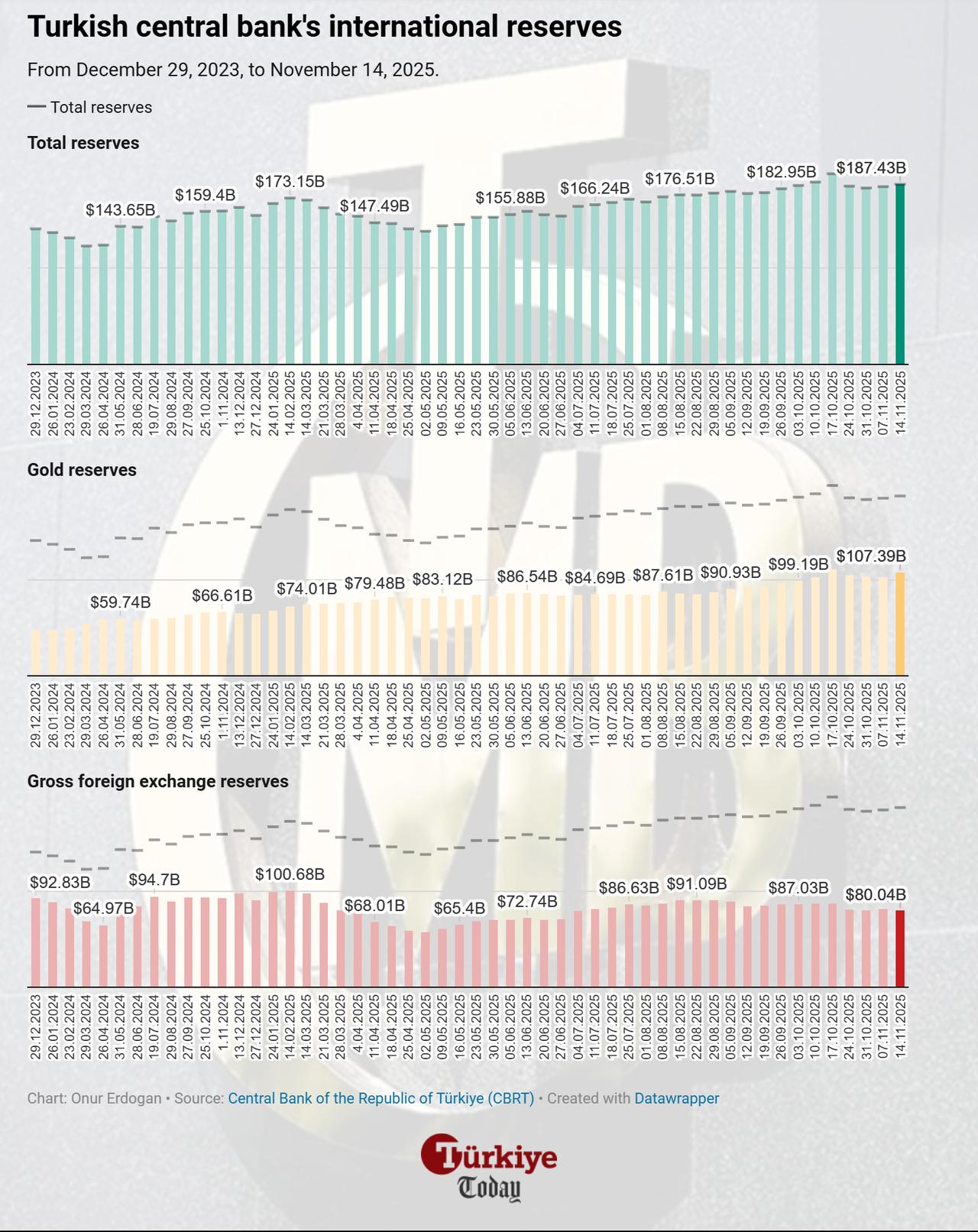

The Central Bank of the Republic of Türkiye (CBRT) increased its total reserves to $187.43 billion during the week ending November 14 with a $2.39 billion rise from the previous week, according to a report released on Thursday.

The gain was primarily driven by a $4.33 billion surge in gold reserves, which rose to $107.39 billion, while gross foreign exchange (FX) reserves fell by $1.94 billion to $80.04 billion in contrast.

Despite the rise in total reserves, the central bank’s net reserves edged down to $72.2 billion from $73.3 billion. When excluding currency swaps, net reserves declined slightly from $58.4 billion to $57.8 billion.

During the same week, non-resident investors sold a net $158.8 million worth of Turkish equities, even as they increased their holdings of government domestic debt securities (GDSs) by $499.8 million. They also offloaded $13.3 million in other public sector assets outside the general government.

Foreign-held equity stocks declined from $32.36 billion to $30.78 billion during the period, while holdings of GDSs rose from $15.85 billion to $16.21 billion, and stocks of other public sector securities decreased from $516.2 million to $501.4 million.

Total deposits in Türkiye’s banking system climbed to ₺26.96 trillion ($636.3 billion) as of November 14, marking an increase of ₺837.9 billion from the previous week.

Turkish lira-denominated deposits rose 3.9% week-on-week to reach 14.64 trillion, while foreign-currency deposits grew 2% to ₺8.98 trillion. Of the foreign-currency total, $213.4 billion was held by residents in Türkiye, reflecting a $742 million increase from the previous week.

Meanwhile, domestic consumer loans rose 2.2% during the week, reaching ₺5.36 trillion.