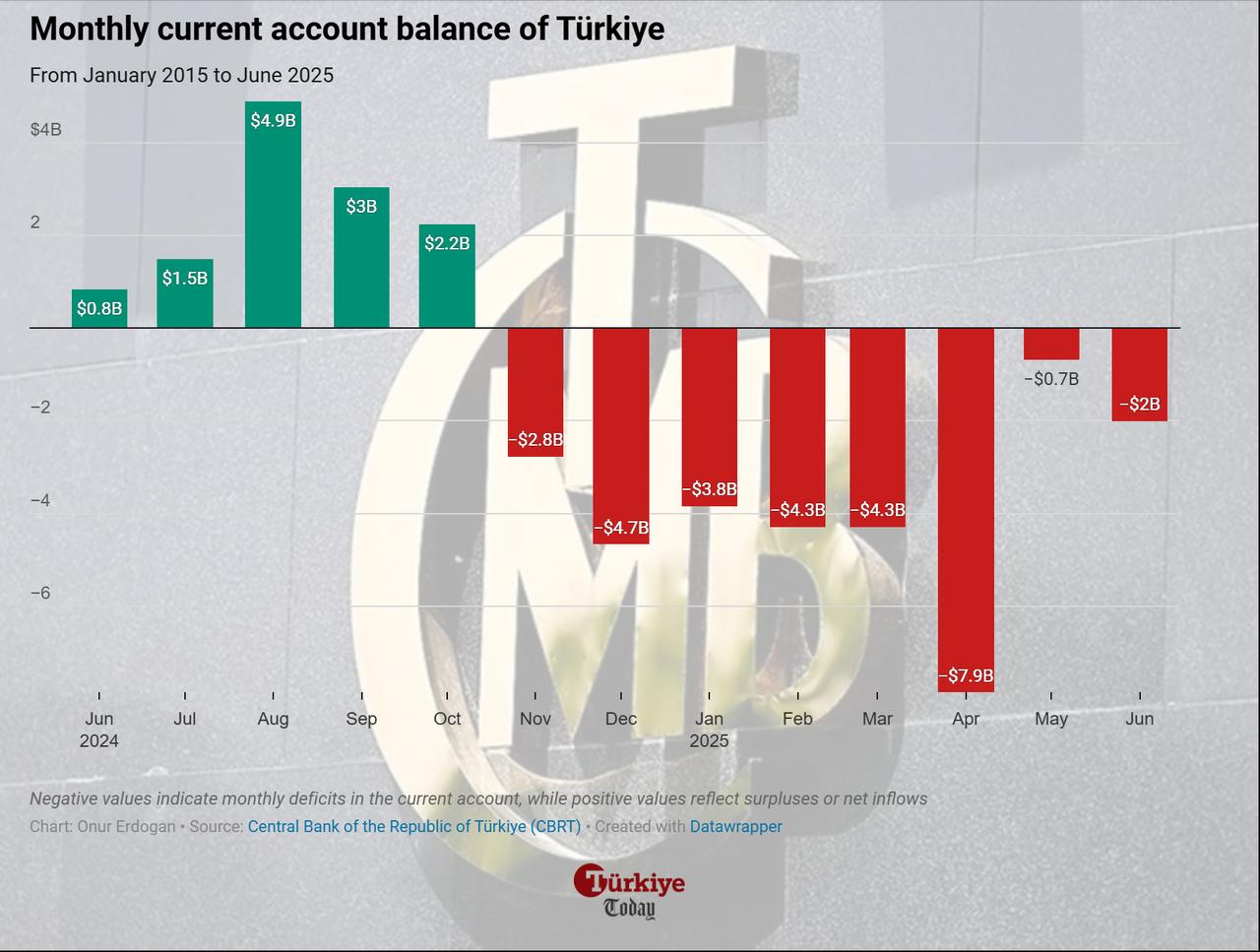

According to Karahan, preliminary data for July pointed to an improvement in the foreign trade balance, helping keep the current account deficit moderate.

“The current account deficit stood at around 1.3% of gross domestic product in the second quarter,” Karahan said, adding that the ratio is expected to remain below long-term averages throughout 2025, although risks from energy prices and global trade policies persist.

Türkiye's current deficit widened to $18.9 billion in July on an annualized basis, while the gap also surpassed $23 billion during the first half of the year.

Karahan also referred to global developments, noting that trade policy uncertainties, while somewhat reduced by bilateral agreements, remain elevated.

“Sector-specific tariffs that were introduced in recent years are still in effect, and geopolitical risks continue to weigh on the global economic outlook,” he said.

Although there has been a modest improvement in growth expectations, Karahan added that forecasts “remain below the levels observed at the beginning of the year.”

Türkiye's economy expanded 2% during the first quarter of 2025 year-over-year, decelerating from the previous quarter's growth of 3%.

Karahan also pointed out that Türkiye’s inflation path has been negatively influenced by persistent pressures in the services sector, particularly in categories such as rent, hotels, cafes and restaurants.

“Even though inflation has come in below market expectations for three consecutive months, inertia in service prices continues to pose risks to our forecasts,” he explained.

Temporary upward movements in core inflation indicators in April and July were largely due to time-based price adjustments in major service categories, he asserted.

Karahan said that as inflation expectations continue to decline and price pressures in the services sector ease, the underlying trend in inflation is expected to keep falling through the rest of 2025.