Türkiye’s pharmaceutical market grew by 92.2% in 2023, reaching ?211 billion ($6.18 million), according to a comprehensive report by the Pharmaceutical Manufacturers Association of Türkiye (IEIS).

Including medical health products, the market’s value rose to ?231.5 billion. However, rising costs and a low exchange rate have slowed the sector’s growth in real terms.

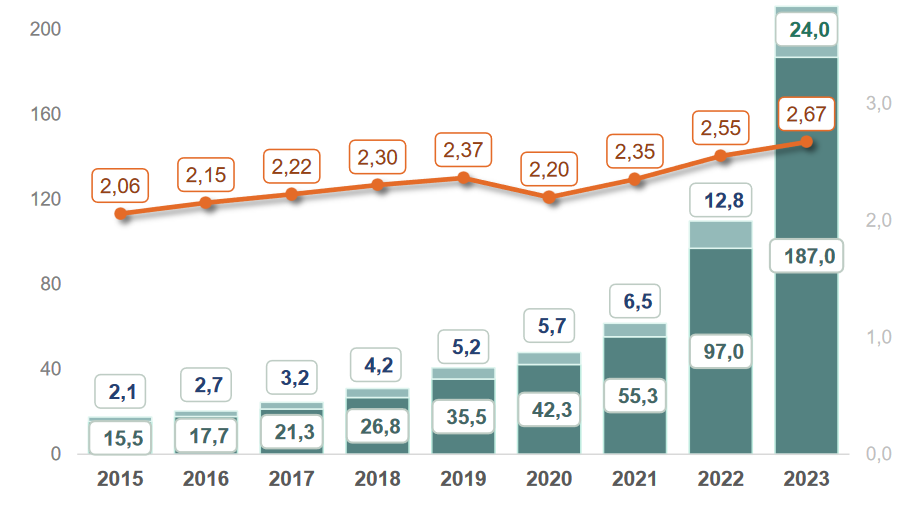

In terms of volume, the pharmaceutical market grew by 4.6% in 2023, reaching 2.67 billion units. However, the sector's real growth, when adjusted for inflation, is significantly lower. Over the past nine years, the volume has increased by 29.8%, but real growth stands at just 12.7%.

The IEIS report underscores the pressures the industry is facing, particularly the rising costs due to inflation and currency fluctuations. Despite updates to the exchange rate in July and December, the sector continues to struggle.

“Although the market grew in volume by 29.8% over nine years, the real value growth of just 12.7% highlights the industry's weakening position year by year,” the report stated.

The report highlights a significant concentration within the market, with the top 50 pharmaceutical companies accounting for 85% of the market value and 82% of the volume. Among these, 38 firms exclusively sell imported drugs, while 121 focus on locally manufactured medicines. Additionally, 71 companies operate in both segments.

The report notes that in 2023, 94.3% of the pharmaceutical market’s value was from drugs covered under reimbursement programs, amounting to ?199 billion.

Volume (billion boxes)

Value (billion TL)

Average price (TL)

Pharma Market

2.67

211.01

78.9

Prescription Medicine

2.64

209.08

79.3

Covered by Reimbursement

2.60

198.05

76.1

Not Covered by Reimbursement

0.04

11.02

304.6

Non-prescription medicine

0.04

1.93

54.2

Covered by Reimbursement

0.02

0.98

40.8

Not Covered by Reimbursement

0.01

0.96

81.2

Pharmaceutical market reimbursement share (2023). (Source: IQVIA, IEIS)

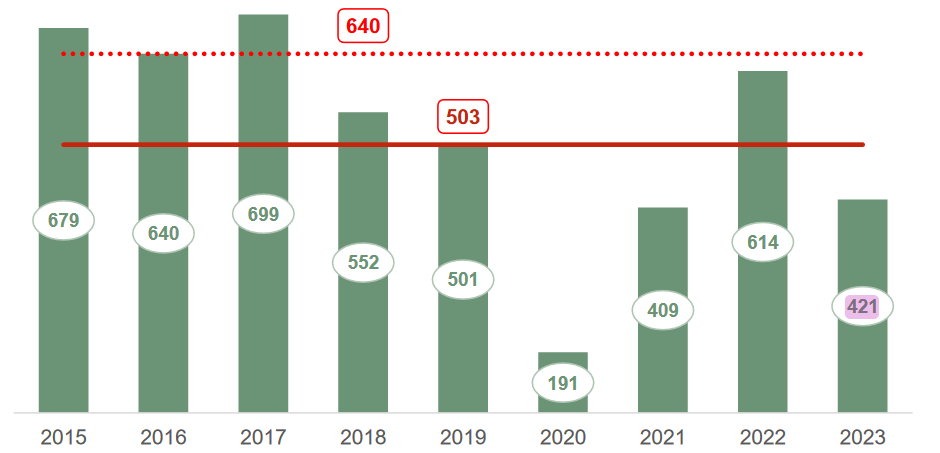

One of the major challenges highlighted in the report is the declining number of new drug licenses. In 2023, only 421 new licenses were granted, a significant drop compared to the 2011-2023 average of 640 licenses. The slowdown in licensing not only impacts the availability of new treatments for consumers but also affects industry investment and growth.

“The licensing process delays are hindering forward-looking investment plans and delaying consumer access to new alternatives,” the report emphasized.

In the reference and generic drug market, the report shows a marked difference in performance.

However, in terms of volume:

Between 2015 and 2023, the generic drug market outperformed reference drugs, growing by 1,387.5%, with an average annual growth rate of 40.1%.

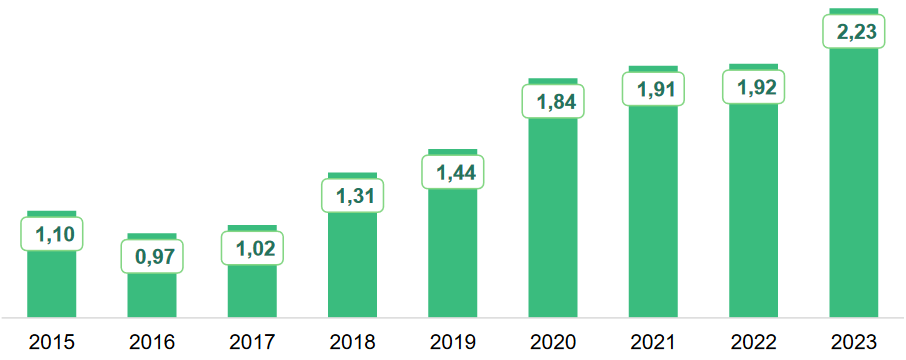

Türkiye’s pharmaceutical exports reached a record high of $2.23 billion in 2023, growing by 16.2%. In comparison, pharmaceutical imports rose by 7.8% to $5.74 billion. Despite challenges, the sector’s export-to-import ratio increased from 22% in 2015 to 39% in 2023.

In terms of volume, local production reached 2.44 billion units in 2023, growing by 5.9%, while imported drugs saw a 6.7% decline to 0.23 billion units.