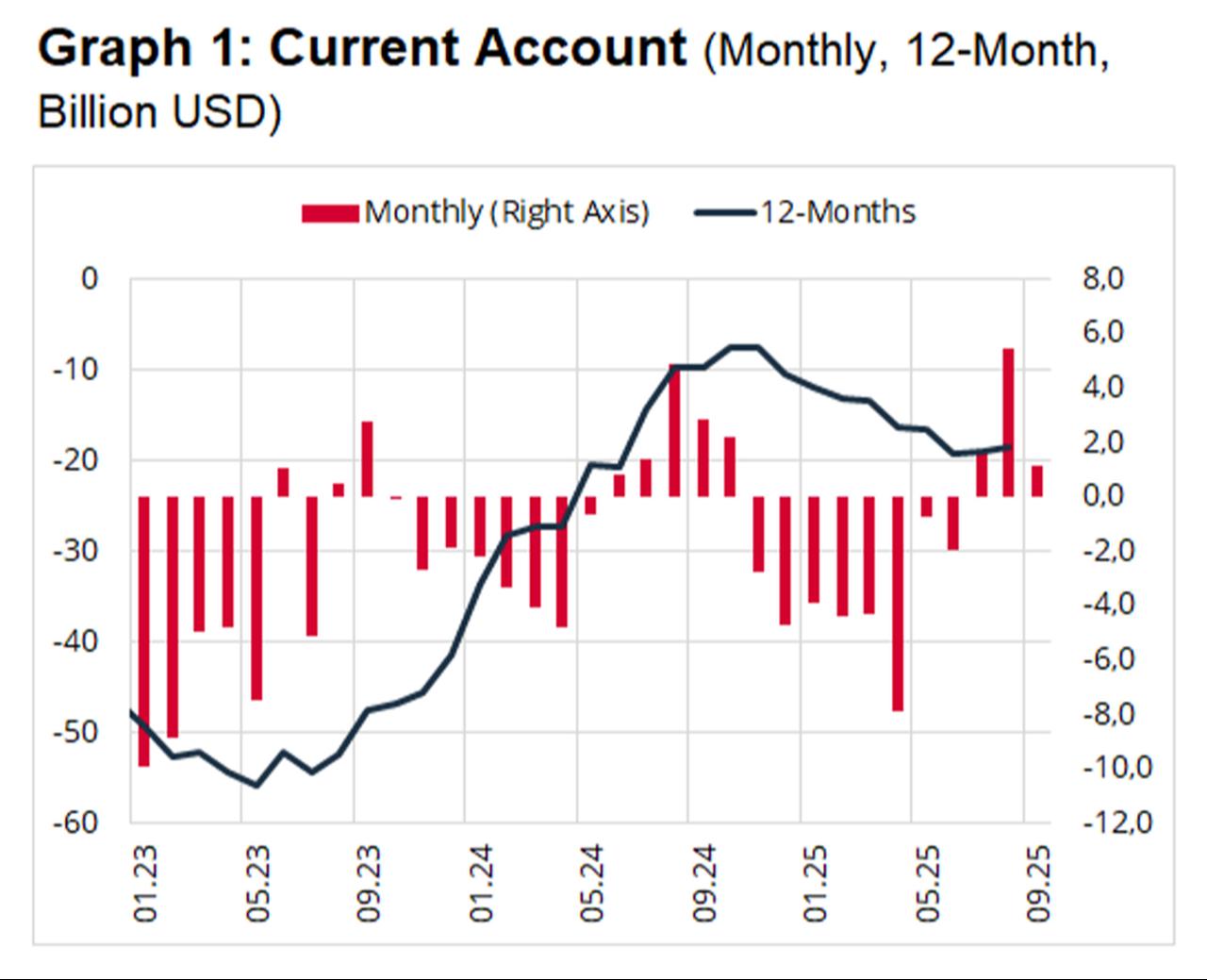

Türkiye’s current account recorded a surplus of $1.11 billion in September, coming in lower than market expectations, according to data released Wednesday by the Central Bank of the Republic of Türkiye (CBRT).

Excluding gold and energy, the current account showed a surplus of $6.8 billion, while the balance of payments–defined foreign trade deficit amounted to $5.36 billion. On an annualized basis, the current account deficit reached approximately $20.1 billion, and the trade deficit under the balance of payments framework widened to $64.8 billion.

For the first nine months of 2025, the cumulative deficit stood at $14.89 billion.

The central bank also revised the previous month’s current account figures — which had marked the highest monthly surplus on record — from $5.45 billion to $5.41 billion.

During the same period, the services balance recorded a surplus of $62.6 billion, offsetting part of the external trade gap. The primary income balance posted a $17.6 billion deficit, while the secondary income balance was slightly negative at $308 million.

Net inflows from services reached $7.7 billion in September, driven mainly by tourism and transportation revenues. Travel services generated $6.26 billion in net inflows, while transportation brought in $2.27 billion.

According to the CBRT, the financing of the annualized current account deficit was supported by $5.7 billion in net direct investments, $2 billion in portfolio inflows, $22.8 billion in loans, and $1.9 billion in trade credits. Meanwhile, net effective and deposit assets contributed a negative $1.1 billion.

Foreign direct investment (FDI) inflows totaled $722 million in September, while Turkish residents’ direct investments abroad increased by $884 million, corresponding to $15.27 billion and $9.51 billion, respectively, on an annualized basis.

Real estate transactions showed $211 million in property purchases abroad by Turkish residents and $180 million in net property acquisitions in Türkiye by non-residents.

In a market note, local brokerage Kuveyt Turk Investment said the surplus came in below expectations due to the end of the tourism season and a widening trade gap, highlighting that the current account balance remains sensitive to fluctuations in global capital flows and trade performance.

"Volatility in global capital flows and changes in trade dynamics continue to pose short-term risks for Türkiye’s external balance," the note stated.

"A potential recovery in European demand, the course of energy prices, and domestic consumption-driven imports will be decisive in shaping the current account trajectory," it said. Preliminary data from the Trade Ministry, the report added, indicates that "the current balance may show further weakness in October."

Türkiye's foreign trade deficit was $7.4 billion in October, up 24% from the same month last year.

As of the second quarter of 2025, Türkiye’s current account deficit stood at 1.31% of gross domestic product, according to CBRT data.