This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Nov. 17 issue. Please make sure you are subscribed to the newsletter by clicking here.

Non-economic factors have once again begun to weigh on Turkish markets. Most recently, the indictment against Ekrem Imamoglu—who was removed from his post as mayor of the Istanbul Metropolitan Municipality as part of a corruption investigation—was unveiled last week.

With the announcement of the indictment, which seeks a prison sentence of up to 2,430 years for Imamoglu, risk appetite in the markets has declined.

Looking at price action on Borsa Istanbul, the BIST 100 index tested levels above 11,000 points last week and hit an intraday high of 11,044. After the indictment, however, the index fell to as low as 10,373 points on Tuesday.

On a weekly basis, the index lost 3.28% in value and closed at 10,565 points. It seems likely that developments on the political front will continue to shape overall market sentiment.

At the same time, scrutiny over alleged illicit activity on Borsa Istanbul has intensified in recent weeks. Earlier in November, Treasury and Finance Minister Mehmet Simsek stated: “We know that certain manipulations are being carried out, especially through some funds."

He added that the government would work to increase penalties and strengthen the regulatory framework, warning that if market manipulation could not be fought forcefully, confidence would remain weak, and stressed that addressing shortcomings and combating manipulation was non-negotiable, with efforts extending even beyond those against the informal economy.

Despite this backdrop, we can highlight as positive factors the relatively stable outlook of Türkiye’s CDS risk premium, which has remained close to 240 basis points, and the continued calm in exchange rates.

Cleansing the markets of manipulation can, in fact, be read as a development that will ultimately boost confidence.

In the meantime, the latest third-quarter earnings released on the stock exchange have generally been better than in previous quarters, which also counts as a positive development.

Among the companies listed on the BIST 30 index, which consists of large companies, we see that profits at firms such as Koza Altin, Gubre Fabrikalari, Emlak Konut REIT, Turk Telekom, Yapi Kredi Bank, Koc Holding and Enka Insaat have increased by more than 50%. However, with financing costs still high, the need for interest-rate cuts to support listed companies is once again underscored.

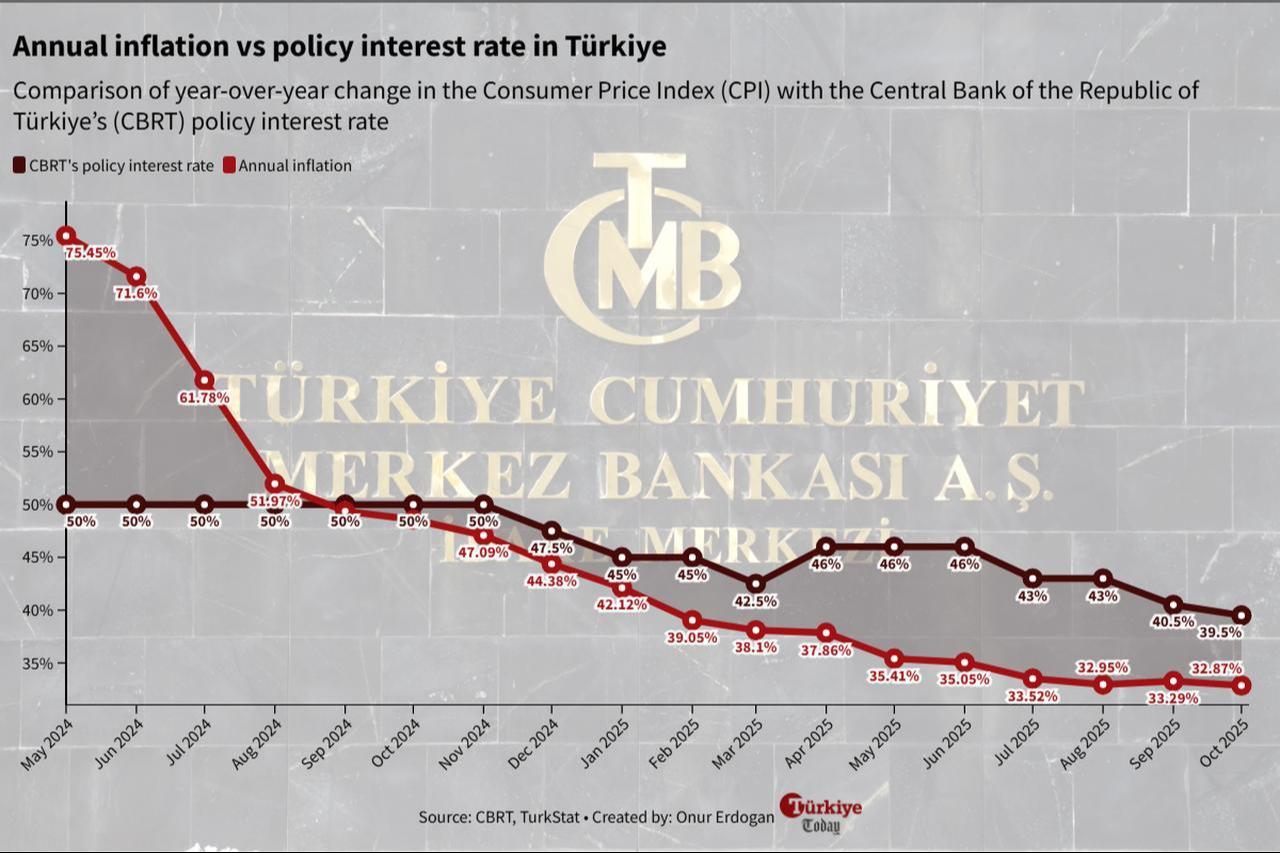

In a report published last week by Akbank Economic Research, the inflation forecast for November was put at 1.5%. In line with this projection, it was noted that a rate cut of up to 150 basis points at the Central Bank of the Republic of Türkiye’s December meeting has now come into view. As interest rates fall and financial statements continue to improve, we may see the stock-market index in Türkiye move to higher levels.