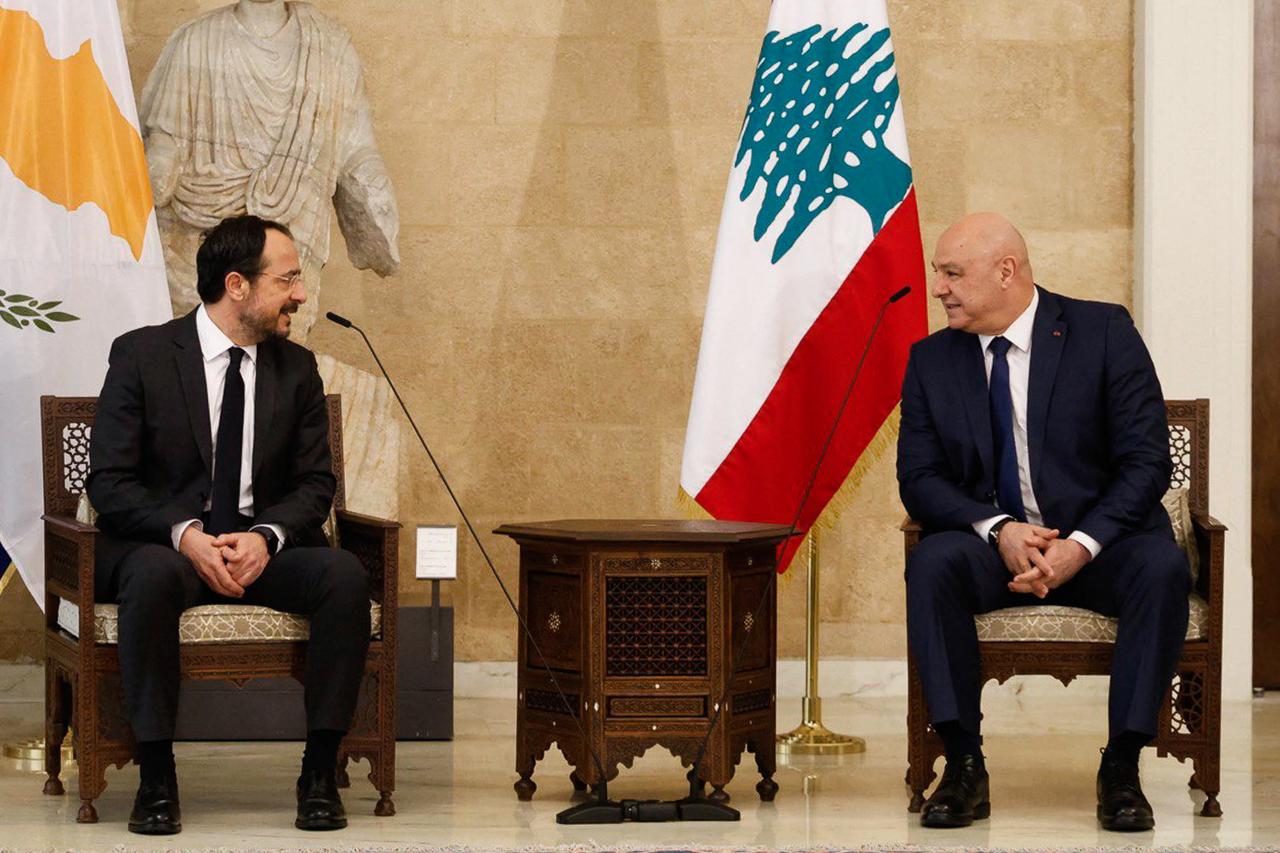

Lebanon and the Greek Cypriot Administration have signed a long-delayed maritime boundary agreement, reviving a file that had been frozen since 2007. The deal does not touch Türkiye’s declared continental shelf coordinates submitted to the United Nations in March 2020, nor does it intersect the Türkiye-Turkish Cyprus maritime jurisdiction areas. For this reason, Ankara has kept its response deliberately measured, noting through diplomatic channels that the agreement does not directly encroach on Turkish rights.

Public rhetoric in Greece and the Greek Cypriot press, however, has portrayed the deal as a strategic “blow” to Türkiye, while Lebanese officials have framed it as a step toward economic stabilization. Lebanese media close to the opposition have already questioned whether Beirut is conceding between 2,000 and 5,000 square kilometers of potential offshore area, and whether the cabinet should have waited for full parliamentary ratification.

Türkiye’s restrained posture reflects a simple fact: no direct legal infringement has occurred. But that is only the surface of the story. The deeper significance lies not in the coordinates themselves, but in the political normalization that follows. Each new agreement in the Eastern Mediterranean, even one that does not violate Türkiye’s declared rights, reinforces a cartographic order that systematically excludes the Turkish and Turkish Cypriot perspective. The map is not redrawn overnight. It shifts gradually.

