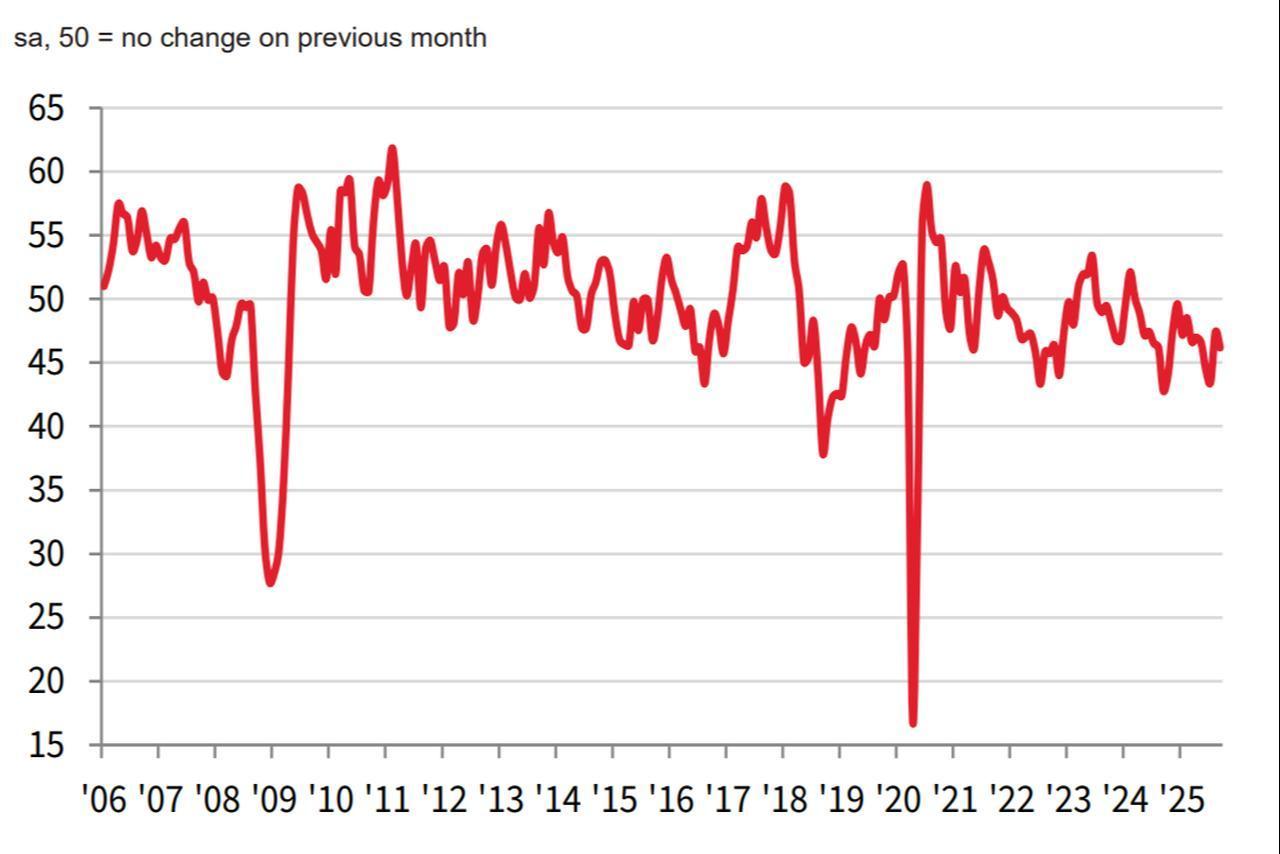

Türkiye’s manufacturing sector remained under pressure in September, extending its downturn to 18 consecutive months as the Istanbul Chamber of Industry (ISO) Purchasing Managers’ Index (PMI) slipped to 46.7 from 47.3 in August, according to survey data compiled by S&P Global.

A PMI reading above 50 indicates growth, while a score below that level signals contraction.

The prolonged weakness reflects ongoing challenges in both domestic and external demand.

Survey responses pointed to challenging demand conditions for manufacturers, leading to a sharper fall in new orders and export sales. The slowdown in incoming business resulted in a marked reduction in production volumes across most sectors.

The weakness in new demand also allowed firms to work through existing backlogs at the fastest rate in nearly a year.

However, unsold goods were added to inventories, leading to the first increase in post-production stocks in three months.

Manufacturers showed limited appetite for hiring during the month, with overall employment declining.

Purchasing activity and pre-production inventories also fell noticeably, as many companies relied on existing stocks instead of procuring new inputs.

The textile sector experienced the steepest decline in both employment and production, whereas the food industry was the only sector to see significant increases in new orders and output.

Electrical and electronic goods producers also managed modest job growth.

The continued depreciation of the Turkish lira contributed to higher input costs in September.

Cost inflation accelerated to its fastest pace in three months, although it remained below the long-term survey average.

Selling prices followed the same trend, with the strongest increase seen in the food sector.

Textile producers, by contrast, cut their output prices for the seventh consecutive month in an attempt to stimulate demand, making them the only sector to lower prices.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said the September PMI results showed patterns consistent with the rest of 2025.

"Demand conditions remained challenging, and as a result production, employment, and purchasing activity all decreased. Meanwhile, the weaker lira contributed to a rise in inflation, although price pressures remained relatively moderate," Harker noted.