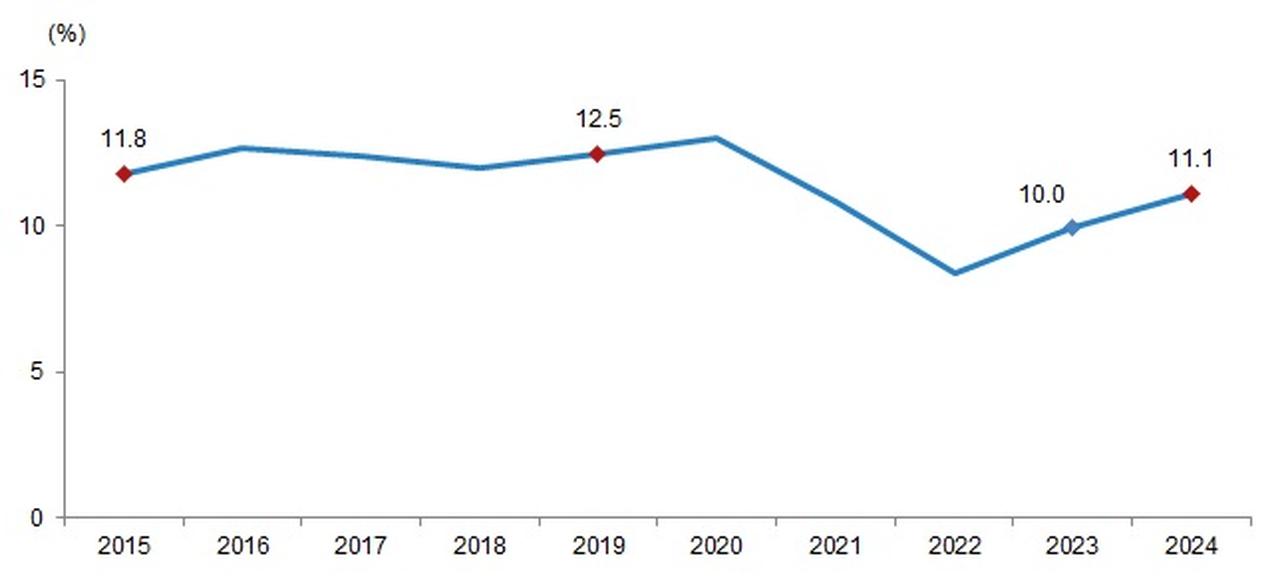

Türkiye’s social protection spending reached nearly ₺5 trillion ($118 billion, approximately) in 2024, marking an 84 percent increase compared to the previous year. The figures were published by the Turkish Statistical Institute (TurkStat) as part of its annual release of Social Protection Statistics.

The data point to a system under significant fiscal expansion, largely reflecting inflationary pressures, demographic trends, and rising benefit levels. Social protection has become one of the largest expenditure items within the broader public finance structure.

