U.S. President Donald Trump renewed criticism of Federal Reserve Chair Jerome Powell on Wednesday following a weaker-than-expected rise in private sector employment in May, urging the central bank to slash interest rates in response.

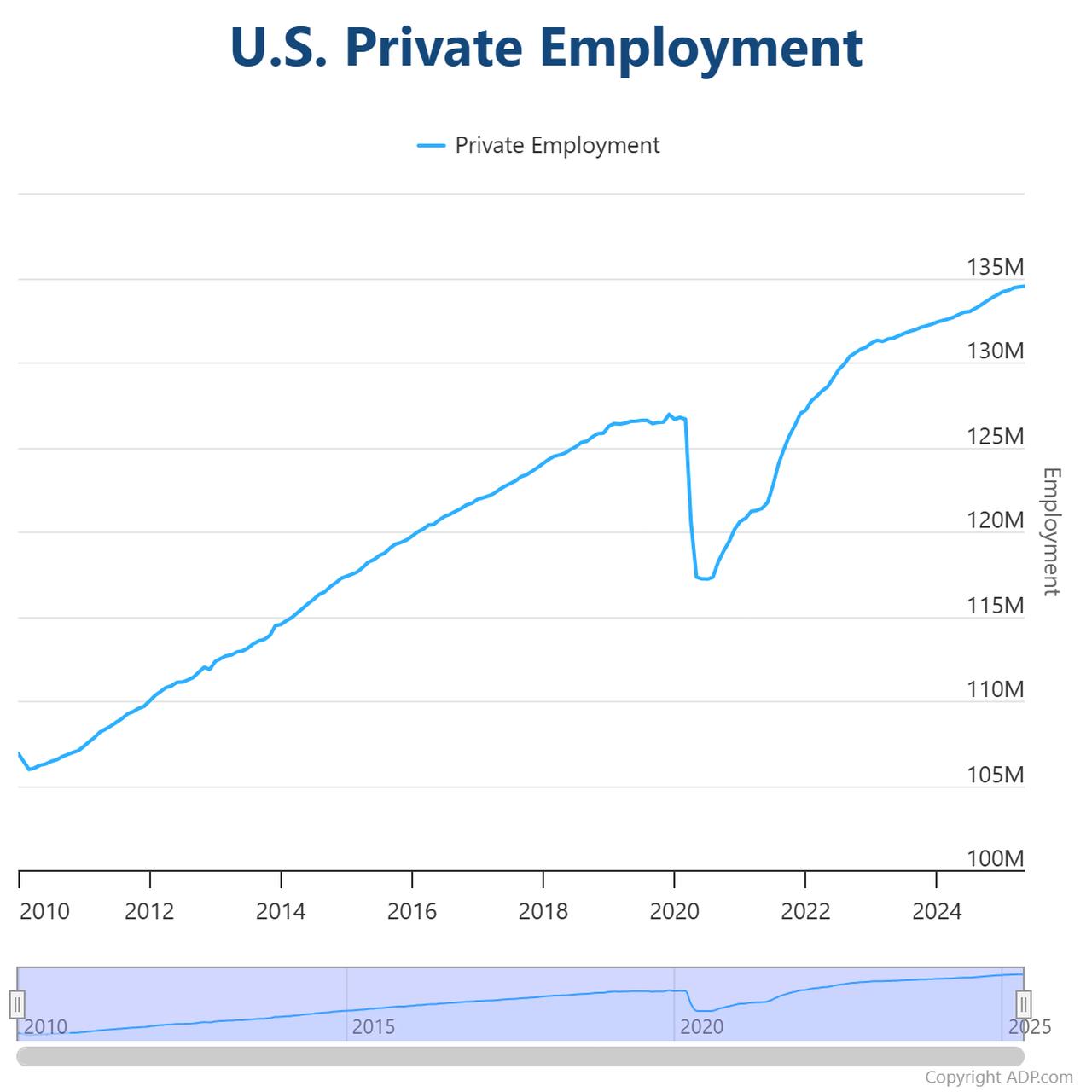

Trump took to social media to call Powell “Too Late,” referencing the ADP National Employment Report, which showed that the U.S. private sector added just 37,000 jobs in May. This marks the weakest monthly increase since March 2023, falling sharply short of market expectations of a 111,000-job gain.

“ADP NUMBER OUT!!! ‘Too Late’ Powell must now LOWER THE RATE,” Trump posted on TruthSocial, reiterating his long-standing demand for rate cuts to spur economic growth. He continued his criticism by calling Powell “unbelievable” and noting, “Europe has lowered NINE TIMES!”—highlighting the contrast with the European Central Bank, which is anticipated to reduce interest rates by 25 basis points later this week after eurozone inflation dropped to 1.9%, below the ECB's 2% target.

Trump has repeatedly called on Powell to ease monetary policy and has previously labeled him “a fool” and “a major loser.” Although he once floated the idea of dismissing the Fed chair before the end of his term, Trump later clarified he had “no intention” of doing so.

The ADP Research Institute's report for May pointed to a significant slowdown in hiring momentum. According to ADP, the services sector added 36,000 jobs during the month, while employment in the goods-producing sector declined by 2,000. Additionally, April’s job growth figure was revised down from 62,000 to 60,000, further underlining the slowdown.

Wage growth, however, remained relatively stable. ADP data—based on payroll records of over 25 million employees—showed a 4.5% year-on-year increase in annual pay.

Commenting on the figures, ADP Chief Economist Nela Richardson noted that the hiring pace has weakened after a strong start to the year, signaling broader concerns about the resilience of the U.S. labor market as monetary policy remains tight.

The Federal Reserve has kept its policy rate unchanged across the past five meetings, maintaining a cautious stance despite growing calls for easing. Meanwhile, global markets are closely watching for Thursday’s ECB decision, which could add further pressure on the Fed to reconsider its rate path.