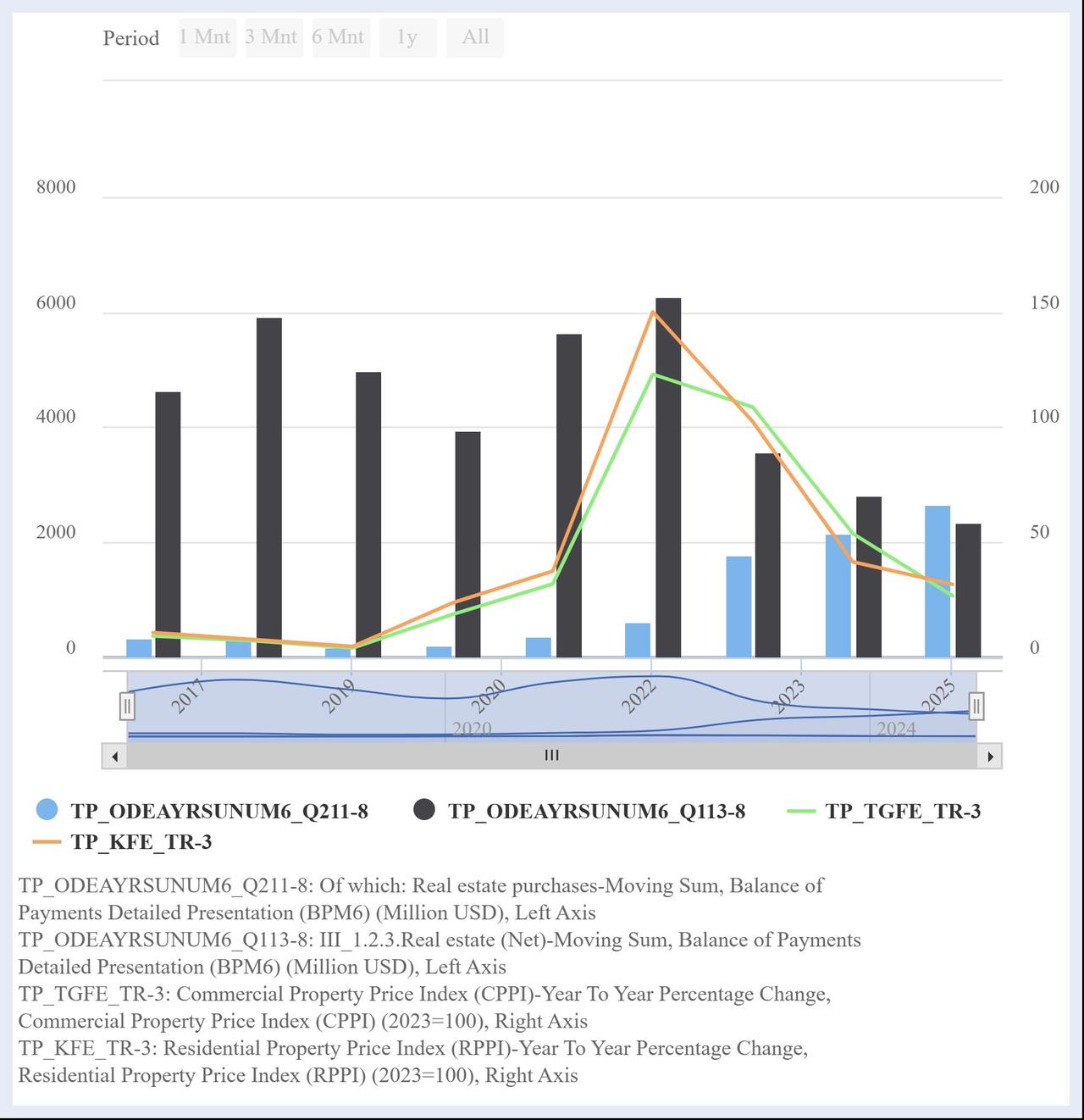

Turkish citizens’ real estate purchases abroad climbed to record levels in 2025, reaching $2.68 billion for the year and exceeding nonresident property investment into Türkiye for the first time, according to central bank data.

Outbound property buying, which picked up after 2023, continues to climb, with overseas real estate purchases rising from $1.8 billion in 2023 to above $2 billion in 2024 and reaching $2.7 billion in 2025.

Figures from balance of payments data showed that Turkish buyers purchased $252 million worth of foreign real estate in the final month of 2025. The monthly average for the year stood at $223 million, while the strongest single month was August, when purchases reached $288 million.

In contrast, nonresidents’ real estate investment in Türkiye fell in 2025, with total purchases by foreign residents dropping 17.02% to $2.34 billion, creating a $340 million gap.

In December alone, nonresidents posted a net real estate purchase of $287 million in Türkiye.

The main driver behind the trend appears to be rapid price inflation in Türkiye’s real estate market, where sharply rising residential and commercial property values have increased entry costs and pushed some investors to look for more affordable or stable opportunities abroad.

Central bank data indicate that after annual price increases in residential and commercial real estate peaked at 150% and 123% in 2022, the pace slowed but remained elevated through 2025. By year-end, residential property prices were still up 31.8% year over year, while commercial property prices rose 26.75%, showing that domestic asset values continued to climb even as momentum cooled, which continues to discourage investors.