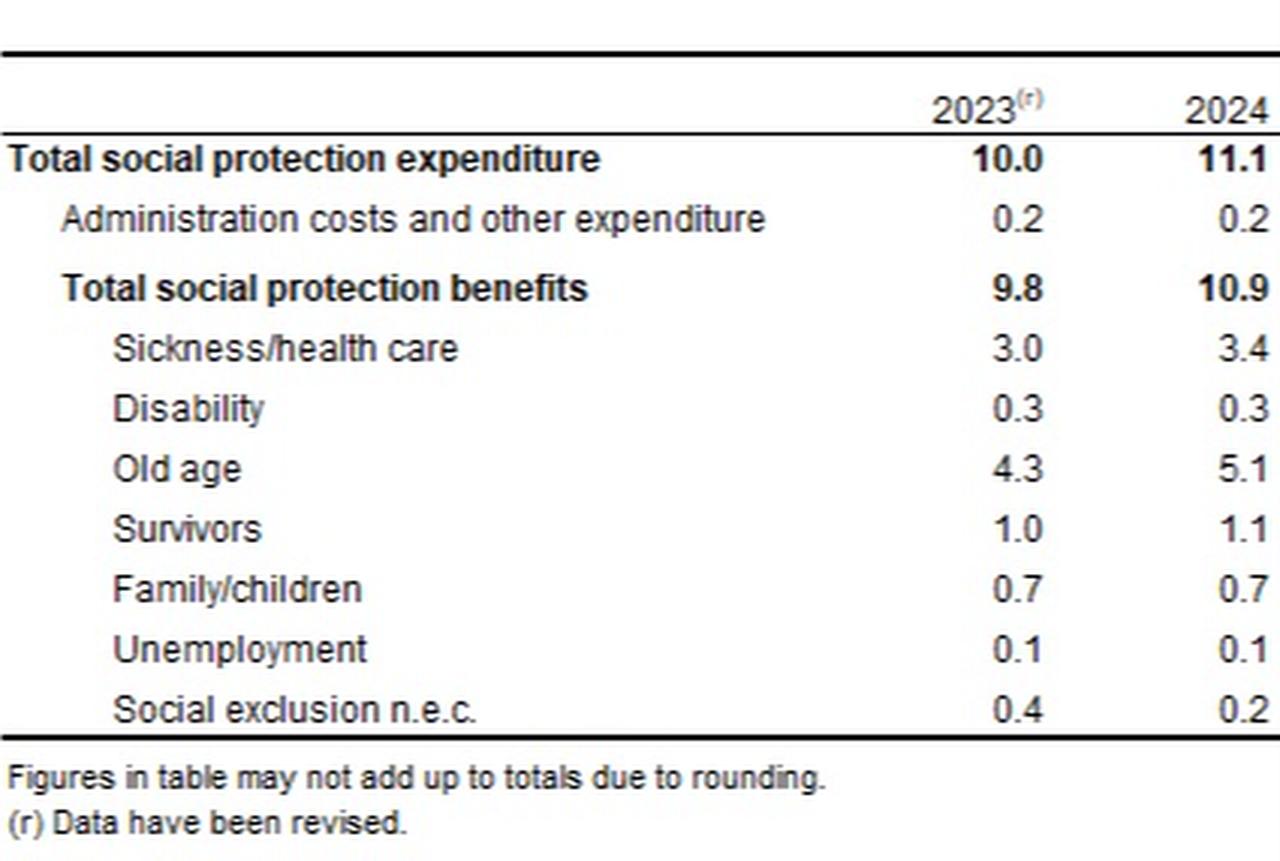

Nearly all of that spending went directly to social protection benefits. Administrative costs and other related expenditures made up a relatively small share.

This structure highlights that Türkiye’s social protection framework remains heavily benefit-oriented, with limited diversion of resources toward overhead or auxiliary spending.

For foreign observers, the scale matters. Social protection is no longer a peripheral policy area in Türkiye; it has become a central pillar of the state’s fiscal architecture.

At the heart of this expansion sits one category: retirees and the elderly. In 2024, pensions and old-age support absorbed roughly $54 billion, accounting for the single largest share of social protection spending.

That means nearly one out of every two lira spent on social protection went to retirees. The figure reflects both an aging population and repeated adjustments to pension payments amid high inflation.

Health care followed as the second-largest item. Spending related to illness and health care reached about $36 billion, underscoring rising treatment costs and sustained demand for public health coverage.

Measured against economic output, the picture becomes even sharper. Social protection spending reached 11% of gross domestic product, with pensions alone accounting for 5% of gross domestic product (GDP).

Breaking the data down by risk and need categories reveals the priorities embedded in the system. After retirees and health care, support for widows and orphans emerged as the third-largest category, accounting for 1.1% of GDP.

Other groups, including families with children, people with disabilities, the unemployed, and those facing social exclusion, received smaller but still significant allocations. Together, they form the backbone of Türkiye’s welfare architecture.

In total, social protection benefits span eight main risk groups, ranging from unemployment and housing to disability and social exclusion. The structure mirrors European welfare models, though with a stronger emphasis on cash transfers.

The dominance of pensions and health spending indicates that the current system responds more to demographic pressure than labor market volatility.

Not all assistance flows automatically. Around 11 percent of social protection benefits in 2024 were conditional, tied to specific criteria such as schooling, health checkups, or eligibility assessments.

Within this category, family and child benefits dominated, taking more than half of all conditional aid. Disability-related support followed, while health-linked conditional assistance ranked third.

Still, Türkiye’s welfare model remains overwhelmingly cash-based. Nearly two-thirds of all benefits were delivered directly as cash payments.

Among those cash transfers, retirees again stood out. Almost three-quarters of all cash assistance went to pensioners and the elderly, reinforcing their central role within the system.

