Recent earthquakes in the Aegean Sea, affecting Türkiye’s most popular coastal destinations such as Izmir, Mugla, and Aydin, are adding further pressure to an already sharp decline in visitor numbers this season, as the tourism sector raises alarms over shrinking profitability amid soaring prices.

These earthquakes, which have continued to rattle the region with hundreds of tremors ranging from magnitude 4 to 6, have been accompanied by increased seismic activity around Greece’s Santorini Island since January.

One of the most recent tremors, a 5.8-magnitude earthquake, struck on June 3, led to 69 injuries in Mugla’s Marmaris district due to widespread panic, and claimed the life of a 14-year-old girl who suffered a fatal panic attack.

In a separate tragedy that preceded these earthquakes, a fire at the Kartalkaya Hotel—one of Türkiye’s most popular ski resort destinations in Bolu—claimed 78 lives.

The incident has already raised serious concerns over the adequacy of safety and disaster preparedness measures at Turkish hospitality facilities, leading to the closure of 1,827 facilities across the country by governorates and municipalities as part of broader inspections.

These challenges appear to be compounding existing inflationary pressures, which have triggered exceptional price hikes across Türkiye’s top holiday destinations.

According to calculations by business-focused ekonomim.com, vacation packages for a family of four, which could be planned for around ₺100,000 ($2,545)–₺110,000 ($2,800) last year, have now surged to ₺170,000, depending on the choice of accommodation and transportation—a 30% to 100% increase.

The average cost of accommodation alone has reached ₺140,000, while ground transportation costs ₺7,500. Air travel requires an even higher budget.

