U.S. stock markets closed at record levels Thursday as investors celebrated the Federal Reserve's first interest rate reduction of 2025, while Intel shares surged following news of a major investment from chipmaking rival Nvidia.

The S&P 500 gained 0.5 percent to close at 6,631.96, marking a fresh all-time high. The Dow Jones Industrial Average rose 0.3 percent to 26,142.42, and the technology-heavy Nasdaq Composite jumped 0.9 percent to 22,470.73. All three major indices set new records.

The market rally followed Wednesday's Federal Reserve decision to cut interest rates by 25 basis points, the central bank's first reduction this year as policymakers attempt to support a softening job market. Fed officials indicated they could implement two additional rate cuts in 2025, though future decisions will hinge on broader economic conditions.

"The move was really a validation and confirmation that Fed officials are looking to move policy towards neutral, so the direction of travel for interest rates ... is going to be lower," said Angelo Kourkafas, an analyst at Edward Jones.

However, Kourkafas cautioned that economic resilience could limit the extent of monetary easing ahead. "So far, growth is holding up, the economy is chugging along. And that restricts a bit... how much easing the Fed will deliver," he predicted.

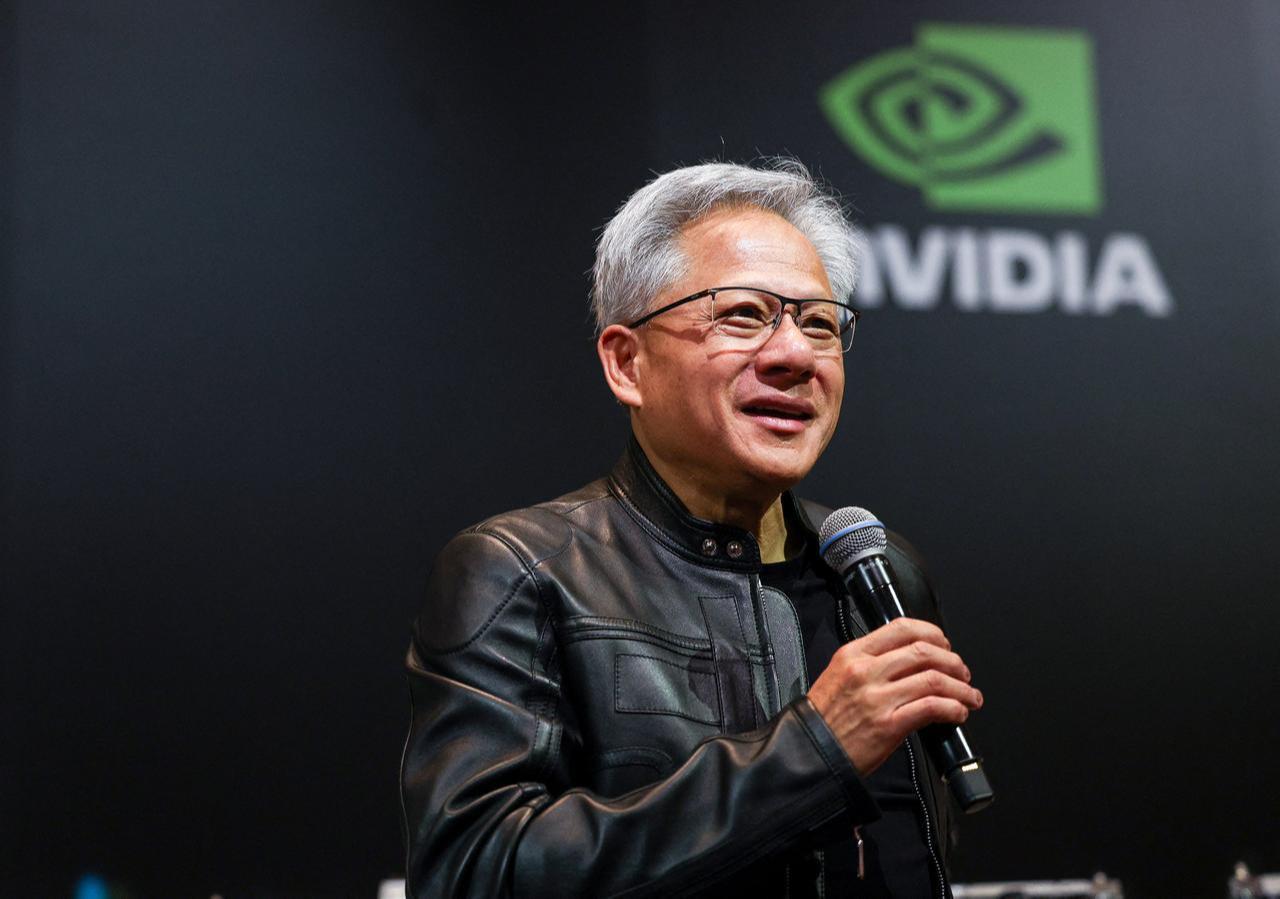

Individual stock movements were dominated by developments in the semiconductor sector. Intel shares rocketed nearly 23 percent after Nvidia announced a $5 billion investment in its struggling competitor. Nvidia's stock climbed 3.5 percent on the news.

The Nvidia investment represents a significant development in the chip industry, coming roughly a month after the Trump administration revealed plans for the U.S. government to acquire a 10 percent equity stake in Intel as part of broader efforts to strengthen domestic semiconductor manufacturing.

Meanwhile, cybersecurity firm CrowdStrike saw its shares surge 12.8 percent following a presentation in Las Vegas where the company detailed its data protection capabilities for artificial intelligence technologies. The presentation prompted several equity analysts to raise their price targets for the stock.

The combination of accommodative monetary policy and corporate developments in key technology sectors provided fresh momentum for markets already riding near historic peaks, suggesting continued investor confidence in the economic outlook despite ongoing uncertainties.