The United States has exempted Kazakhstan’s main oil export pipeline, the Caspian Pipeline Consortium (CPC), and two major oil field ventures from sanctions imposed on Russian energy companies, allowing their operations to continue.

The license follows the U.S. decision in October to add Rosneft, Lukoil, and 34 subsidiaries of those companies to a new sanctions package targeting Russia’s energy sector.

The Treasury’s Office of Foreign Assets Control (OFAC) issued a general license authorizing all transactions related to the Caspian Pipeline Consortium (CPC), the Tengizchevroil joint venture, and the Karachaganak oil field development project.

However, the authorization explicitly excludes any transactions involving the sale, disposition, or transfer of ownership interests in these projects.

The exemption is designed to ensure operational continuity while preventing any changes in the ownership structure, particularly for Russian entities subject to sanctions.

Kazakhstan’s Energy Minister Yerlan Akkenzhenov confirmed on Nov. 12 that the government had applied for an exemption for the Karachaganak oil field. Akkenzhenov stated that the necessary paperwork had been submitted to U.S. authorities, explaining that the request aimed to prevent disruptions to operations at the field.

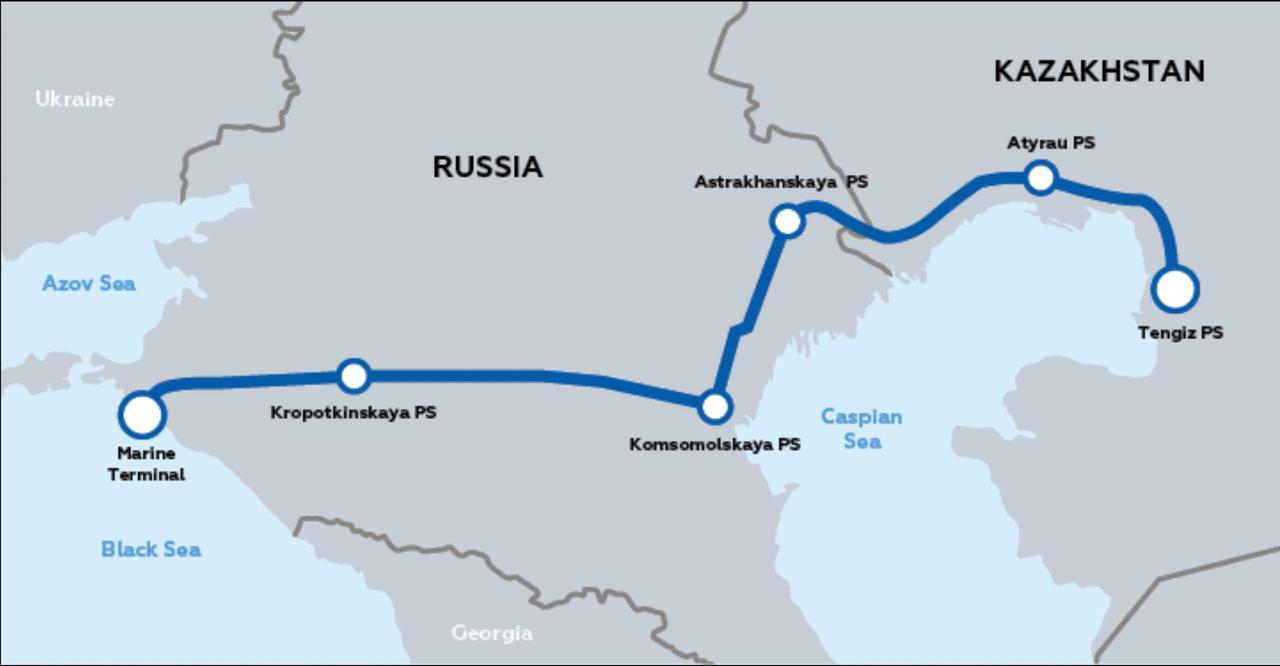

The CPC pipeline serves as Kazakhstan’s primary export route for crude oil produced at the Tengiz and Karachaganak fields. It transports oil to the Russian Black Sea port of Novorossiysk, where it is loaded onto tankers for shipment to international markets.

Established in 1992 by the governments of Russia, Kazakhstan, and Oman, the CPC was created to build a dedicated export route from Kazakhstan to the Black Sea.

It is operated by an international consortium that includes state-controlled firms and global energy companies.

The consortium’s largest shareholders are Transneft, KazMunaiGaz, and Chevron Caspian Pipeline Consortium Co., alongside LukArco, Mobil Caspian Pipeline Co., and Rosneft–Shell Caspian Ventures Ltd. Other shareholders include BG Overseas Holdings, Eni International, Kazakhstan Pipeline Ventures, and Oryx Caspian Pipeline.