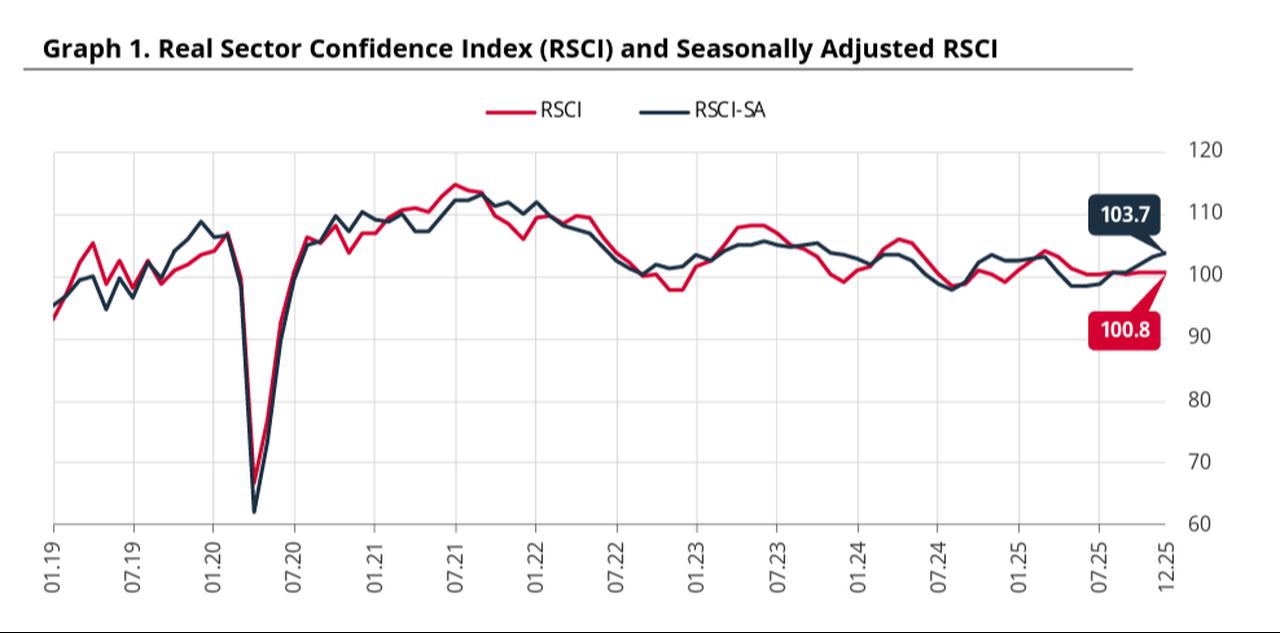

Türkiye’s Real Sector Confidence Index, one of the key gauges of business sentiment in manufacturing, rose to 103.7 in December, gaining 0.5 points from November to reach its highest level in 25 months on a seasonally adjusted basis, the Central Bank of the Republic of Türkiye (CBRT) reported on Thursday.

The index remained above the 100-point threshold that separates optimism from pessimism, driven by improved expectations for production volume over the next three months, a more positive general business outlook, higher current inventories of finished goods, and anticipated employment growth.

Despite the overall improvement in confidence, certain indicators reflected weakness in the Business Tendency Survey, which is based on responses from manufacturing enterprises.

Assessments regarding current total orders, export orders over the next three months, fixed capital investment plans, and past three-month order levels exerted downward pressure on the index.

Meanwhile, expectations for sales prices in the coming three months showed stronger upward momentum.

The annual domestic producer price index (D-PPI) inflation expectation for end-2026 declined by 0.5 points to 33%. Annual producer inflation stood at 27.23% in November, with a monthly increase of 0.84%.

"The trend in favor of those who stated that the general outlook in their industrial branch was more pessimistic compared with the previous month has weakened," the CBRT's report said.

In separate data, the Turkish Statistical Institute (TurkStat) reported December confidence figures for Türkiye’s services, retail trade, and construction sectors.

The services confidence index increased by 0.4% to 112.3, while retail trade rose 1.1% to 115.4. Conversely, the construction sector index declined by 0.5% to 84.5.

Within the services sector, the past three months saw a 0.6% decline in reported business activity and a 1.8% decrease in demand. However, expectations for service demand in the next three months rose by 3.7%.

Retail trade reported a 2.4% increase in business volume and a 3.5% rise in inventory levels. Yet, expectations for future business volume fell by 2.1%.

In the construction sector, the current level of registered orders rose by 1.9%, while the expected number of employees over the next three months dropped by 2.5%.