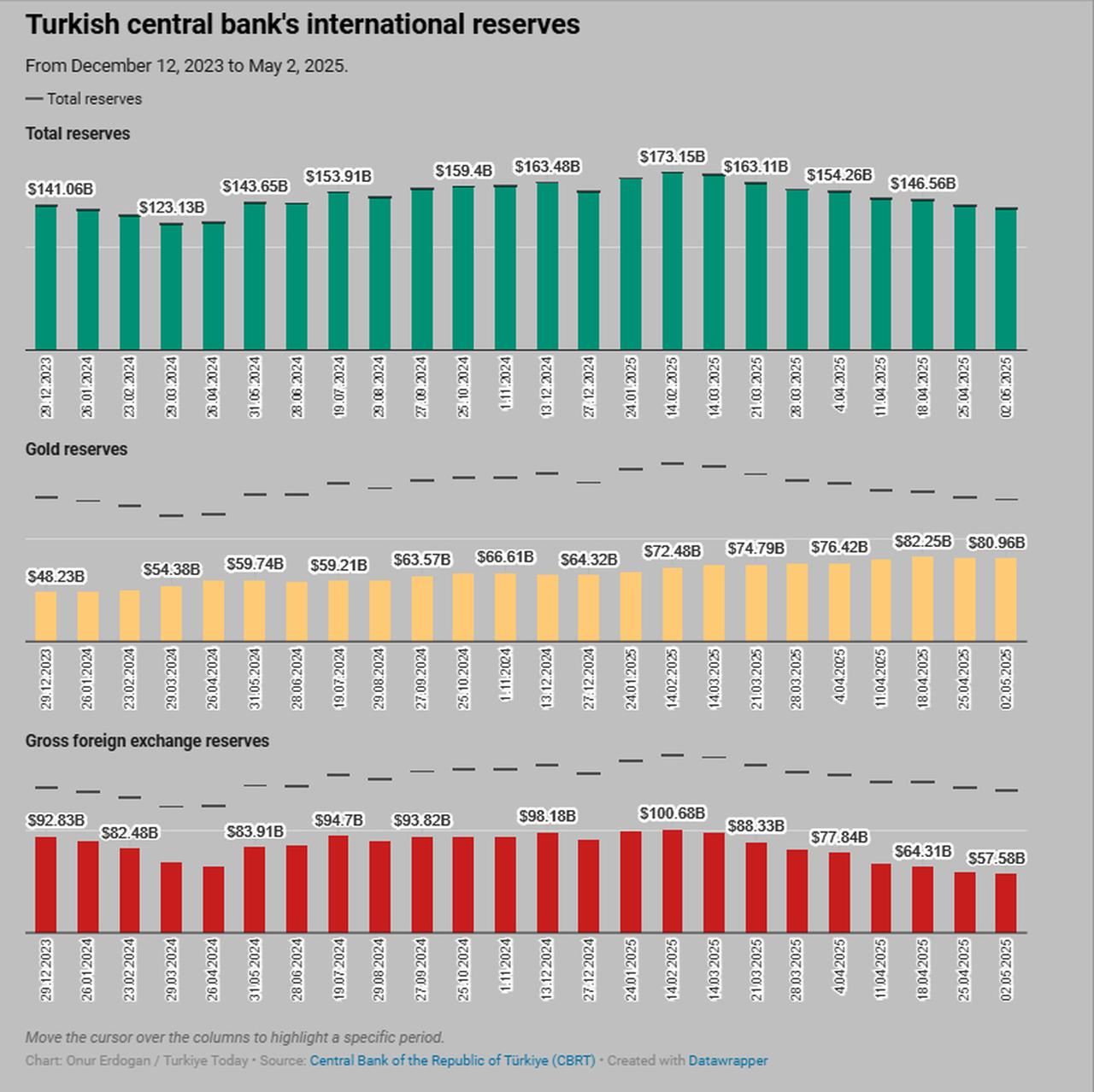

The Central Bank of the Republic of Türkiye (CBRT) reported on Thursday that its total reserves decreased by $2.52 billion to $138.53 billion in the week ending May 2, compared to the previous week.

The bank had held $141.05 billion in total reserves as of April 25, reflecting continued pressure on Türkiye’s foreign exchange and gold reserves.

As of May 2, gross foreign exchange reserves fell by $1.67 billion to $57.58 billion. Gold reserves also dropped by $845 million, decreasing from $81.80 billion to $80.96 billion.

According to the "Weekly Securities Statistics," non-resident investors were net buyers of $173.6 million in equities during the week ending May 2, while they sold $1.16 billion in Government Domestic Securities (GDS) and $30.8 million in securities issued by sectors other than general government.

The equity holdings of non-resident investors declined from $28.57 billion on April 25 to $27.81 billion as of May 2. During the same period, their holdings in GDS dropped from $10.33 billion to $9.12 billion, and their holdings in non-government sector securities fell from $370.7 million to $338.6 million.

The banking sector’s total deposits increased by ₺74.91 billion ($1.93 billion) in the week ending May 2, rising from ₺22.53 trillion to ₺22.60 trillion.

Domestic consumer loans in the banking sector rose by 2% last week to ₺4.32 trillion. Of these loans, ₺562.09 billion were housing loans, ₺63.85 billion were vehicle loans, and ₺1.62 trillion were personal loans.

The total credit volume of the banking sector, including the CBRT, rose by ₺182.35 billion during the week ending May 2, reaching ₺17.80 trillion.