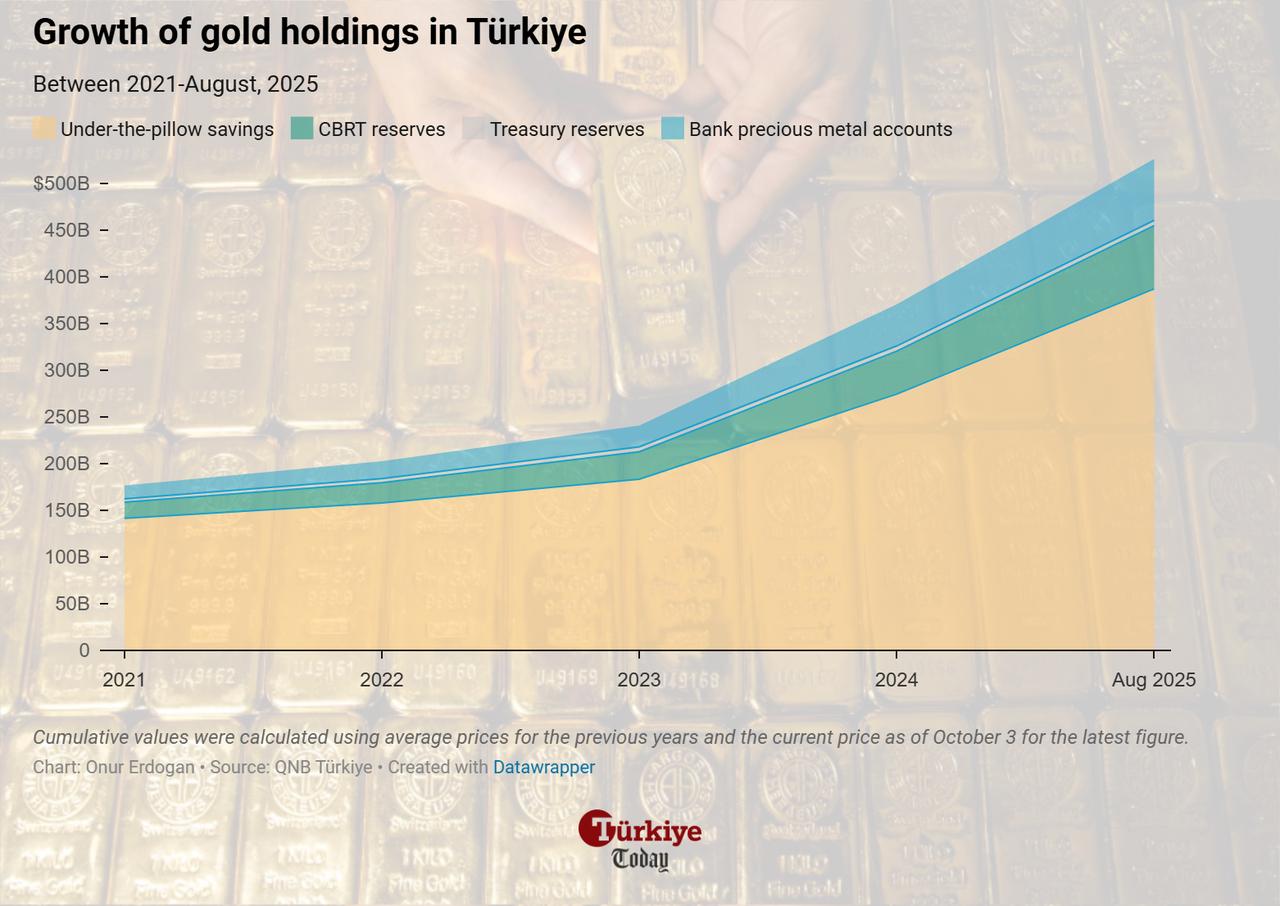

Amid a record-breaking gold rally that has pushed global prices to levels nearing $4,000 per ounce, figures show that the Turkish economy’s cumulative gains over the past five years have reached an estimated $349.69 billion, with total reserves standing at 4,210 tons as of August and valued at $526.04 billion at current prices.

