The Central Bank of the Republic of Türkiye (CBRT) increased its total reserves by $6.99 billion in the week ending January 9 to $196.08 billion, nearing the all-time high of $198.44 billion, largely due to a rise in foreign currency assets.

Meanwhile, foreign inflows into Turkish assets surpassed $1 billion during the same period, reflecting renewed investor confidence and growing expectations of an improved macroeconomic outlook.

Gross foreign exchange reserves rose by $4.78 billion to $79.35 billion, while gold reserves increased by $2.20 billion to $116.73 billion. Net international reserves increased from $76.9 billion to $82.9 billion during the same period, while net reserves excluding swaps rose from $62.6 billion to $70.1 billion.

Türkiye’s benchmark BIST 100 index closed the week at 12,190 points, gaining 6.11%, while 2-year treasury yields eased to 37.04% as softer-than-expected inflation data for December 2025 boosted market expectations for a 150 basis point rate cut at the central bank’s next policy meeting.

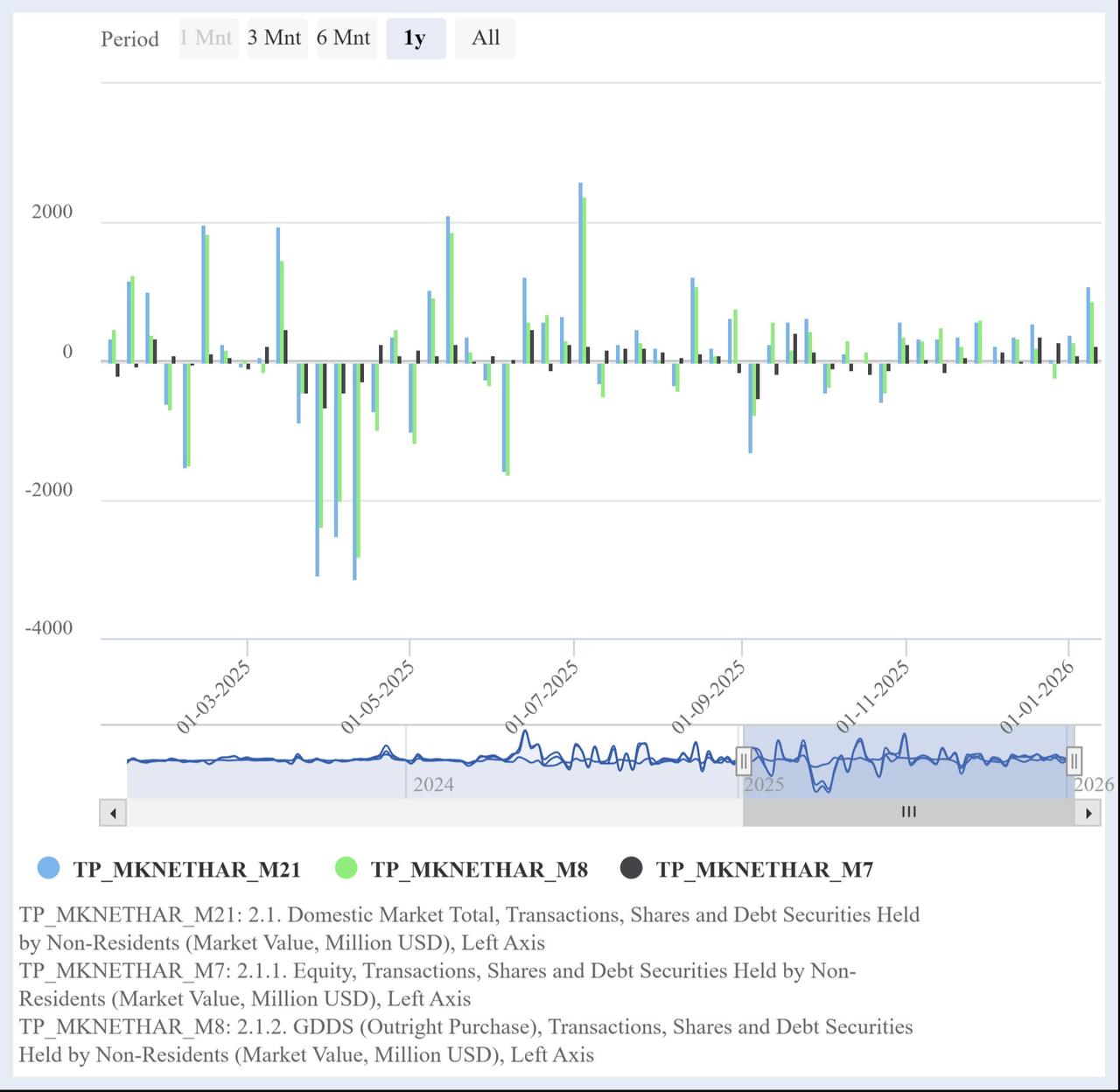

The improved sentiment also fueled renewed foreign interest in Turkish assets, including $237.6 million in equities and $864.8 million in government domestic debt securities, marking the highest weekly bond purchase by non-residents since mid-August.

The stock of Turkish equities held by foreign investors rose from $33.91 billion to $36.33 billion, while their holdings in GDSs increased from $18.41 billion to $19.25 billion. Non-government sector securities held by foreign investors stood at $618.2 million.

In the same period, total deposits in the banking sector rose by 0.4%, reaching ₺28.12 trillion ($651.02 billion).

Deposits in Turkish lira declined slightly by 0.1% to ₺15.15 trillion, while total foreign currency deposits remained stable at $256.88 billion. Of this amount, $219.75 billion was held by domestic residents, representing a $520 million week-on-week decrease.

Consumer loans issued to domestic residents fell by 0.4% to ₺5.70 trillion, indicating a mild pullback in credit activity.