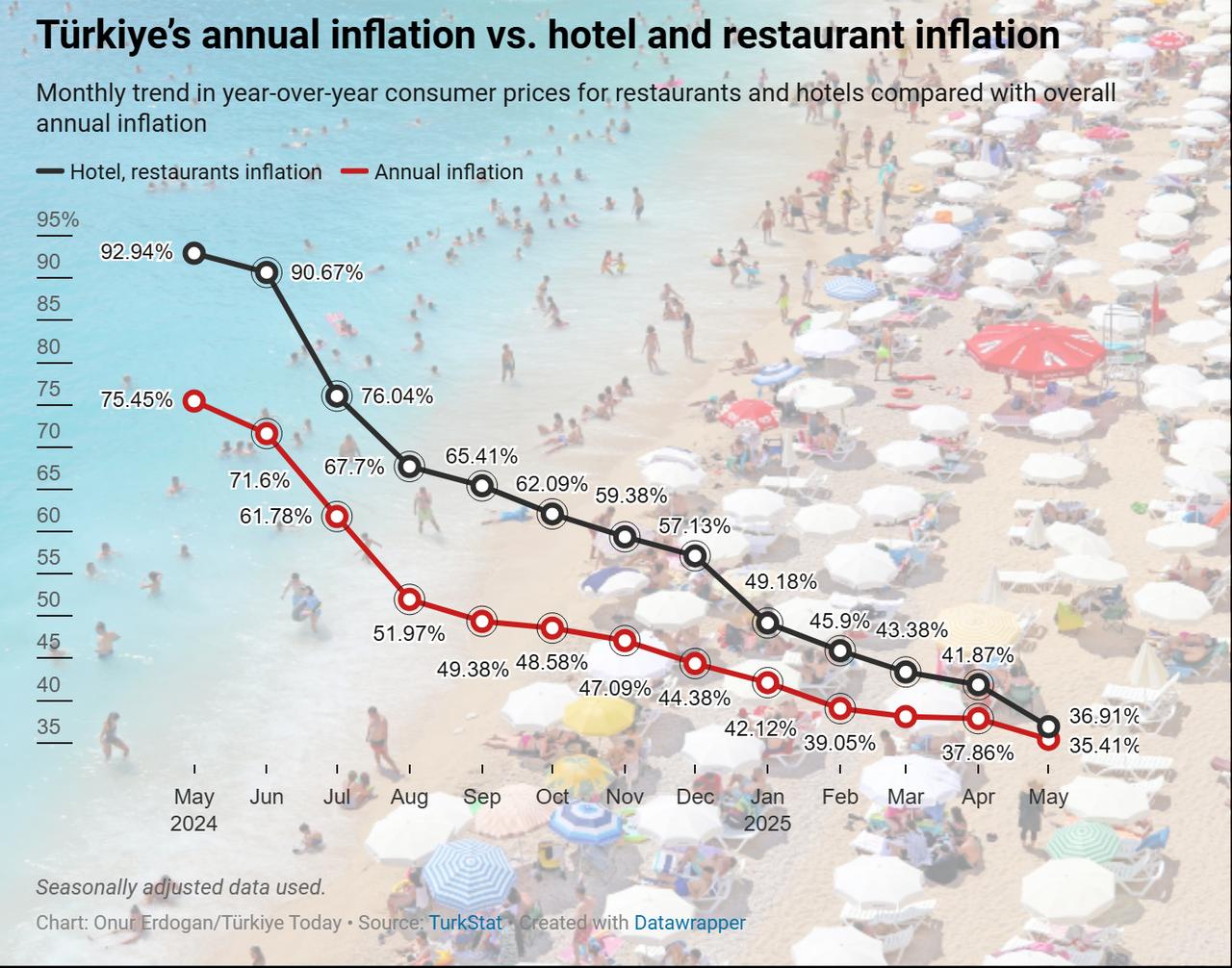

According to data from the Turkish Statistical Institute, annual consumer price inflation in the restaurant and hotel segment slowed to 36.91% in May—still above the national average inflation rate, which unexpectedly declined to 35.41%.

Türkiye recorded a 5% year-on-year decline in foreign visitor numbers during the first quarter of 2025, bringing the total down to 6.6 million. When including Turkish citizens residing abroad, overall tourist arrivals fell by 2.4% to 8.84 million.

Despite the subdued first-quarter performance, April saw a notable rebound, with 3.9 million foreign visitors recorded—a year-on-year increase of 8.01%.

Throughout this period, Iran remained the leading source of foreign visitors, followed by Russia, Germany, Bulgaria, and the United Kingdom.

Meanwhile, according to the Ministry of Culture and Tourism, occupancy rates in licensed accommodation facilities dropped to 26.79% in March, the lowest level recorded since the pandemic.

Speaking to Türkiye Today about the earthquakes’ impact on regional tourism, Aslan Tan, a senior member of the Association of Turkish Travel Agencies (TURSAB), warned that the Aegean and Mediterranean regions are experiencing one of their most difficult tourism seasons in recent memory.

While acknowledging the influence of natural disasters on perceptions of the Aegean region, he emphasized that the core challenges are more deeply rooted—namely, soaring operational costs, sharply declining occupancy rates, and the ongoing lack of coordinated, sector-wide planning.

Tan noted that hotel occupancy rates have fallen significantly across Türkiye, with the steepest drops seen on the Aegean and Mediterranean coasts. “We’ve reached a frightening point,” he said. “It will take a long time for this wound to heal.”

He added that beyond the visible economic slowdown, the earthquakes have also exposed structural weaknesses in the tourism sector, particularly among newer businesses. Tan criticized the government’s response as overly reactive, arguing that regulatory enforcement alone is insufficient.

“The ministry shuts down businesses that fail to meet disaster safety standards, but closing down thousands won’t help unless we foster collective awareness,” he said.

“We are a country prone to earthquakes and natural disasters. Our businesses need to embrace a broader consciousness—this only makes sense within a national strategy.”

He stressed that long-term disaster preparedness should be a fundamental pillar of Türkiye’s tourism policy, particularly in high-risk regions, and called for a national framework to guide awareness, training, and regulatory compliance.

Tan stated that while seismic activity has influenced tourist sentiment to some extent, it is not the primary reason for the current downturn.

He pointed instead to sharp cost increases and serious deficiencies in planning and marketing. “What deters tourists the most right now is not fear, but unpredictability—especially in pricing,” he said.

“Foreign tourists are increasingly price-conscious. There is a clear shift in consumer awareness.”

He also pointed out that Türkiye’s mid-tier domestic demand is weakening, as many local travelers are priced out. Simultaneously, efforts to attract high-end international visitors have seen limited success, due largely to the lack of consistent branding and professional service standards.

Tan warned that without urgent and strategic intervention, the Aegean tourism sector risks a long-term loss of competitiveness. He called for a government-led response that goes beyond short-term solutions.

“We need a serious, long-term policy framework from the government,” he said. “Without it, the damage will only deepen, and the Aegean could lose its competitiveness for years to come.”

He concluded by emphasizing the need to shift from reactive crisis management to a proactive and strategic approach.

“Tourism is not just about rooms and beaches—it’s about trust, safety, and experience. If we fail to meet those expectations, no recovery plan will matter.”