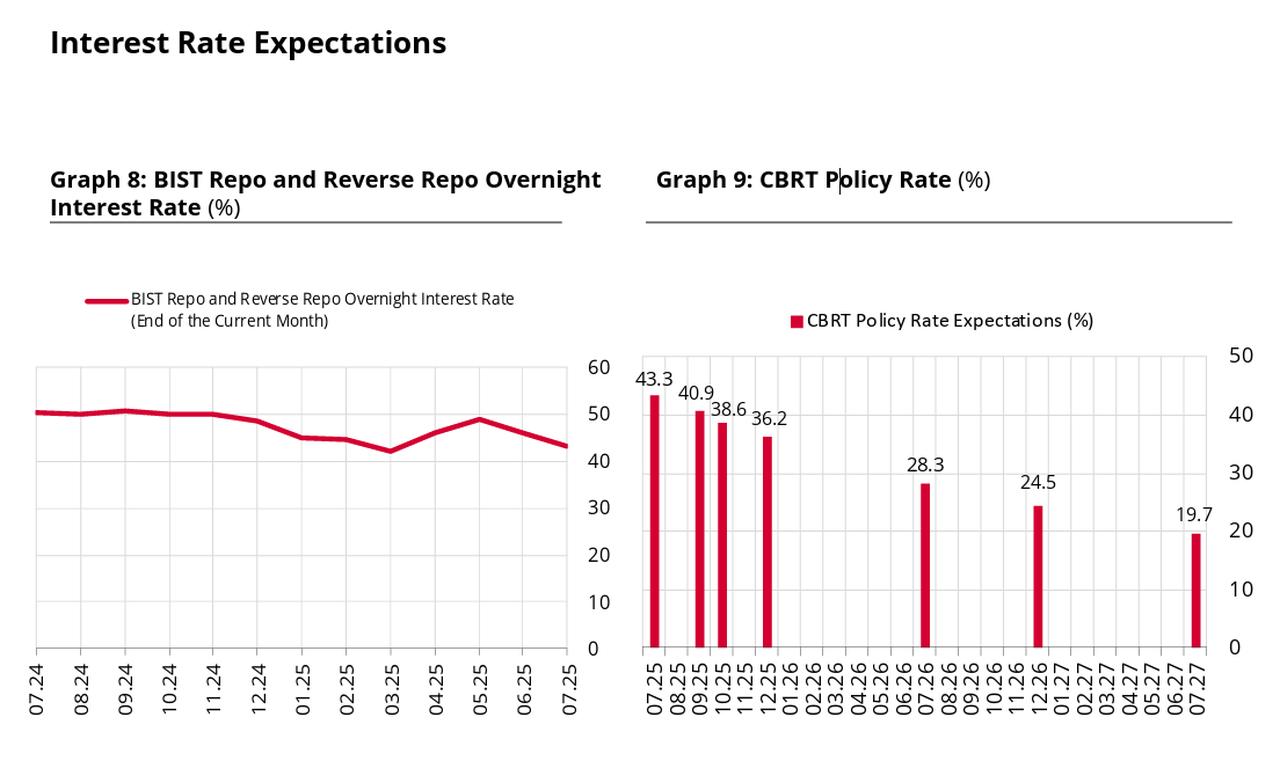

Market participants in Türkiye anticipate a sharp monetary policy shift beginning in July, with the Central Bank of the Republic of Türkiye (CBRT) expected to lower its benchmark interest rate by at least 250 basis points.

The latest Market Participants Survey conducted by the CBRT places the policy rate expectation for the upcoming meeting at 43.29%, signaling a notable departure from the current stance.

Forecasts for subsequent meetings also suggest continued rate cuts, with expectations declining to 40.90% for the second policy meeting and 38.60% for the third.

The year-end policy rate is projected at 36.16%, while the 12-month outlook falls further to 28.25%, reflecting expectations of an extended easing cycle.

