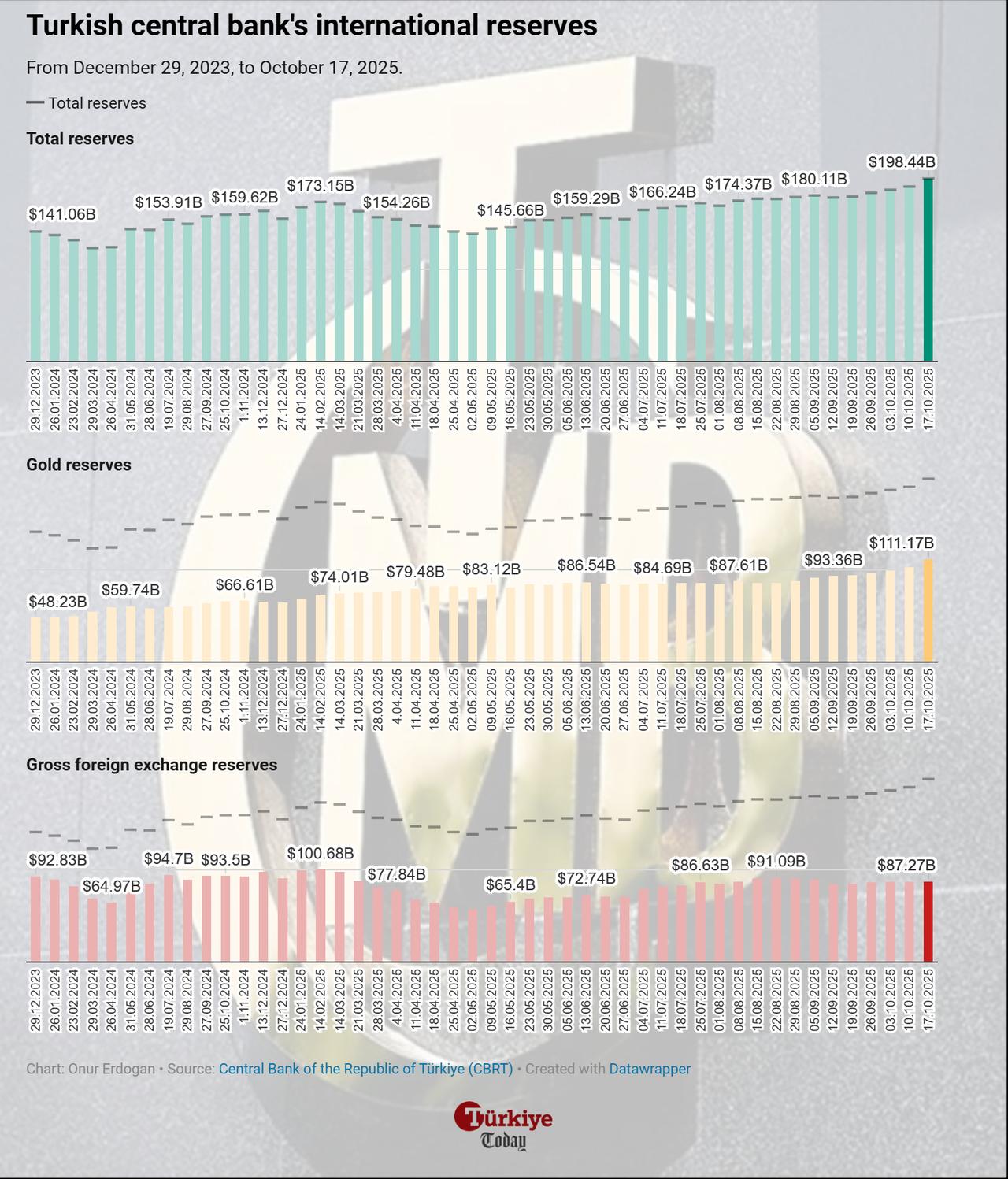

The Central Bank of the Republic of Türkiye (CBRT) recorded its highest-ever total reserves, reaching $198.44 billion as of the week ending Oct. 17, driven primarily by a sharp rise in global gold prices, which closed the week at $4,249 per ounce.

Gold holdings increased by $8.77 billion during the week, rising from $102.4 billion to $111.17 billion. In contrast, gross foreign exchange (FX) reserves declined slightly by $64 million to $87.27 billion, compared with $87.34 billion a week earlier.

The CBRT’s swap-adjusted net reserves—which exclude temporary FX swap transactions—rose from $61.8 billion to $63.3 billion. Total net reserves, including swaps, also inched up from $79.3 billion to $79.6 billion, continuing the steady buildup seen since early summer.

Weekly securities data showed that non-resident investors sold a net $178 million in Turkish equities during the same period. However, they purchased $151.1 million in government domestic debt securities and $2.2 million in private-sector bonds issued by entities outside the general government category.

As a result, foreign investors’ total equity holdings decreased from $32.53 billion to $30.66 billion, while their government bond holdings fell slightly from $15.45 billion to $15.38 billion. Private-sector debt holdings remained nearly unchanged at $593.7 million.

According to CBRT data, total deposits in Türkiye’s banking sector rose by ₺944.44 billion ($22.49 billion) during the week, reaching ₺26.75 trillion. Turkish-lira-denominated deposits increased by 3% to ₺14.39 trillion, while foreign-currency deposits climbed by 5% to $256.67 billion.

Of that amount, $218.26 billion was held by residents, with domestic foreign-currency deposits rising by $2.29 billion during the week ending Oct. 17.

Domestic consumer loans in the banking sector edged down 0.5% from the previous week to ₺5.1 trillion, reflecting a cautious lending environment amid high borrowing costs and the central bank’s gradual monetary easing path.