U.S. investment bank Morgan Stanley warned investors about increasing their Turkish lira positions, noting that the currency is becoming increasingly vulnerable following the Central Bank of Türkiye’s decision to resume rate cuts with a 300-basis-point reduction on Thursday.

In a note to its clients, the bank stated that investor interest in lira-linked carry trades has become increasingly crowded. Despite delivering positive real returns when adjusted for inflation, the lira’s pace of depreciation has accelerated, according to the bank’s latest guidance.

The Central Bank of the Republic of Türkiye (CBRT) reduced its policy rate by 300 basis points to 43% on Thursday, resuming cuts after a surprise 350-basis-point hike in April and a pause in June. The move sent the lira to a record low of 41.9184 against the U.S. dollar in late-session trading, bringing its year-to-date depreciation to approximately 13%, Bloomberg reported.

However, as of Friday close in Türkiye, the U.S. dollar/Turkish lira exchange stood at 40.5492 with a slight 0.2% daily gain.

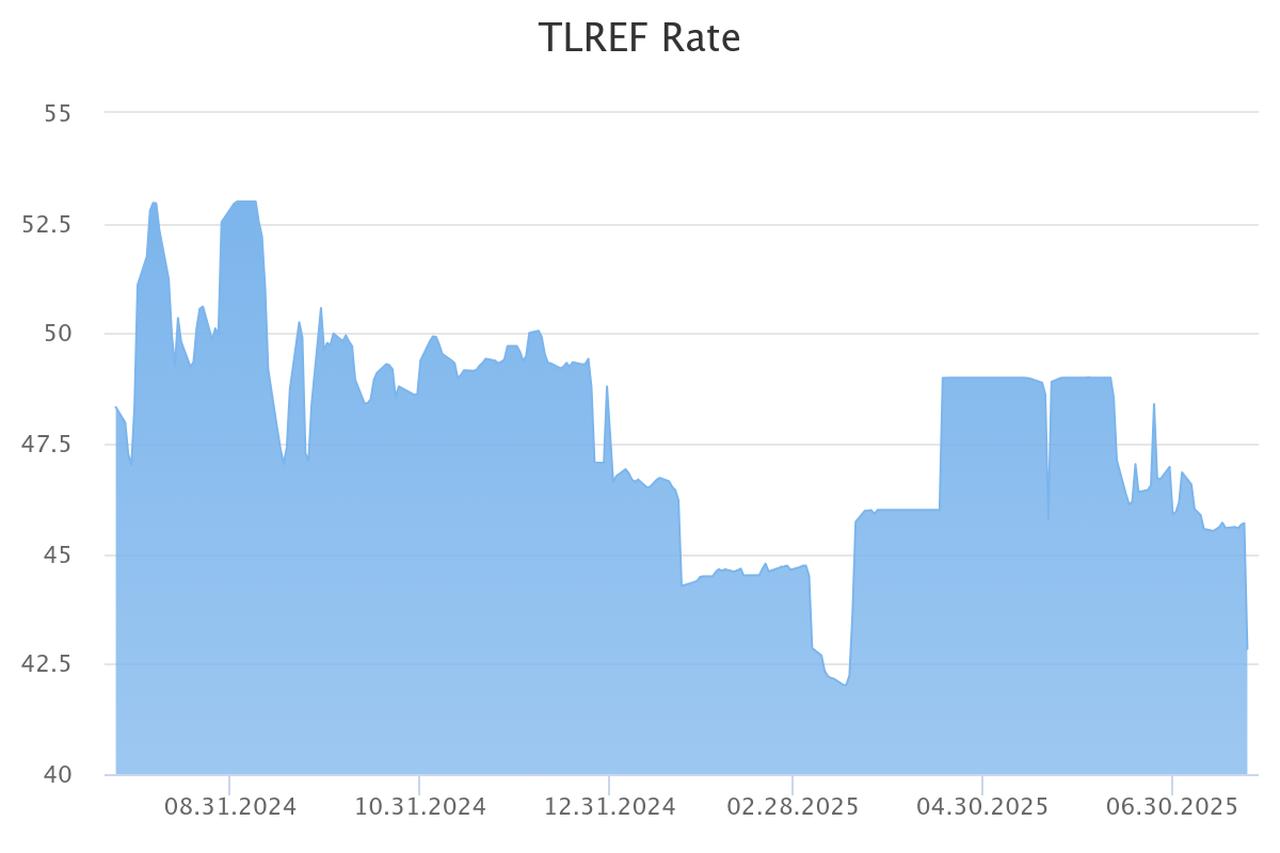

Following the decision, the Turkish Lira Overnight Reference Rate (TLREF) declined to 42.84% on Friday, indicating further loosening in domestic funding conditions.

Türkiye’s 5-year credit default swaps (CDS) also edged down to 281 basis points—its lowest level since early spring—reflecting a modest improvement in perceived sovereign risk after reaching a peak of 375 in April. Meanwhile, 10-year government bond yields stood at 31.5%.

Despite its nominal losses, the Turkish lira continues to offer positive real returns when adjusted for inflation, supporting its popularity in carry trade strategies. These involve borrowing in lower-yielding currencies to invest in assets offering higher returns, such as Türkiye’s high interest rates.

However, Morgan Stanley highlighted that the lira’s growing weakness is eroding the trade’s risk-reward profile. The increasingly crowded nature of lira carry positions adds further risk, as any reversal in sentiment could trigger rapid outflows.

In a decision to pressure an increase in carry trades, the Turkish central bank had also moved to restrict access to offshore lira funding by raising reserve requirements on short-term foreign borrowing. In May, the bank raised reserve requirement ratios to 18% for lira-denominated liabilities with maturities up to one month and to 14% for those up to three months, up from a flat 12% previously applied to terms of up to one year.

The move was aimed at tightening offshore lira liquidity and reinforcing the effectiveness of domestic monetary transmission.

Another U.S. investment bank, Goldman Sachs, had earlier identified the lira carry trade as one of the most profitable globally, but also warned that its sustainability depends on the authorities’ willingness to prevent excessive currency depreciation.

UK-based Barclays, in a separate note, emphasized the importance of foreign exchange management in retaining investor interest. The bank noted that dollar-based returns of approximately 1% per month have so far helped sustain both domestic and foreign investment in lira assets.