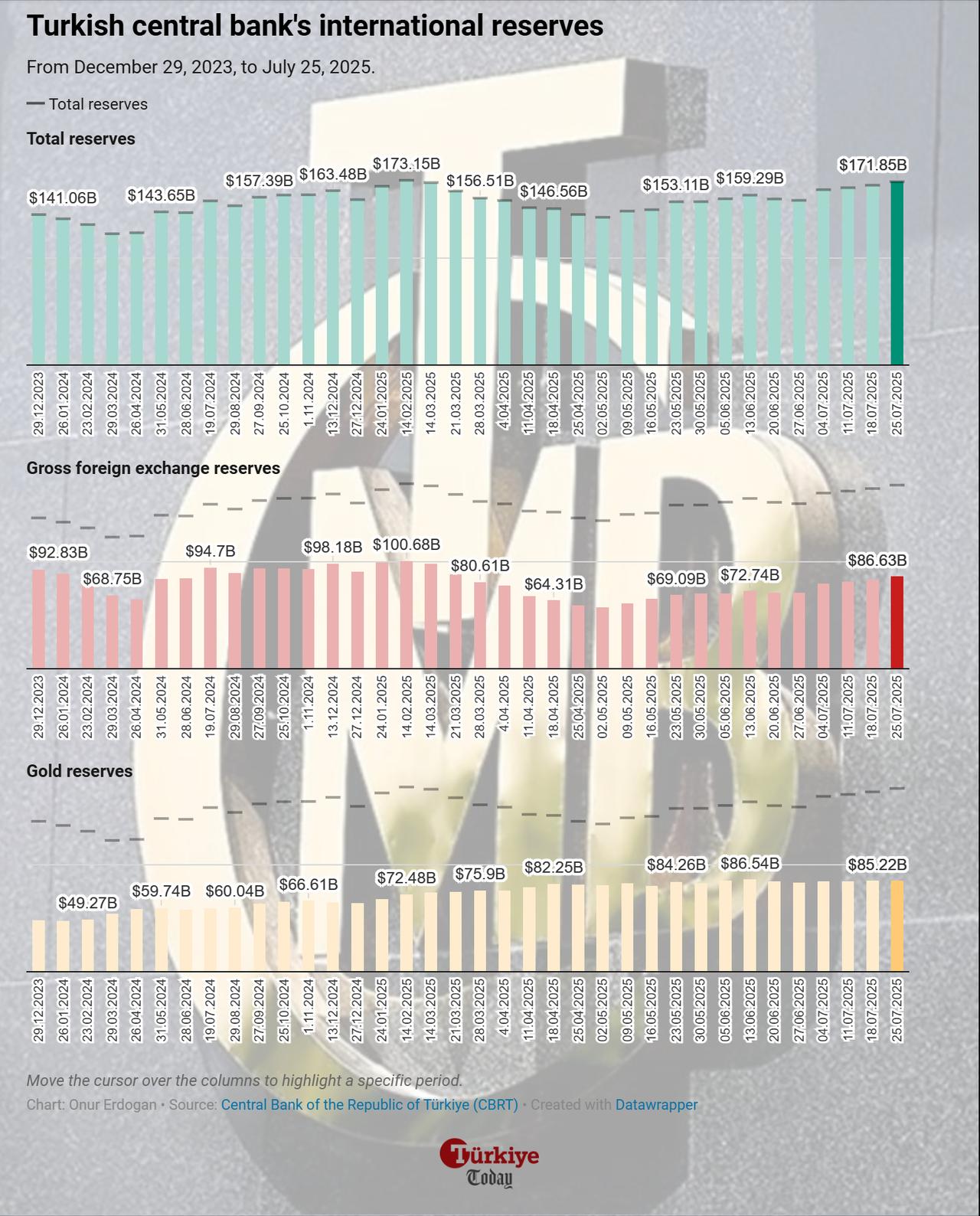

Türkiye’s central bank reserves increased by $3.28 billion during the week ending July 25, reaching $171.85 billion, according to data released by the Central Bank of the Republic of Türkiye (CBRT).

Net international reserves excluding foreign exchange swaps, a key indicator of the central bank’s usable assets, rose from $44.3 billion to $46.7 billion in the same week.

The rise was driven primarily by a $3.32 billion boost in gross foreign exchange reserves, which climbed to $86.63 billion from $83.3 billion a week earlier. Gold reserves, on the other hand, saw a slight decrease of $43 million to $85.22 billion.

This brought the total reserve stock up from $168.57 billion the previous week, reflecting a continued strengthening of the central bank’s financial buffer.

This recovery trend has been closely watched by analysts as Türkiye seeks to rebuild reserve adequacy amid efforts to stabilize its currency and improve investor sentiment.

Foreign investors increased their exposure to Turkish assets in the same week. According to the CBRT’s weekly securities statistics, non-residents purchased $205.2 million worth of equities and $271 million in government domestic debt securities (GDDS), along with $1.4 million in non-government sector bonds.

Total foreign equity holdings rose from $31.95 billion to $32.92 billion, while GDDS stock held by non-residents increased from $13.93 billion to $14.31 billion. Holdings of non-government sector bonds edged down from $780.9 million to $778.5 million.

The total deposit volume in Türkiye’s banking sector rose by ₺315.24 billion ($7.76 billion) to ₺24.74 trillion during the week ending July 25.

Lira-denominated deposits increased by 1.2%, reaching ₺13.71 trillion, while foreign currency (FX) deposits declined by 1.2% to ₺7.88 trillion. The total FX deposits across all banks amounted to $234.34 billion, of which $195.6 billion was held by domestic residents.

After adjusting for exchange rate effects, domestic residents’ FX deposits increased by $1.21 billion over the week.

Consumer loans held by residents grew by 1.6% to ₺4.70 trillion, with the largest portion allocated to personal loans and credit cards.

Housing loans totaled ₺591.23 billion, auto loans stood at ₺56.62 billion, personal consumer loans reached ₺1.76 trillion, and credit card debt amounted to ₺2.29 trillion.

The total credit volume of the banking sector, including loans extended by the central bank, increased by ₺156.5 billion, reaching ₺19.34 trillion.