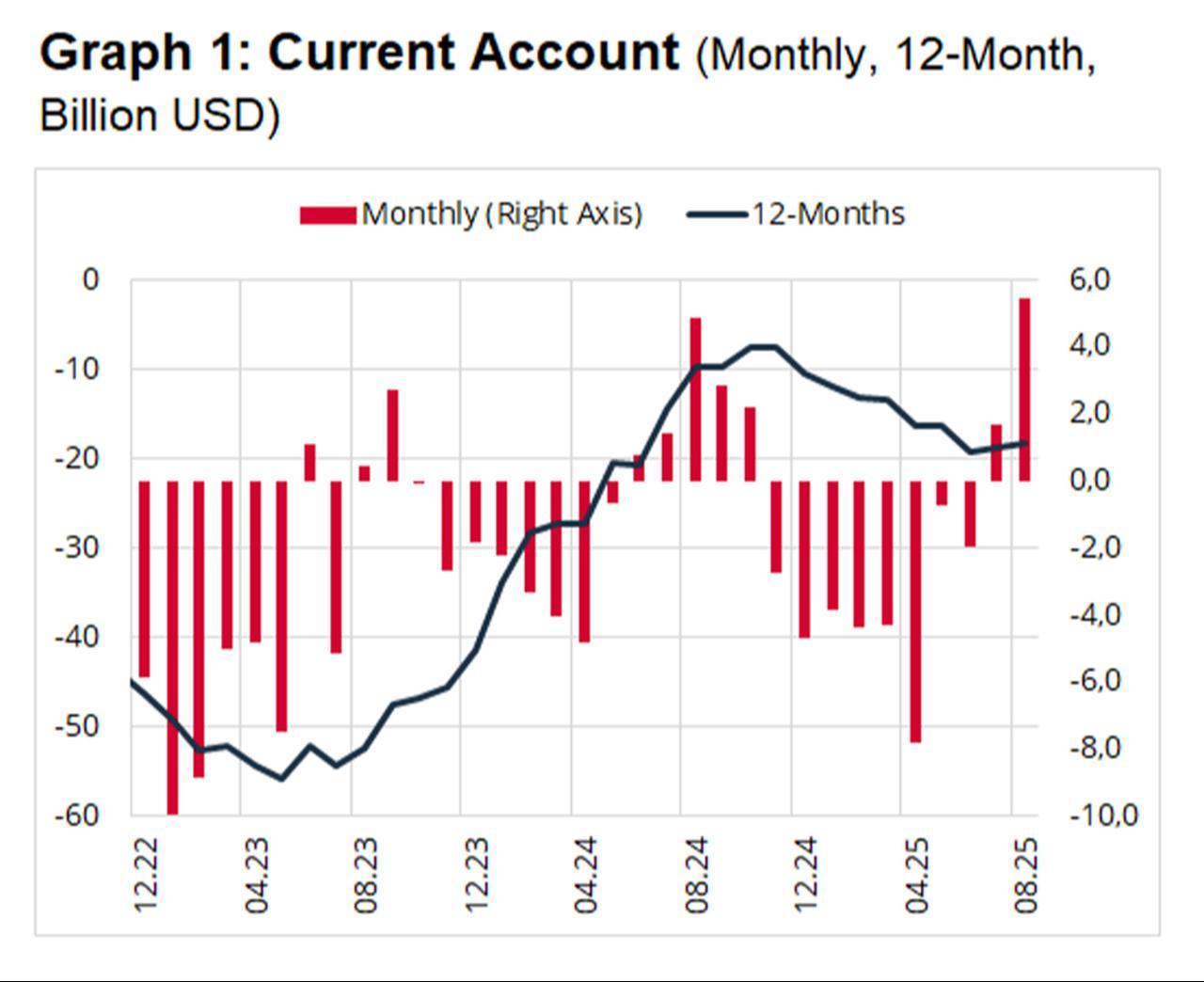

Türkiye recorded a current account surplus of $5.46 billion in August, its highest monthly surplus ever, the Central Bank of the Republic of Türkiye (CBRT) reported on Monday.

Excluding gold and energy, the current account posted an even larger surplus of $10.01 billion, marking the second consecutive month of surplus after years of persistent deficits.

Türkiye’s current account deficit-to-GDP ratio stood at 1.3% in the second quarter of 2025, while the government’s new medium-term program projects it to reach 2% by the end of the year.

The balance of payments-defined foreign trade deficit stood at $2.81 billion for the same month. On a 12-month rolling basis, the current account deficit narrowed sharply to $18.3 billion, while the trade deficit under the balance of payments definition reached $62.6 billion.

Between January and August, Türkiye’s current account deficit stood at $15.85 billion—nearly double the $7.99 billion shortfall recorded during the same period last year.

The services balance, supported primarily by tourism revenues, recorded a net inflow of $9.52 billion in August. Within this category, travel income reached $7.67 billion, while net transportation revenues amounted to $2.77 billion.

Net inflows from foreign direct investment (FDI) totaled $986 million in August. Foreign residents increased their direct investments in Türkiye by $1.77 billion, while Turkish investors’ overseas investments amounted to $782 million.

Real estate investments also reflected cross-border activity, with foreign investors purchasing $202 million worth of property in Türkiye and Turkish investors buying $288 million abroad.

Over the past 12 months, cumulative FDI inflows reached $15.6 billion.

Commenting on the figures in his post on X, Treasury and Finance Minister Mehmet Simsek emphasized that the improvement, marked by the highest-ever monthly current account surplus, is helping reduce Türkiye’s need for external financing.

Noting that the annual deficit has narrowed to $18.3 billion — an improvement of $37.6 billion compared to May 2023 — Simsek said, "We project that the gross external financing requirement, which was 23% of GDP in June 2023, will decline to around 17% by 2025."

He added that the combination of lower foreign currency needs, stronger access to external financing, and higher reserves is reinforcing Türkiye’s macro-financial resilience.