To understand what the Lebanon-Greek Cypriot deal means for Türkiye, we must examine the three underlying layers driving it: Lebanon’s economic desperation, the Greek Cypriot and Greek approach to maritime issues, and Europe’s broader energy realignment after the Russian gas shock.

Lebanon’s immediate motivations are shaped by economic survival. Since the 2019 financial collapse, Beirut has lacked foreign investment, fiscal stability, and energy security. The 2022 U.S.-mediated Israel-Lebanon maritime agreement unlocked the possibility of offshore exploration and allowed Beirut to present itself as a rules-based actor in the eyes of international lenders. The new deal with the Greek Cypriot Administration must be viewed in this context.

Even though Lebanese experts warn that sticking to the 2007 median-line formula may lead to a loss of maritime area compared to more maximalist interpretations of the tri-junction point, Beirut’s leadership views the agreement as a step toward stabilizing investor expectations rather than an assertive geopolitical maneuver. The controversy within Lebanon (including accusations that the cabinet acted without full constitutional process) underlines how contested the move is at home.

For the Greek Cypriot Administration and Athens, the agreement aligns with a long-standing pattern rather than a newfound “strategic breakthrough.” Their objective has remained consistent: to generate a chain of formally registered boundaries that reflect their own interpretation of maritime law. The specific coordinate points of the Lebanon agreement do not directly impair Türkiye’s continental shelf claim, but they help embed a regional framework that sidelines the northern coast and treats the island as if it were represented solely by the Greek Cypriot Administration. This is why the agreement is politically relevant to Türkiye even when no legal overlap exists. It reinforces a political and legal fiction in which the Turkish Cypriot coastline is rendered invisible. A similar dynamic would emerge if a future Syria-Greek Cypriot agreement were concluded once Damascus stabilizes, which could narrow Türkiye’s maneuvering space in the eastern basin much more substantially.

The energy backdrop is the third and most structural layer. Europe’s gas imports from Russia have fallen by more than 80% since 2021, forcing the EU to seek diversification across the Eastern Mediterranean. The 3+1 framework linking the United States, Greece, Israel, and the Greek Cypriot Administration has been reactivated, with renewed attention to grid interconnectors, LNG infrastructure, and possible pipeline concepts.

Even if an Israel-Europe gas pipeline remains uncertain, every delimitation agreement that reduces perceived risk increases the bargaining leverage of Greece and the Greek Cypriot Administration within this emerging energy architecture. This does not immediately disadvantage Türkiye, especially as Ankara strengthens its own hand through TANAP expansion and increased production at the Sakarya gas field. But it does mean that regional defaults (the “starting assumptions” of future negotiations) are drifting toward an order that does not reflect Turkish or Turkish Cypriot positions.

Türkiye’s core challenge is therefore not the Lebanon-Greek Cypriot agreement as a set of coordinates. The country faces no direct maritime loss. Rather, the challenge is the cumulative effect of unilateral arrangements that slowly consolidate an order in which Türkiye and the TRNC are treated as peripheral actors. The 2019 Türkiye-Libya maritime delimitation agreement remains the primary structural counterweight to this trend, but it cannot, on its own, counterbalance a growing network of third-party deals that create their own political momentum.

Given this landscape, the appropriate Turkish response is neither overstatement nor complacency. What is needed is a calibrated diplomatic posture that avoids feeding maximalist narratives on the Greek Cypriot side while still articulating clear red lines. Ankara should deepen its engagement with Beirut, emphasizing that any future discussions regarding the unresolved Lebanon-Syria boundary must consider the wider regional geography, including the Turkish continental shelf and Turkish Cypriot interests.

Türkiye should also expand technical dialogues with the European Union on energy transit, highlighting its indispensable role in east-west gas flows and the unique flexibility provided by its LNG and pipeline network. At the same time, Ankara must continue to reinforce the legitimacy and operational relevance of the Türkiye-Libya memorandum, which remains the sole formal counter-map to the Greek Cypriot interpretation of the region.

The Lebanon-Greek Cypriot deal is not a defeat for Türkiye. It is a reminder that the Eastern Mediterranean is moving again, piece by piece, through incremental agreements that gradually shape the diplomatic terrain. Türkiye retains strong legal, geographic, and strategic advantages. But protecting them requires sustained diplomatic initiative, technical engagement, and a clear narrative that reflects both national interests and the realities of the evolving regional map. The map will continue to move. The question is whether Türkiye moves with it or simply reacts to it.