The world's largest sovereign wealth fund, Norges Bank Investment Management (NBIM), announced on Monday that it has withdrawn its investments from U.S. construction equipment manufacturer Caterpillar and five Israeli banks, citing their involvement in activities that contribute to human rights violations during the ongoing conflict in Gaza.

The five Israeli banks included in the list are First International Bank of Israel and its holding company FIBI Holdings Ltd, Bank Leumi Le-Israel BM, Mizrahi Tefahot Bank Ltd and Bank Hapoalim BM, according to a statement from the fund.

According to the fund's investment sheet, last updated on June 30, the total amount of the investments in these companies topped $2.7 billion, with the majority in Caterpillar at $2.12 billion and $660.92 million in Israeli banks.

The fund explained that the divestments were made on the advice of its Council on Ethics, an independent body that reviews companies against internationally recognized ethical standards.

The Council on Ethics highlighted that Caterpillar’s bulldozers have been used by Israeli authorities in the demolition of Palestinian homes, often in ways that contravene international law.

The council concluded that the company’s products were linked to actions that caused "serious violations of human rights in situations of war and conflict," prompting the exclusion.

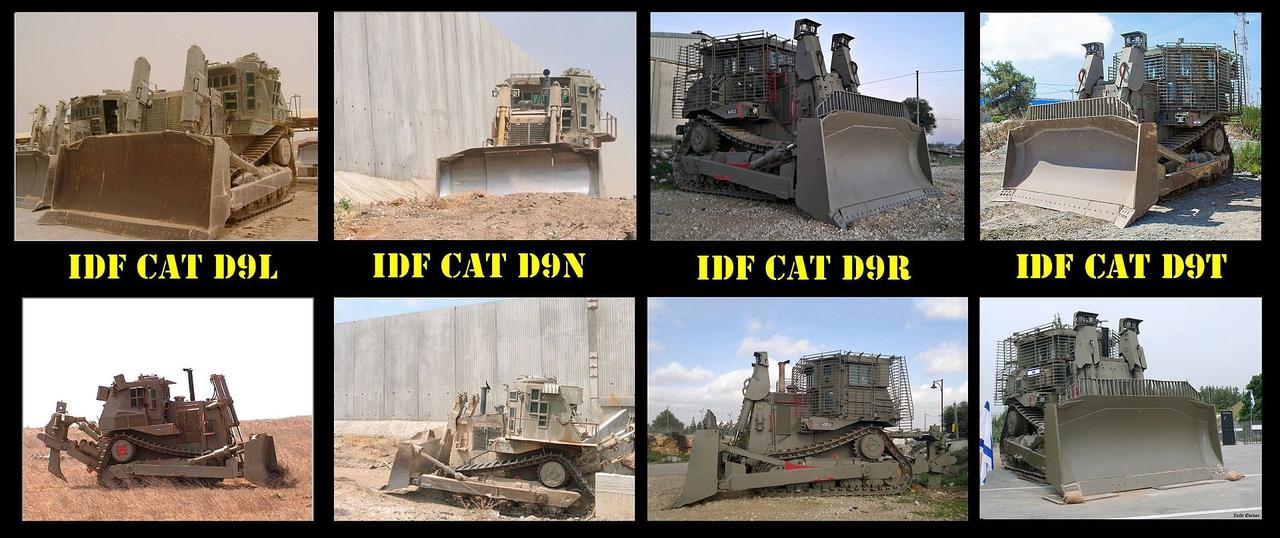

Caterpillar, known as one of the world’s leading engineering equipment manufacturers, has supplied a range of heavy demolition vehicles specially designed for the Israeli army, including wheel loaders, armored excavators, mini loaders and several models of the D9 series of armored bulldozers (notably the D9R, D9N, D9L and D9T).

According to Who Profits, an independent research center that tracks international companies in cooperation with the Israeli government, the most widely known machine is the D9 armored bulldozer, often referred to by its nickname "Doobi."

The vehicles are used in house demolitions and settlement construction in the occupied Palestinian territories, as well as for building the Separation Wall in the West Bank.

According to the Council on Ethics, the Israeli banks mentioned in the list provided financial services that enabled settlement construction in the West Bank.

Israeli settlements are considered illegal under international law, and the council said such activity contributes to long-term human rights concerns.

In August, the Israeli government unveiled a plan to expand settlements in the West Bank, along with a broader occupation strategy for Gaza that projects the displacement of millions of Palestinians.

NBIM, which manages assets worth about $2 trillion, is the world’s largest sovereign wealth fund, playing a central role in safeguarding the long-term value of Norway’s petroleum revenues.

The move follows an earlier decision on Aug. 12, when NBIM, which manages assets of about $2 trillion and is the world’s largest sovereign wealth fund, announced the divestment of $143 million from 11 Israeli companies.