Türkiye is expected to more than double its wheat imports to 7.3 million metric tons in 2026 due to severe drought conditions, slashing domestic production, representing a 121% increase, the U.S. Department of Agriculture (USDA) projected.

The department attributed the surge to a sharp decline in Türkiye’s wheat harvest, which is projected to fall 15% to 16.3 million tons despite nearly unchanged planting areas. With domestic stocks tightening and milling demand remaining steady, Türkiye is turning heavily to global suppliers to meet food and feed requirements.

Barley production, which is largely dry-farmed, is also expected to contract sharply, falling by nearly 2 million tons year-over-year to 5.1 million tons. In response, barley imports are projected to rise significantly to 1.7 million tons to help meet domestic feed demand, particularly for the livestock and dairy sectors. First-quarter import figures show early acceleration, while the Turkish Grain Board (TMO) also issued tenders to secure an additional 500,000 tons of imported barley.

In contrast to wheat and barley, corn production is forecast to grow 12% to 7.9 million tons in 2026, driven by an expansion in harvested area, particularly second-crop corn in the southeast. The USDA noted that most cornfields benefit from irrigation, insulating yields from the broader drought impact. As a result of increased domestic output, corn imports are expected to fall to 3.3 million tons, down from an estimated 5.7 million tons the previous year.

Türkiye’s rice production is forecast to decline slightly to 560,000 metric tons (milled equivalent), though irrigation helped prevent more severe losses. Although national consumption is projected to remain steady at 790,000 tons, rice imports are expected to rise to 425,000 tons, with about half of this volume anticipated to be transshipped to neighboring countries.

Ending stocks are set to decline across all major grains, with wheat falling to 2.3 million metric tons from 3.4 million, barley to 437,000 from 687,000, corn to 641,000 from 1 million, and rice to 122,000 from 177,000 as the TMO begins drawing down inventories.

Meanwhile, Türkiye’s livestock industry is also expected to come under renewed pressure as high input costs and disease outbreaks continue to drive herd liquidation, with the country likely to remain the world’s second‑largest importer of live cattle in 2026.

The national cattle inventory is projected to decline by 4% to 14.3 million head in 2026, with analysts citing high slaughter rates and financial stress among small producers. Annual calf losses, estimated between 400,000 and 500,000 head, nearly match the country’s yearly cattle imports.

In July 2025, the National Milk Council raised the reference price for raw milk by 7% to ₺18.35 per liter (around 45 cents per liter), but producers argue this remains below breakeven, estimated at ₺20.50 (51 cents). Rising feed and energy costs have outpaced milk revenues, leading many farmers to slaughter breeding cows and reduce herd sizes.

A mid-2025 outbreak of foot-and-mouth disease (FMD) disrupted the market, prompting accelerated slaughter and the closure of livestock markets. Despite a government vaccination campaign, average slaughter weights dropped to 270–300 kg per animal, down from over 400 kg in previous years, even as beef production rose to 1.7 million tons in 2025 and is forecast at 1.8 million tons in 2026.

Cattle imports are expected to stabilize at 450,000 head in 2026 under the state-run Meat and Milk Board, which now controls imports amid ongoing concerns over documentation and animal welfare. Beef imports are projected to rise to 70,000 tons, mostly from Poland, while exports remain minimal and restricted to small volumes of preserved meat.