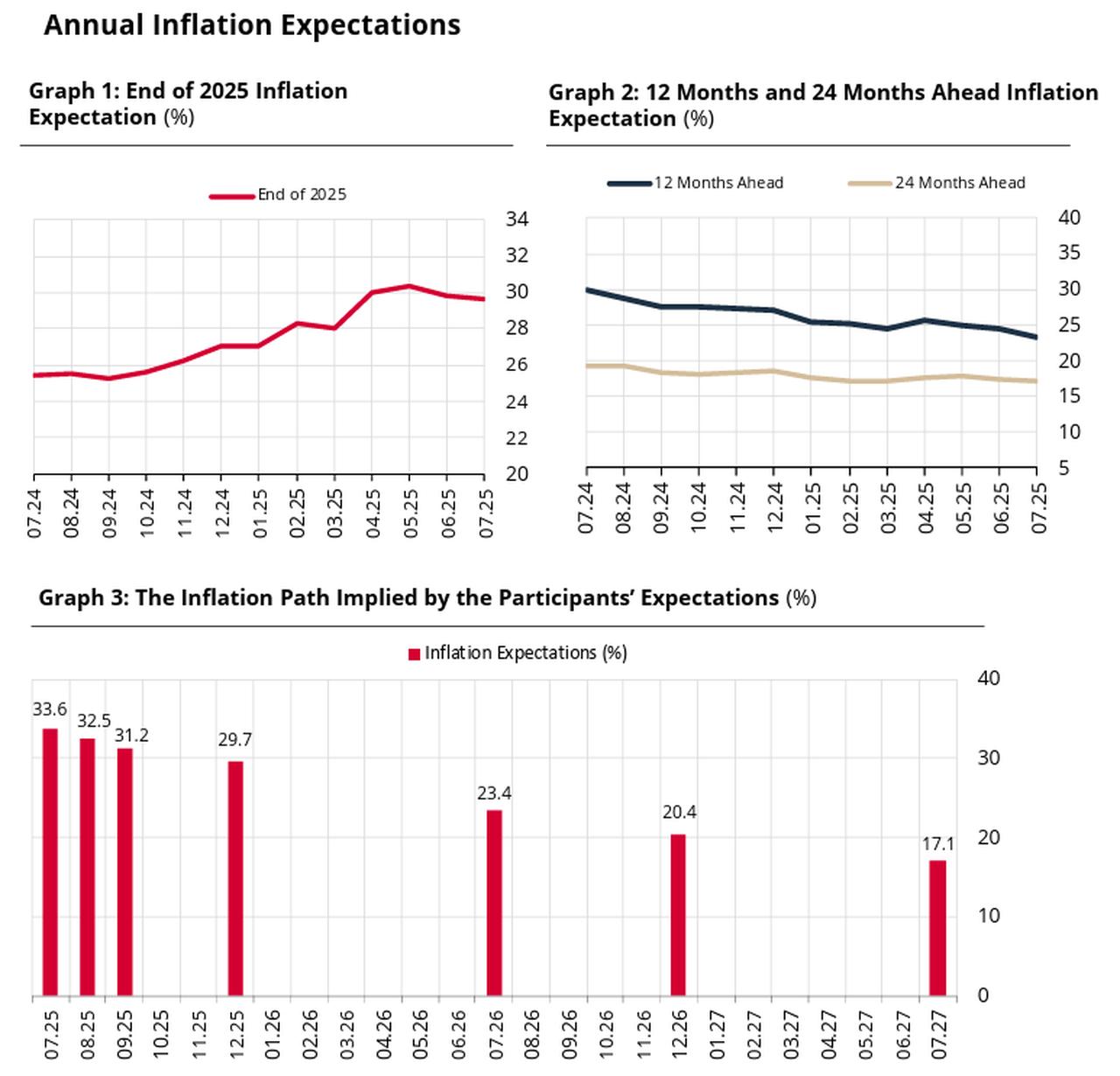

Despite the projected monetary easing, market participants maintain a cautious inflation outlook.

The year-end forecast for consumer price inflation (CPI) stands at 29.66%, slightly down from the previous month’s projection of 29.86% but still well above the central bank’s 24% year-end target.

Short-term price pressures appear to be rising, with the expected monthly CPI increase for July revised upward to 2.11% from 1.86%.

However, longer-term inflation expectations show a mild improvement.

The 12-month CPI projection declined to 23.39% from 24.56%, while the 24-month estimate eased to 17.08% from 17.35%.

Türkiye's annual inflation continued its downward trend for the 13th consecutive month in June, falling to 35.05%, while consumer prices rose 1.37% from the previous month.

The survey indicates continued depreciation pressure on the Turkish lira.

The year-end USD/TRY exchange rate is forecast at 43.7219, up from 43.5731. The 12-month forecast rose more sharply, from 47.0352 to 47.6972.

Expectations for Türkiye’s current account deficit have also shifted upward.

Market participants now estimate a year-end deficit of $19.9 billion, compared to $18.8 billion in the previous survey. The forecast for 2026 widened to $25.3 billion.