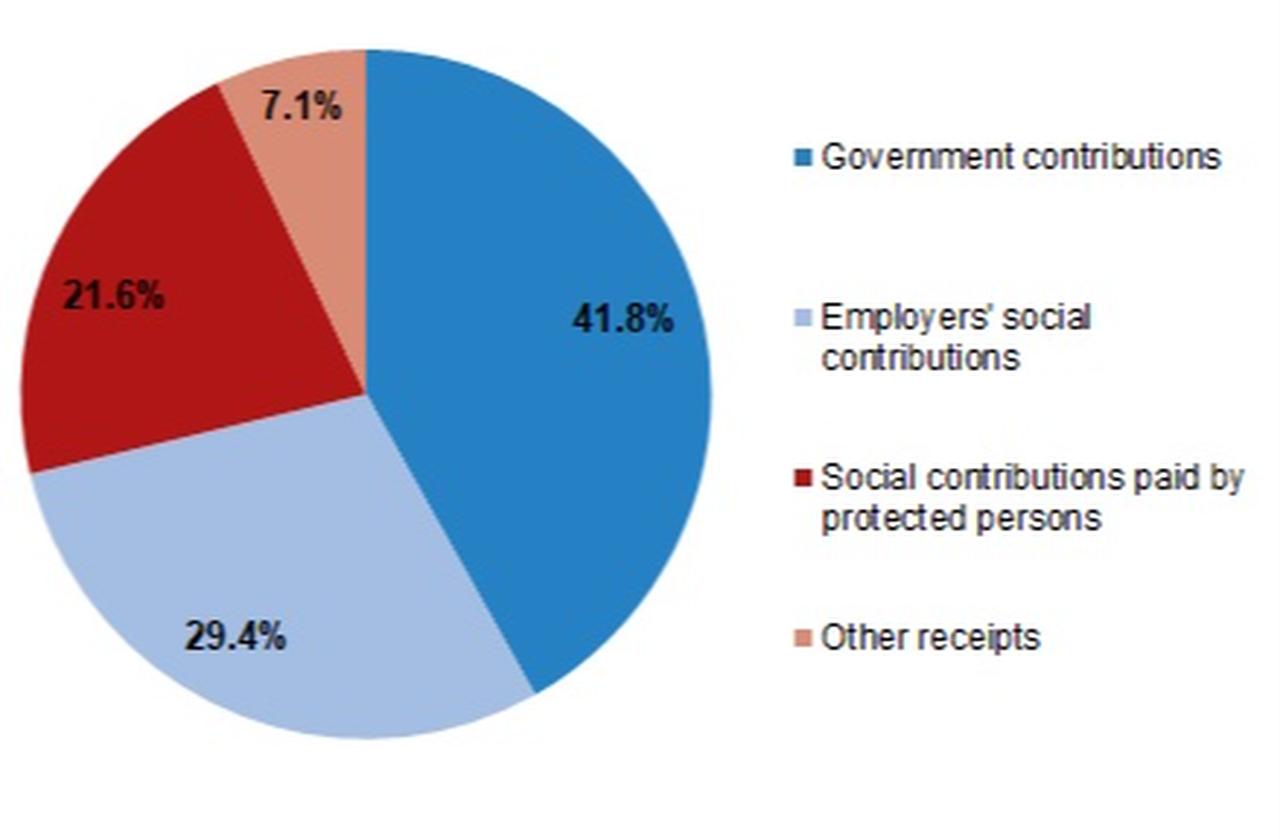

Financing such a large system requires multiple revenue streams. In 2024, state contributions covered 41.8% of social protection income, making the central government the single largest financier.

Employers contributed one-third of it through social security payments, while individuals covered by the system provided 21.6% themselves. The balance reflects a hybrid model combining public funding with contributory mechanisms.

This mix places Türkiye somewhere between tax-funded welfare states and contribution-heavy social insurance systems. As benefit levels rise, the sustainability of this balance is likely to remain a key policy debate.

The expansion of spending has been matched by growth in coverage. In 2024, the number of people receiving pensions or regular allowances under social protection schemes reached 17.48 million, up from 16.89 million a year earlier.

That increase may appear modest at 3.5 percent, but it translates into hundreds of thousands of additional beneficiaries. The total number of payments, including multiple benefits received by the same individuals, rose to 18.34 million.

Together, these figures point to a welfare system that is not only growing in size but also deepening its reach.

The statistics show that for Türkiye, the nearly five-trillion-lira question is no longer whether social protection is expanding, but how long such expansion can be sustained.