According to a study by QNB Türkiye economists, the majority of these gains came from local residents’ physical holdings, known as "under the pillow" savings kept outside the financial system, which rose by 51 tons to 3,100 tons in the first eight months of 2025 with an estimated value of $387.35 billion.

Gains since the end of 2024 reached $155.55 billion from the total gold holdings in the Turkish economy.

By contrast, gold holdings secured within the Turkish financial system represent only a minority share, amounting to $139.07 billion, or 26.2% of the total stock, when official gold reserves are included.

Total gold holdings in Turkish banks reached $65.72 billion with 526 tons, while the combined official reserves of the central bank and the treasury stood at 587 tons, valued at $73.34 billion.

This imbalance reflects Turkish citizens’ longstanding habit of protecting wealth against high inflation through physical gold investment. Cultural preferences that elevate jewelry demand also play a role, with Türkiye ranking as the world’s fourth-largest market for gold jewelry, according to the World Gold Council.

However, data from the Central Bank of the Republic of Türkiye (CBRT) reveal that between January and August, production of physical gold coins by the Turkish Mint fell 52% to 28 tons, signaling a notable decline in demand.

While holding gold continues to be a safe-haven strategy, its benefits remain limited when assets stay isolated from the financial system. Yet, QNB economists underlined that the pace of shifting into "under the pillow" savings has clearly slowed.

"Alongside the attractiveness of interest-bearing Turkish lira investments, the high levels reached by gold prices may have played a role. Accordingly, the annual growth in ‘under the pillow’ gold investments has fallen to around 100 tons, while the average monthly increase during the first eight months of this year has been limited to only 6 tons," the bank's economists noted.

During an investor meeting in Amsterdam this week, Turkish central bank Governor Fatih Karahan also addressed the matter, stressing that "as inflation falls, gold demand also declines."

Gold prices have surged by over 48% year-to-date, reaching $3,886.45 per ounce as of the October 3 close. This marks the most profitable year for the precious metal since 1979, fueled by heightened demand from global central banks, investors, and exchange-traded funds amid rising geopolitical tensions and uncertainties.

In Türkiye, the gram price of gold rose 74.67%, far outpacing the annual inflation rate, which rebounded to 33.2% in September.

The rapid rise in gold prices has not only boosted the value of household savings but has also influenced spending behavior in ways that complicated monetary policy.

According to the QNB Türkiye's Chief Economist Erkin Isik, wealth created through gold and other assets often translates into stronger consumption, making it harder for higher interest rates alone to slow demand.

The central bank acknowledged this dynamic in its February Inflation Report, noting that asset price gains — from gold, real estate, and financial instruments—were feeding into resilient household demand. Later analyses suggested that this wealth effect temporarily weakened in mid-2024, which helped reinforce disinflation efforts. Yet with gold climbing again, the same mechanism appears to be working in the opposite direction, softening policy effectiveness.

Isik argued that while higher gold prices clearly strengthen household balance sheets, the fact that much of this wealth is kept outside the financial system limits how far it can support broader economic stability.

