Turkish citizens spent $8.8 billion abroad with credit cards in the first seven months of 2025, equal to ₺364.9 billion and up 65.6% from ₺220.4 billion ($5.3 billion) in the same period of 2024, according to data from the Interbank Card Center (BKM).

The number of overseas transactions also rose, reaching 277 million between January and July, compared with 212 million in the previous year.

The surge was mainly driven by a rising number of Turkish tourists traveling abroad amid steep price increases in Türkiye, as data from the Culture and Tourism Ministry showed that 12.5 million citizens went abroad during the same period, up 7.3% from 11.65 million a year earlier.

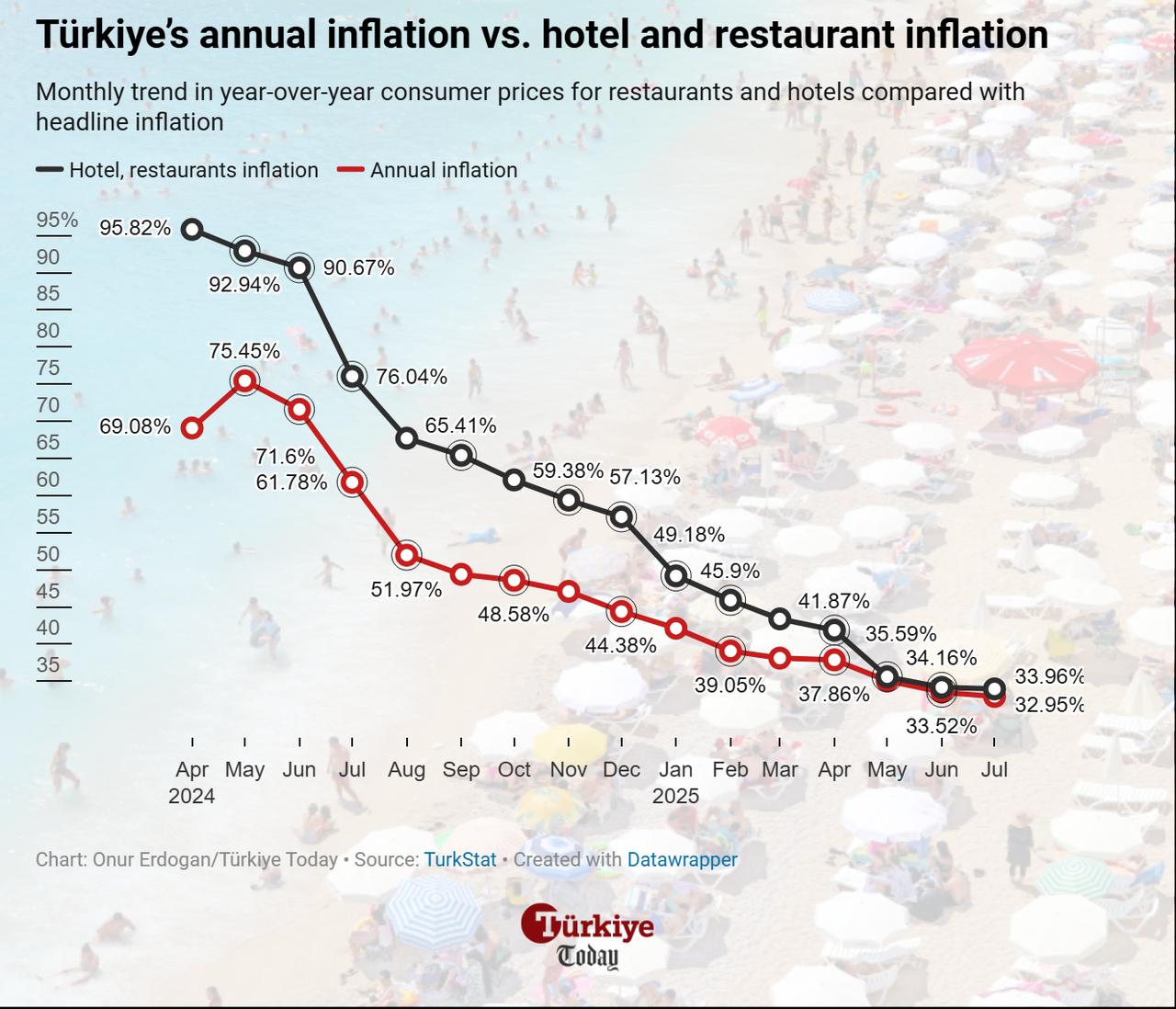

According to the Turkish Statistical Institute (TurkStat), hotel and restaurant inflation eased to 34% in August from a peak of 95.8% in April 2024, prompting holidaymakers to look overseas for more affordable resorts.

Monthly data show steady growth throughout the summer. Spending reached ₺56 billion ($1.36 billion) in May and ₺57.8 billion ($1.40 billion) in June before climbing to ₺63.2 billion ($1.53 billion) in July.

The July total represented a 67% increase from ₺37.8 billion ($0.92 billion) in July 2024. In terms of transaction numbers, July saw 44.3 million payments abroad, up from 34.6 million a year earlier.

Overseas cash withdrawals also grew from ₺225 million ($5.46 million) in July 2024 to ₺372 million ($9.02 million) in July 2025.

The rise in overseas card spending has been stark over the longer term. In July 2021, such transactions totaled ₺2.7 billion ($65.5 million), increasing to ₺7 billion ($169.7 million) in July 2022 and ₺63.2 billion ($1.53 billion) in July 2025.

This reflects a fivefold increase in just two years and a ninefold rise over four years.

The surge has also been amplified by currency movements, as the Turkish lira has depreciated by 17% against the U.S. dollar since the start of 2025.