Türkiye’s 39.0% tax wedge for both single and married workers stands out among OECD countries, despite its relatively low per capita gross domestic product (GDP) of $15,340 in 2024 and average annual wages of $47,253 as of 2023, according to the OECD report.

Financial pressures include personal income tax, social security contributions, and employer-paid benefits. Moreover, when calculated relative to per capita GDP and average wages, the overall tax burden on labor ranks the highest among all OECD countries.

In its Taxing Wages 2025 report, the OECD defines the discrepancy between a worker’s net income and the total cost of employment as the “tax wedge.” It represents the share of gross income absorbed by taxes and social contributions.

The OECD evaluates and compares tax wedges based on workers’ marital and family status. The data indicates a steady and gradual increase in Türkiye’s labor tax burden, making it one of the highest among member countries.

Despite these already high levels, the tax wedge increased by 0.9 percentage points in 2024, further squeezing real disposable incomes. The OECD average in the same category was 25.7%, underscoring the disparity between Türkiye and other members.

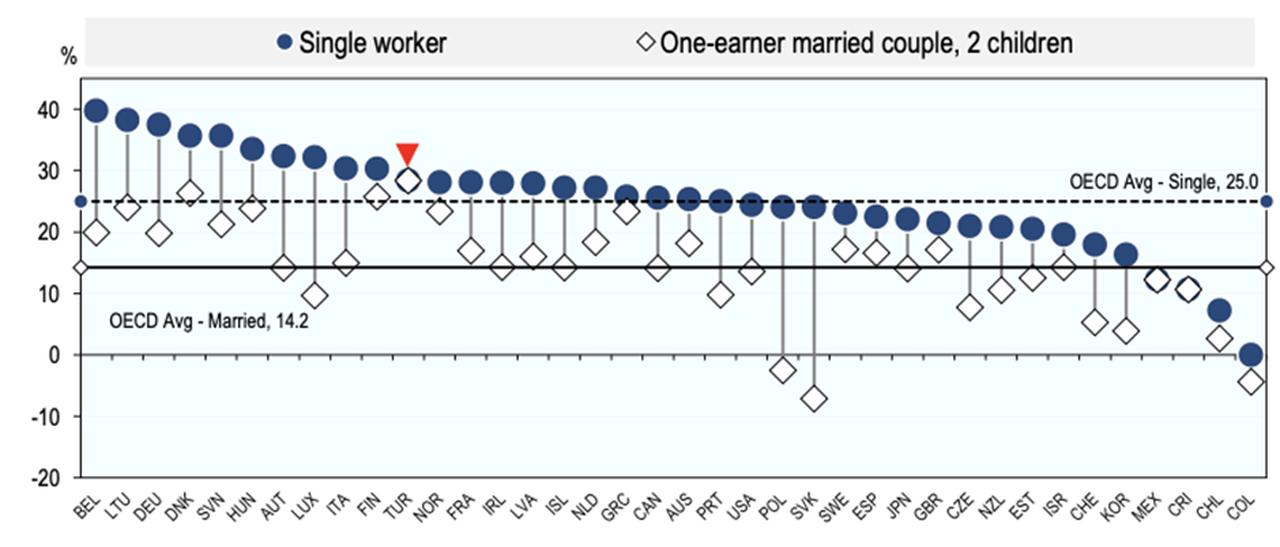

Another notable issue is the lack of differentiation between family types. The tax wedge for both single and married workers with children stands at 39%, indicating that Türkiye does not provide meaningful tax relief based on family status. This is among the highest rates across the 38 OECD members.

At 39.0%, Türkiye’s tax wedge for one-earner married couples with children is 13.3 percentage points above the OECD average of 25.7%.

It is also one of only three OECD countries that provide no family-based tax relief, leaving single-income families in Türkiye with a significantly heavier burden compared to their peers in other member states.