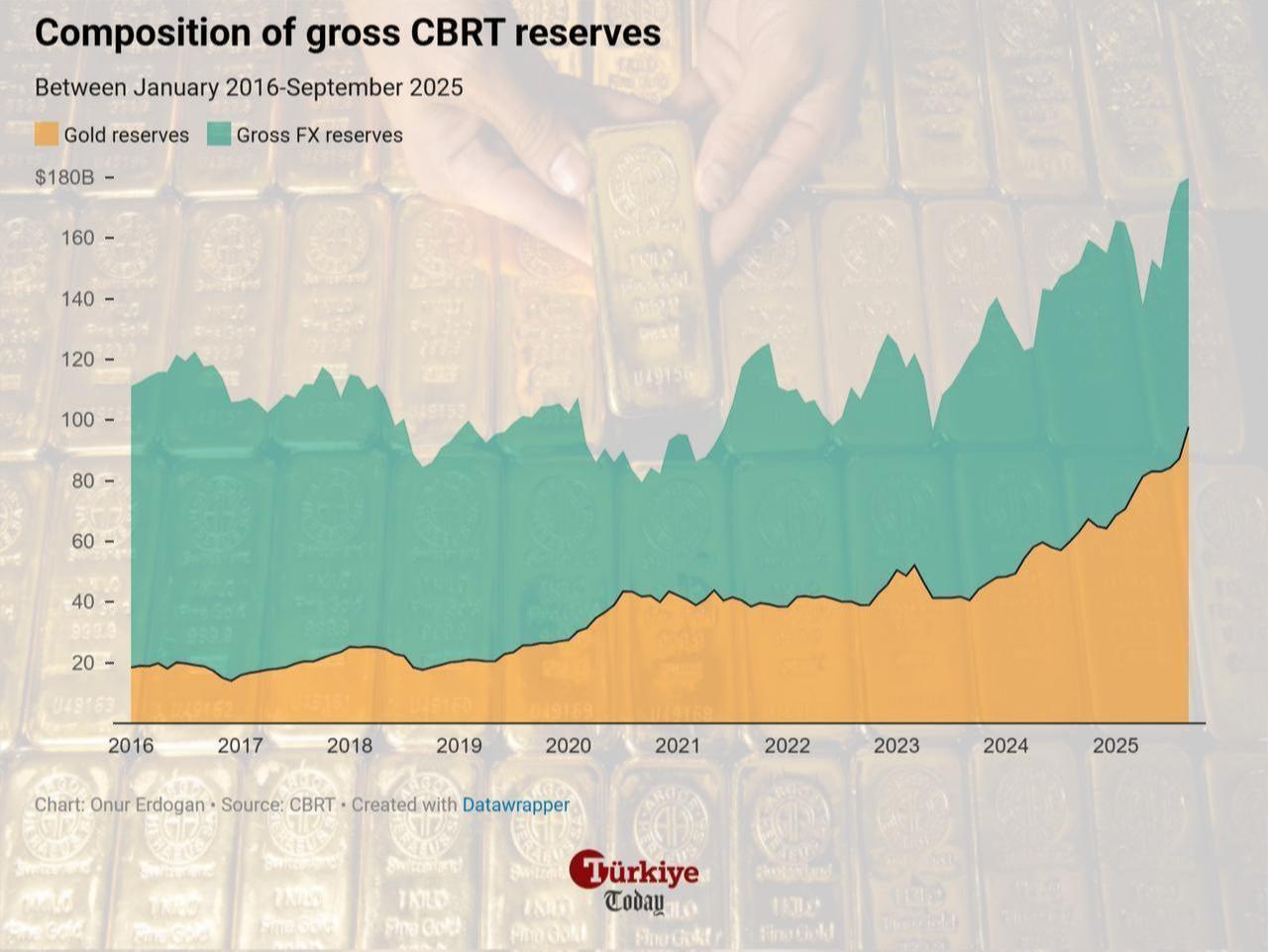

Meanwhile, during the first eight months of 2025, the Turkish central bank and treasury remained among the world’s most active gold buyers. Their official reserves rose by a net 21.7 tons, equivalent to $5.02 billion, according to the World Gold Council’s latest figures.

Over the past five years, Türkiye is estimated to have boosted its official gold reserves by 244.4 tons. According to the central bank’s latest report on reserve positions for the week ending September 26, gross gold reserves stood at $87.32 billion—an increase of more than $45.16 billion since 2021.

This expansion has been a key driver of the central bank’s record-breaking accumulation in recent months, helping push Türkiye’s total international reserves to $182.95 billion.

As a hedge against currency volatility and global financial uncertainty, Türkiye has sought to diversify its international assets. Reliance on foreign capital has often left the economy exposed to shifts in investor sentiment, but stronger gold reserves provide greater balance. By holding a larger share of reserves in gold rather than in foreign currencies, the central bank aims to reduce external vulnerabilities, strengthen market confidence, and demonstrate resilience against geopolitical and economic shocks.

With these purchases, Türkiye has secured its place among the world’s top 10 gold holders, ranking eighth with a total of 634.76 tons.