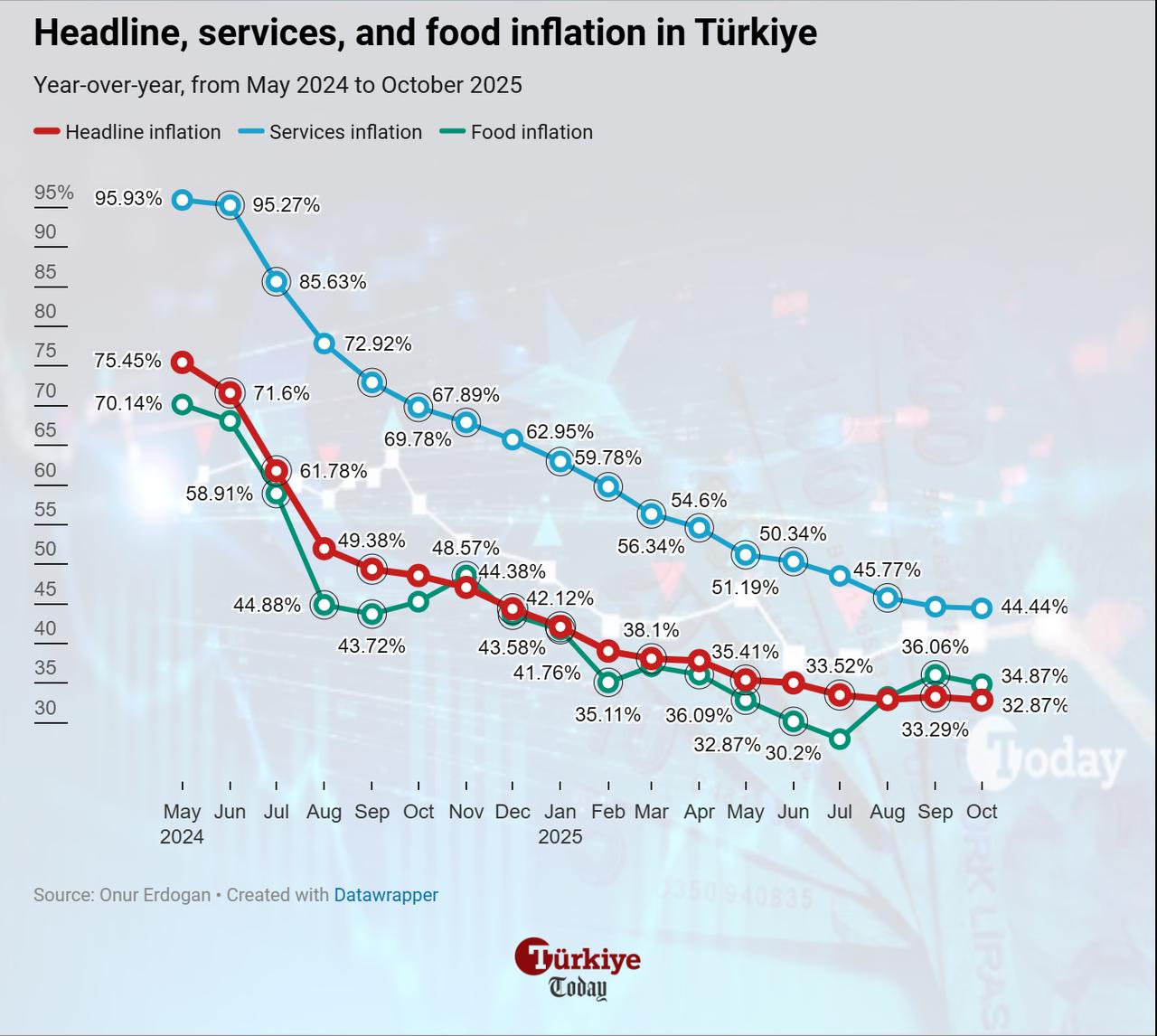

Bottlenecks in supply conditions have also placed upward pressure on domestic prices, with annual food inflation reaching 34.87%, outpacing the headline inflation rate of 32.87% as of October, according to the Turkish Statistical Institute (TurkStat). Among key subcategories, rice prices rose by 26.79%, flour and other cereals by 31.95%, and beef by 36.09%.

The situation not only impacts Turkish consumers’ wallets but also undermines the government’s disinflation program. When headline inflation rose in September, breaking a 15-month uninterrupted downward trend, food prices were the primary driver of the overall increase, registering a month-on-month jump of 4.6% and outpacing nearly all other expenditure groups.

In its latest Inflation Report, the Central Bank of the Republic of Türkiye (CBRT) revised its year-end inflation forecast for 2025, raising the projected range to 31%–33%, up from the previously estimated 25%–29%. The bank attributed the upward revision largely to unfavorable supply-side dynamics in food, citing persistent drought conditions.

The CBRT emphasized that food inflation remains highly sensitive to both domestic shocks, such as seasonal harvest shortfalls, and global commodity volatility, particularly in grains and meat. As a result, the bank signaled it may maintain a tight monetary stance for longer than previously expected, until underlying price pressures subside and the impact of supply-side constraints moderates.