Syria’s central bank governor, Abdelkader Hasriyeh, said that the termination of the U.S. Caesar Act would represent the final and most significant step toward paving the way for his country’s integration into the global banking system.

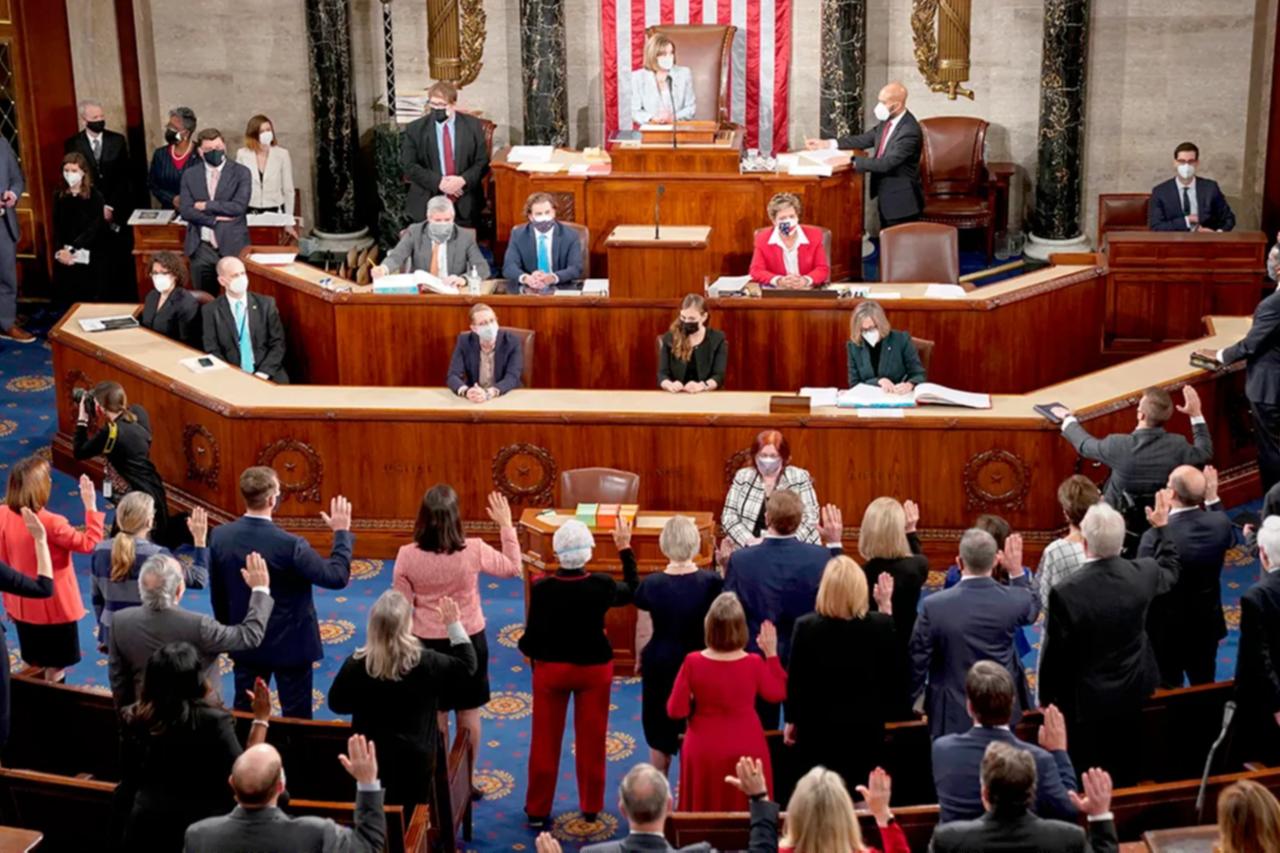

The U.S. House of Representatives voted on Wednesday by a majority in favor of lifting the sanctions imposed on Syria under the Caesar Act, which was passed in December 2019 to punish the former regime for war crimes committed against the Syrian people during the years of the revolution.

Hasriyeh said in an exclusive interview with Al Jazeera that the law, which has been suspended since the fall of Bashar al-Assad’s regime, left a negative impact on Damascus’s financial transactions and its ability to manage reserves after most international banks halted dealings with it.

Because of this law, the Central Bank of Syria was unable to carry out key functions such as printing currency, shaping monetary policy, and securing liquidity, measures that Hasriyeh affirmed will be initiated immediately once the Caesar Act sanctions are formally lifted.

Syria had also been unable to benefit from global financial technology due to the Caesar sanctions, which Hasriyeh described as a miracle to have lifted.

He stressed that taking advantage of such technologies will require establishing clear and well-defined financial policies and objectives.

The central bank governor said the government has prepared plans to develop the financial and banking system once the Caesar sanctions are lifted, adding that the bank has received training at the U.S. Treasury Department and has held discussions with major banks regarding its next steps.

Damascus aims, after the lifting of sanctions, to integrate into the global banking system in a way that enables it to secure liquidity and attract foreign investments.

Countries such as Qatar, Saudi Arabia, the United Arab Emirates and Türkiye have pledged to inject significant investments into Syria once the Caesar Act is officially terminated.

Hasriyeh added that the central bank has developed a banking strategy extending through 2030, centered on combating money laundering and adjusting monetary policy to boost confidence in Syria’s financial system, supported by new legislation currently being formulated.

On Nov. 10, the U.S. Treasury Department announced the suspension of sanctions imposed on Syria under the Caesar Act for 180 days.

On Dec. 11, 2019, the U.S. Congress approved the Caesar Act to punish senior figures in the Assad regime for war crimes committed against civilians in Syria.

Repealing the law would pave the way for the return of foreign investments and aid to support the new Syrian government led by President Ahmed al-Sharaa, which was established in March 2025.

The U.S. sanctions have constituted a major obstacle to the recovery of the Syrian economy, and their removal is considered evidence of the new Syrian government’s success.