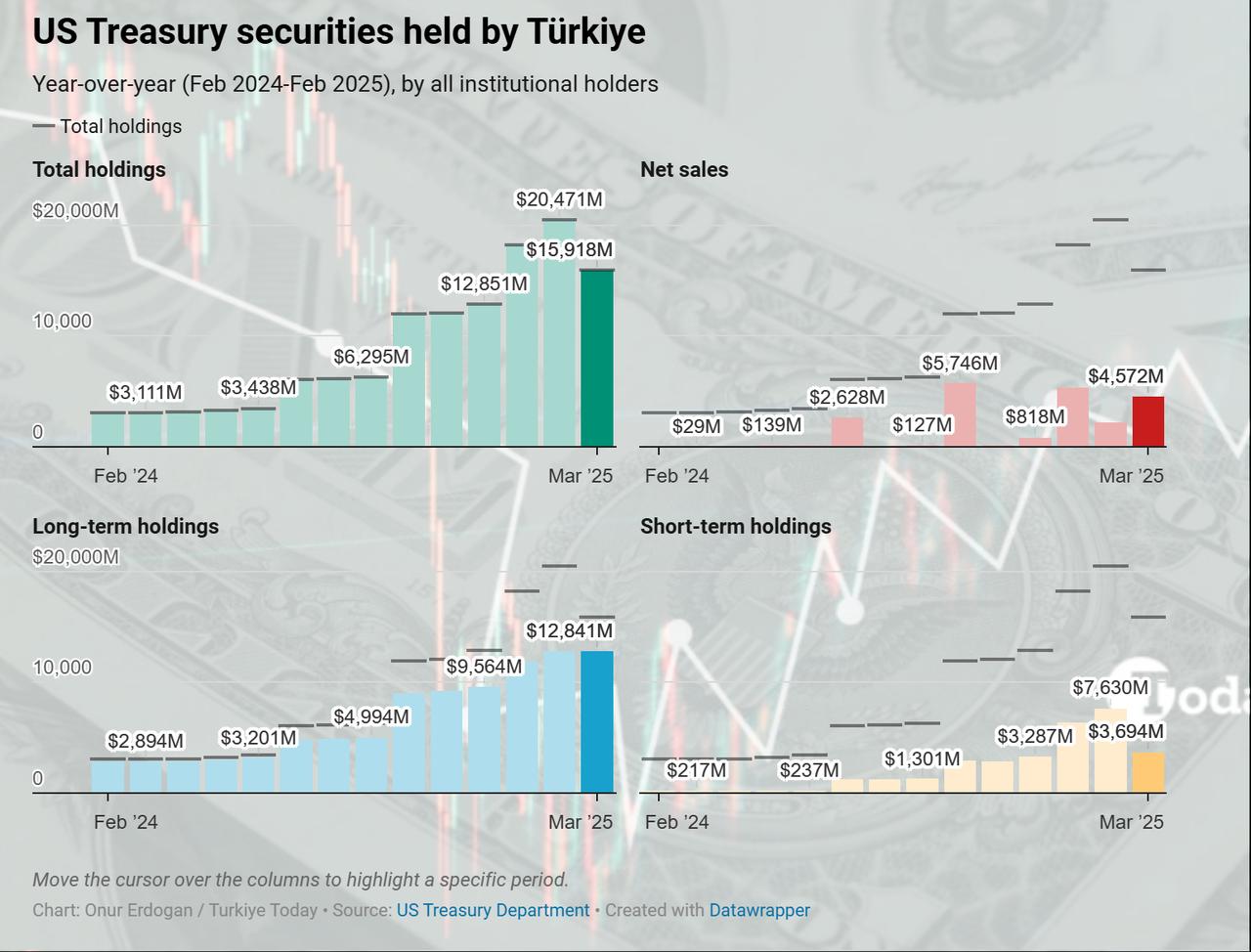

Türkiye cut its holdings of U.S. Treasury securities sharply in March, selling $4.55 billion worth in a notable shift from the accumulation trend that had continued throughout 2024 and early 2025.

According to data compiled from the U.S. Department of the Treasury, the March sell-off reduced Türkiye’s total holdings to $15.92 billion by the end of the month.

This large-scale divestment came after investors in Türkiye had steadily increased their holdings over the previous 14 months, purchasing a total of $10.7 billion worth of U.S. Treasuries in 2024 and an additional $7.62 billion in the first two months of 2025.

By the end of February, Türkiye’s total investor-held U.S. government debt stood at $20.47 billion. The March sell-off marked a decline of more than 22%, indicating a decisive shift in investor strategy regarding reserve assets.

The sell-off in March was especially concentrated in short-term U.S. Treasury securities. Of the $4.55 billion liquidated, $3.94 billion came from short-term instruments—those maturing in one year or less.

Consequently, the total value of Türkiye-based investors’ short-term U.S. debt holdings fell sharply from $7.63 billion to $3.69 billion within a single month.

In contrast, long-term Treasury holdings—those with maturities exceeding one year—remained relatively stable, standing at $12.22 billion after the rebalancing.

This divergence suggests that while liquidity was withdrawn from short-term assets, longer-dated Treasuries may still be perceived by Turkish investors as a strategic hedge amid shifting market conditions.

In a broader emerging market context, Türkiye ranked as one of the most active divestors of U.S. government debt in March 2025. According to country-level data in the accompanying spreadsheet, the scale of Türkiye’s sell-off was the fourth largest among emerging economies for that month.

Only China, Brazil, and India reported larger reductions in their U.S. Treasury holdings. China recorded the highest decrease, cutting $22.7 billion in March alone, followed by Brazil with $6.2 billion and India with $4.8 billion in net sales.

Türkiye followed with a divestment of $4.55 billion, placing it ahead of other major emerging economies such as Mexico ($1.2 billion), the Philippines ($0.9 billion), and Colombia ($0.6 billion).

Notably, while China’s and Brazil’s reductions primarily affected long-term securities, Türkiye’s focus on liquidating short-term bonds set it apart.

The overall trend across emerging markets reflects a diminishing appetite for U.S. government debt—once bolstered by a strong dollar and high yields.

Now, with growing expectations of U.S. Federal Reserve rate cuts and ongoing geopolitical uncertainties, many countries appear to be reconfiguring their reserve portfolios in anticipation of shifting global financial conditions.