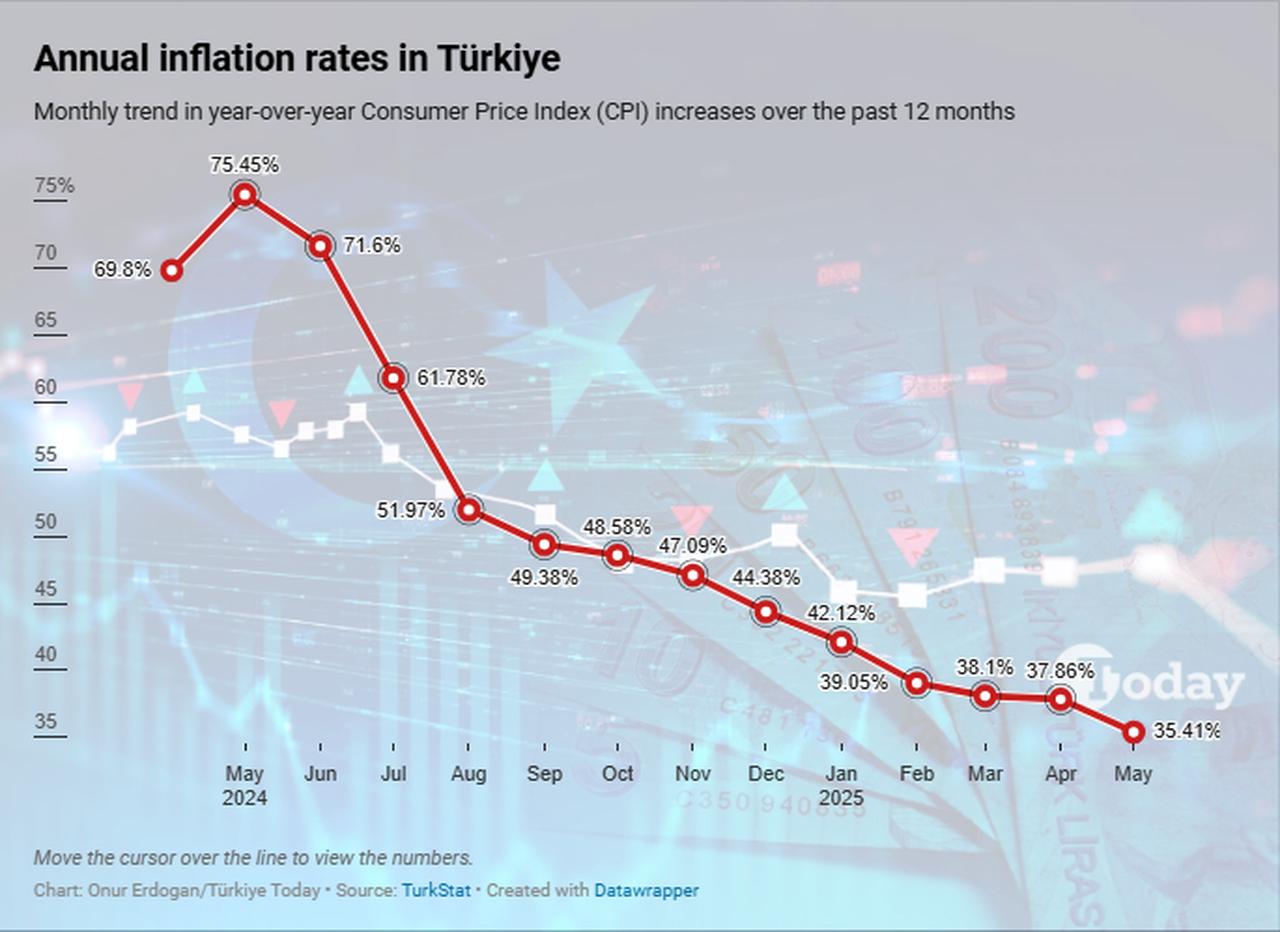

Türkiye’s annual inflation dropped sharply to 35.41% in May from 37.86% in April, the lowest since November 2021, boosting investor sentiment amid growing expectations of a potential interest rate cut by the central bank.

Monthly inflation came in at 1.53%, below the forecasted 2.1%, fostering optimism toward a potential shift in monetary policy ahead of the Turkish central bank’s next interest rate decision on June 19.

Better-than-expected inflation figures sparked a rally on the Istanbul exchange, with Borsa Istanbul’s benchmark BIST 100 index opening over 2% higher, climbing above 9,200 points. The banking index led the gains, rising as much as 5%.

Analysts identified 9,250 as the next key resistance level, noting that a sustained break above this threshold could accelerate the upward momentum in the market.

