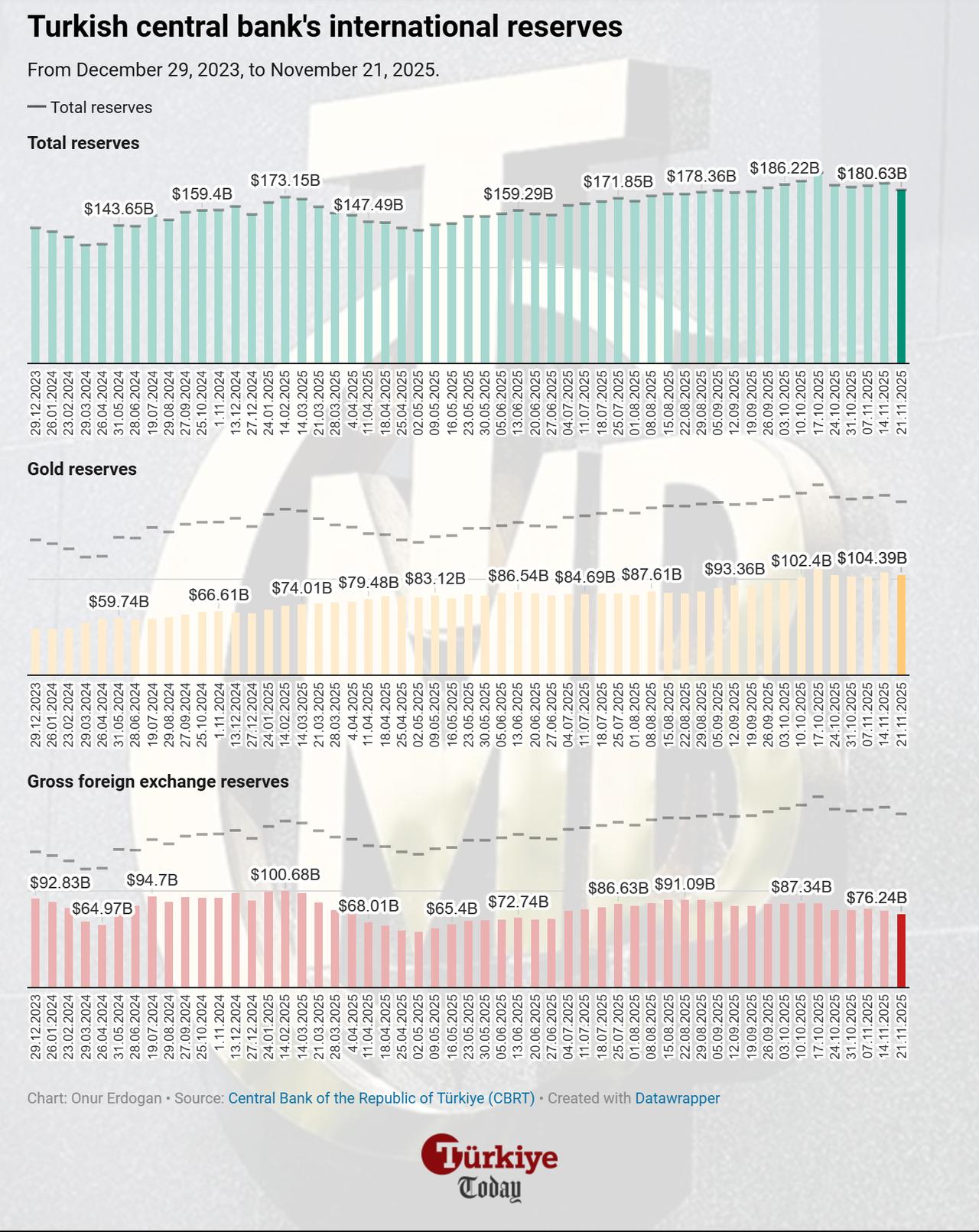

The Central Bank of the Republic of Türkiye (CBRT) reported a $6.8 billion decline in total reserves for the week ending November 21, bringing the figure down to $180.63 billion from $187.43 billion.

Gross foreign exchange reserves fell by $3.8 billion over the period, declining from $80.04 billion to $76.24 billion. Meanwhile, the CBRT’s gold reserves also dropped by $3 billion, falling to $104.39 billion from $107.39 billion.

Net international reserves fell to $69.4 billion from $72.2 billion the previous week, while swap-adjusted net reserves declined to $55.1 billion from $57.8 billion.

Despite the fall in central bank reserves, foreign investor participation in Turkish financial markets showed a modest uptick. According to weekly securities statistics published by the CBRT, non-resident investors purchased $71.9 million in Turkish equities during the same week ending November 21.

In addition to equities, international investors purchased $239.1 million worth of government domestic securities (GDSs) and $47.3 million in securities issued by sectors outside the general government. As a result, the total amount of bonds acquired by non-residents over the past four weeks reached $1.4 billion.

As a result, foreign-held Turkish equities rose from $30.78 billion to $31.59 billion, domestic bond holdings increased from $16.21 billion to $16.46 billion, and non-sovereign sector securities climbed to $547.1 million.

Banking sector data from the same period showed a parallel decrease in local currency activity. Total deposits in the banking system declined by ₺197.13 billion ($4.64 billion), falling from ₺26.96 trillion to ₺26.76 trillion ($630.72 billion).

Turkish lira-denominated deposits dropped slightly by 0.1%, while foreign-currency deposits in the system decreased by 0.9%, settling at $247.95 billion. Of this total, $210.84 billion belonged to domestic residents.

Consumer loans issued to residents also recorded a slight contraction, declining by 0.6% to ₺5.33 trillion ($125.62 billion).