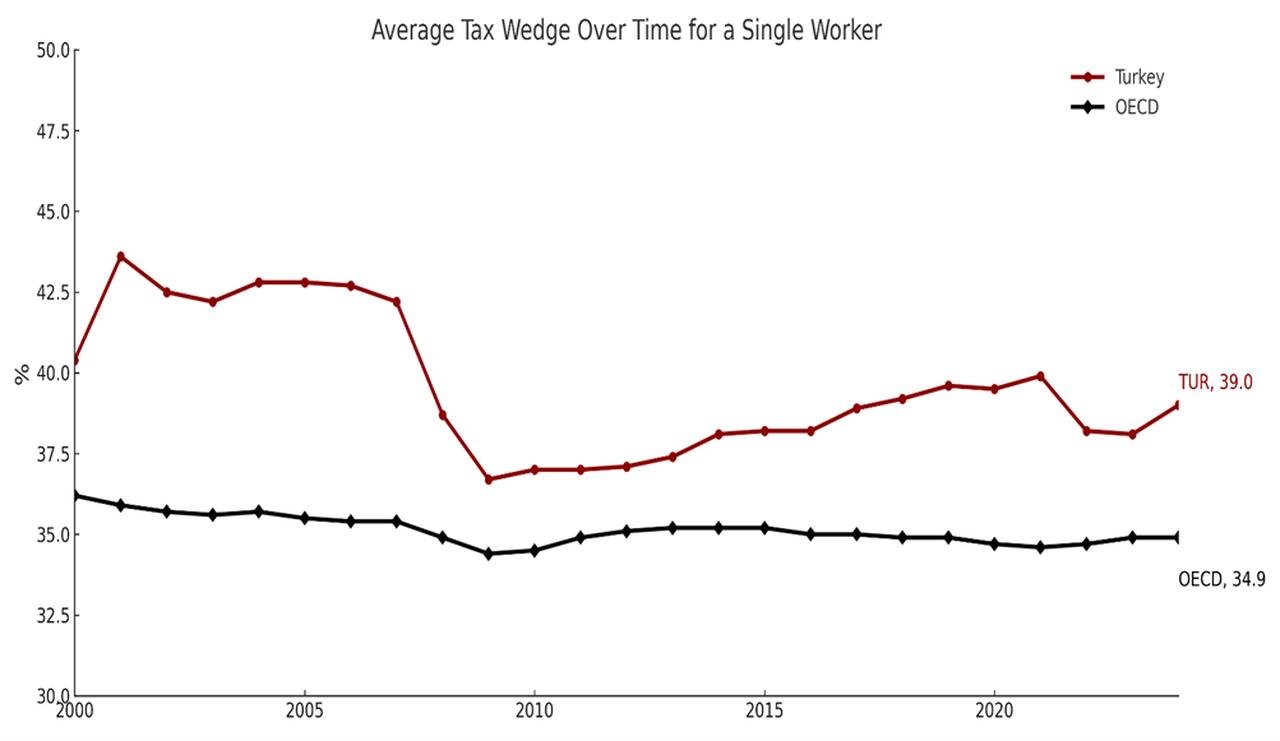

Historically, Türkiye’s tax wedge for single workers has shown minor fluctuations but remains consistently above the OECD average.

Since 2000, the wedge declined by only 1.4 percentage points. From 2009 to 2024, it increased by 2.3 points, while the OECD average peaked at 35.2% in 2013–2014 and fell to 34.9% in 2024.

While Türkiye experienced a noticeable rise in the tax burden on single workers, the overall trend in OECD countries was more stable, with only small changes over time.

Nominal wages increased in all 37 OECD countries between 2023 and 2024, while real wages rose in 33. In Türkiye, nominal wages surged by 82.9%, and after adjusting for inflation, real wages increased by 15.5%. However, this also led to a 3.9% rise in the personal income tax burden.

Another distinctive circumstance appears in the employee tax on labor income. As it appears in many other categories, Türkiye remains above the OECD average with 3.4%.

According to 2024 data, the average single worker in Türkiye faced a net tax rate of 28.4%, retaining 71.6% of gross earnings—below the OECD average of 75.0%.

For married workers with two children, the rate remained 28.4%, the highest among OECD countries, despite family-related tax benefits. By contrast, the OECD average for this group was 14.2%, leaving them with 85.8% of their gross income.

Reflecting this trend, the government’s income tax revenues doubled in the first half of 2025 compared to the same period of 2024, rising by approximately 96.5% to ₺1.15 trillion ($46.64 billion).

Commenting on Türkiye’s rising wage-related burdens, economist Nevzat Saygilioglu highlighted that growing deductions from wages not only reduce workers’ take-home pay but also increase employers’ cost burdens. This dual pressure, he warned, contributes to the proliferation of informal or unregistered employment—particularly among undocumented migrant workers from Syria and Central Asia.

"Both workers and employers are uncomfortable with the current system," Saygilioglu wrote on the business-focused ekonomim.com, "which leaves the state as the sole beneficiary through increased tax and social security revenue."

By prioritizing easy fiscal gains, the government undermines the very competitiveness it is meant to foster.

Instead, the state should focus on improving fair and balanced labor market conditions, he added.