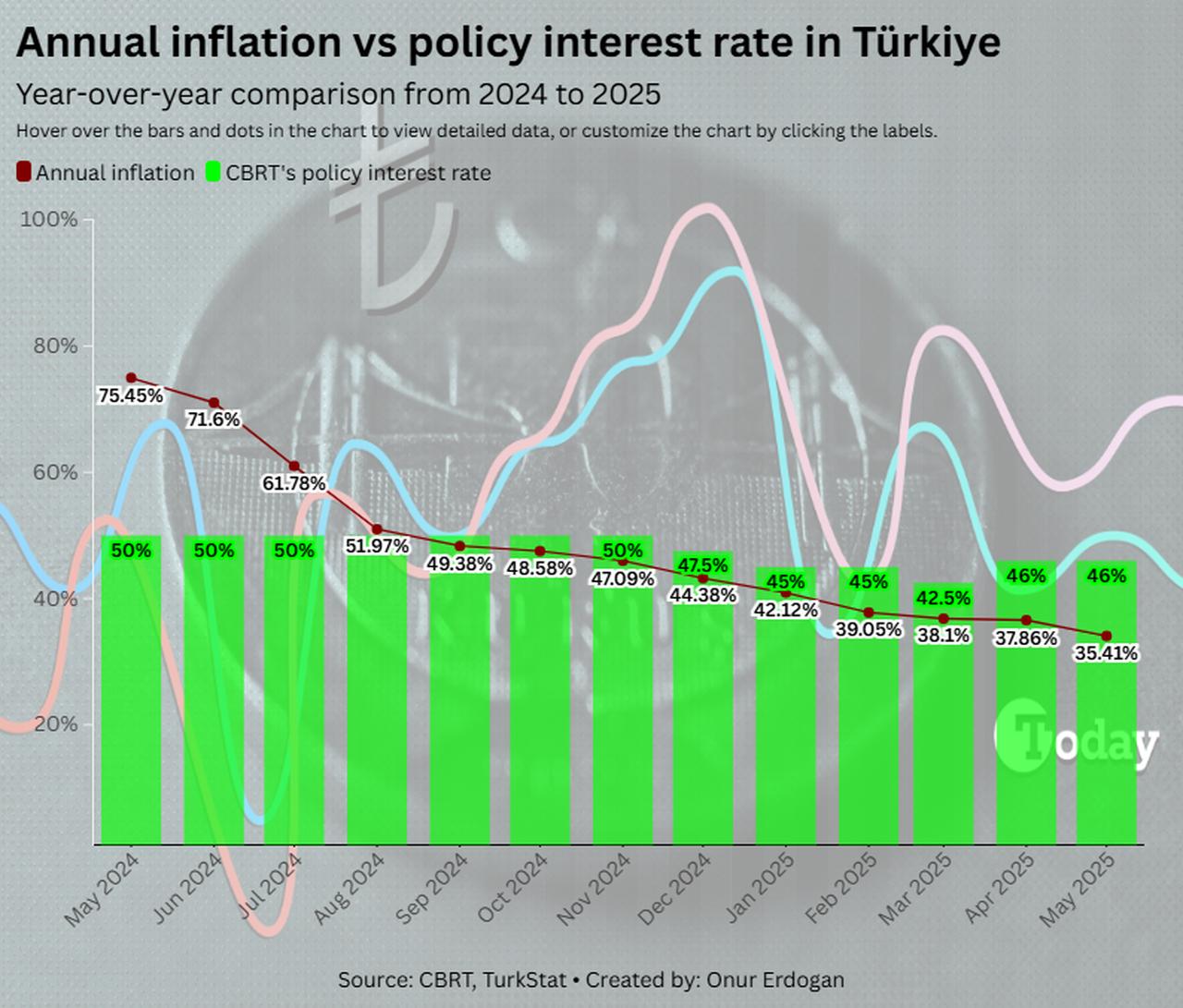

Market participants have shifted their focus to the upcoming Monetary Policy Committee meeting, as the gap between inflation and the policy rate has widened to over 10 percentage points, strengthening the central bank’s position to take action.

In its most recent move in April, Türkiye’s central bank delivered a surprise 350 basis point hike, raising the policy rate to 46% and the overnight lending rate to 49%.

Sinan Paksoy, Deputy General Manager at Nurol Portfolio Management, said the inflation surprise provided a positive backdrop but added that external dynamics would also play a role: “If the Central Bank sees a significant rise in its foreign currency reserves and a decline in demand for hard currency by June 19, a rate cut could be on the table.”

With monthly deposit and money market fund returns exceeding 3%, Türkiye’s local currency, the lira, is currently delivering a strong real return compared to the 1.53% monthly inflation figure.

Analysts suggest that this opens up some room for the central bank to ease rates, especially amid the seasonal uptick in tourism-driven foreign currency inflows.

Following the inflation announcement, the lira remained stable, with the dollar trading at 37.17 and the euro at 44.77. In precious metals, gram gold in the spot market fell by 0.85% to 4,225 lira, partly due to losses in global gold prices.

In his post on X, Türkiye's Treasury and Finance Minister Mehmet Simsek highlighted that annual inflation dropped by 40 percentage points over the past year to 35.4% in May. He noted that goods inflation fell to 28.7%, the lowest in three and a half years, while service inflation declined by 45 points year-on-year to 51.2%, its lowest since June 2022.

Simsek stated that the ongoing disinflation, driven by determined policy implementation, will improve predictability, financing conditions, and the investment climate.

He added that this environment will boost productivity and support sustainable high growth, ultimately increasing national welfare.