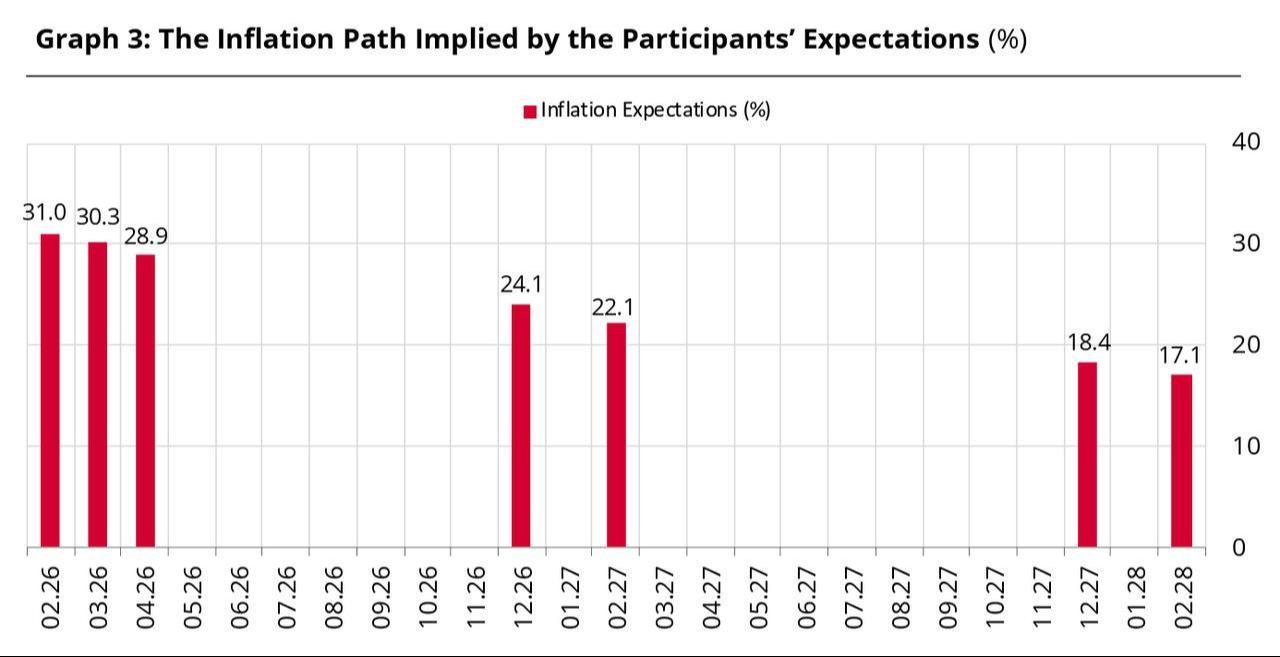

Market participants in Türkiye raised their year-end consumer inflation forecast to 24.11%, up from 23.23% in the latest Central Bank of the Republic of Türkiye (CBRT) survey, while expectations for policy rate cuts shifted toward a more limited easing cycle.

The expected monthly CPI increase for February rose to 2.54% from 2.05% in the previous survey period, implying annual inflation of around 31%.

The revision follows faster-than-expected price growth in January, which came in at 4.84% month-on-month and brought annual inflation down to 30.65%, along with a more cautious tone from policymakers during the presentation of the year’s first inflation report.

Survey participants priced in a gradual decline in the policy rate across upcoming meetings, with expectations centered on a roughly 100-basis-point cut in March, putting projected rates at 36.08%, 34.98%, and 33.69% for the first three decisions, respectively.

The policy rate expectation for 12 months ahead rose to 27.67%, indicating a higher forward path than earlier projections.

U.S.-based investment bank Goldman Sachs also echoed the more cautious market expectations in a recent note, saying total rate cuts delivered by year-end could fall short of a previously projected 900 basis points.

In its assessment, the bank said economic growth momentum in Türkiye adds pressure to inflation and may require additional monetary tightening measures.

The bank’s economists added that such tightening would likely come through non-rate tools rather than direct policy rate increases, pointing in particular to tighter credit growth limits.

During the inflation report briefing, Deputy Governor Cevdet Akcay said the timeline for phasing out macroprudential measures depends on how fast disinflation progresses, stating that "the faster disinflation moves, the sooner macroprudential tools can be withdrawn." He added that the main goal is for macroprudential measures to gradually return to their core function as disinflation gains speed.