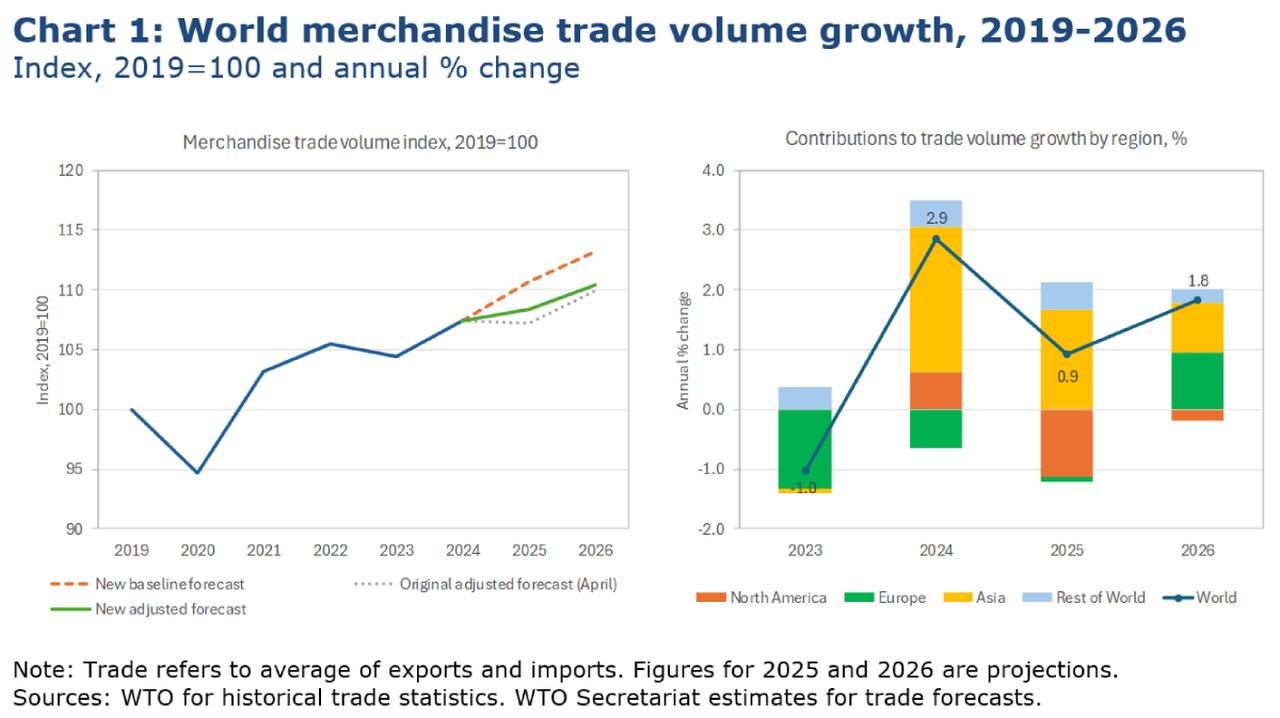

The World Trade Organization (WTO) has raised its projection for global merchandise trade growth in 2025 to 0.9%, up from a 0.2% contraction forecast in April, citing a surge in early-year imports to the United States ahead of anticipated tariff hikes.

However, the organization warned that higher tariffs, including those implemented this week, are likely to weigh on trade in the second half of 2025 and further slow growth in 2026.

The WTO’s previous forecast, issued in April, anticipated a sharper slowdown in global trade due to tariff measures announced by the United States in early April. At that time, the outlook dropped from a pre-tariff growth estimate of 2.7% to a projected 0.2% contraction.

According to the WTO's update on Friday, U.S. import volumes rose 11% year-on-year in the first half of 2025, with a sharp 14% quarter-on-quarter increase in the first quarter followed by a 16% decline in the second quarter. The surge was driven by “frontloading” — the practice of accelerating imports ahead of expected tariff increases — and inventory accumulation.

A similar pattern, though less pronounced, was observed in other economies, potentially reflecting concerns over retaliatory trade measures. This frontloading effect provided the largest boost to the revised 2025 forecast.

Asia is expected to remain the largest positive driver of global trade growth in 2025, with exports from the region projected to increase 4.9%, up from the 1.6% forecast in April.

In contrast, North America’s imports are now expected to fall by 8.3% in 2025, a smaller drop than the 9.6% decline previously projected, while the region’s exports will contract by 4.2%.

Europe’s trade contribution has weakened, with exports expected to fall 0.9% and imports to grow just 0.4% this year.

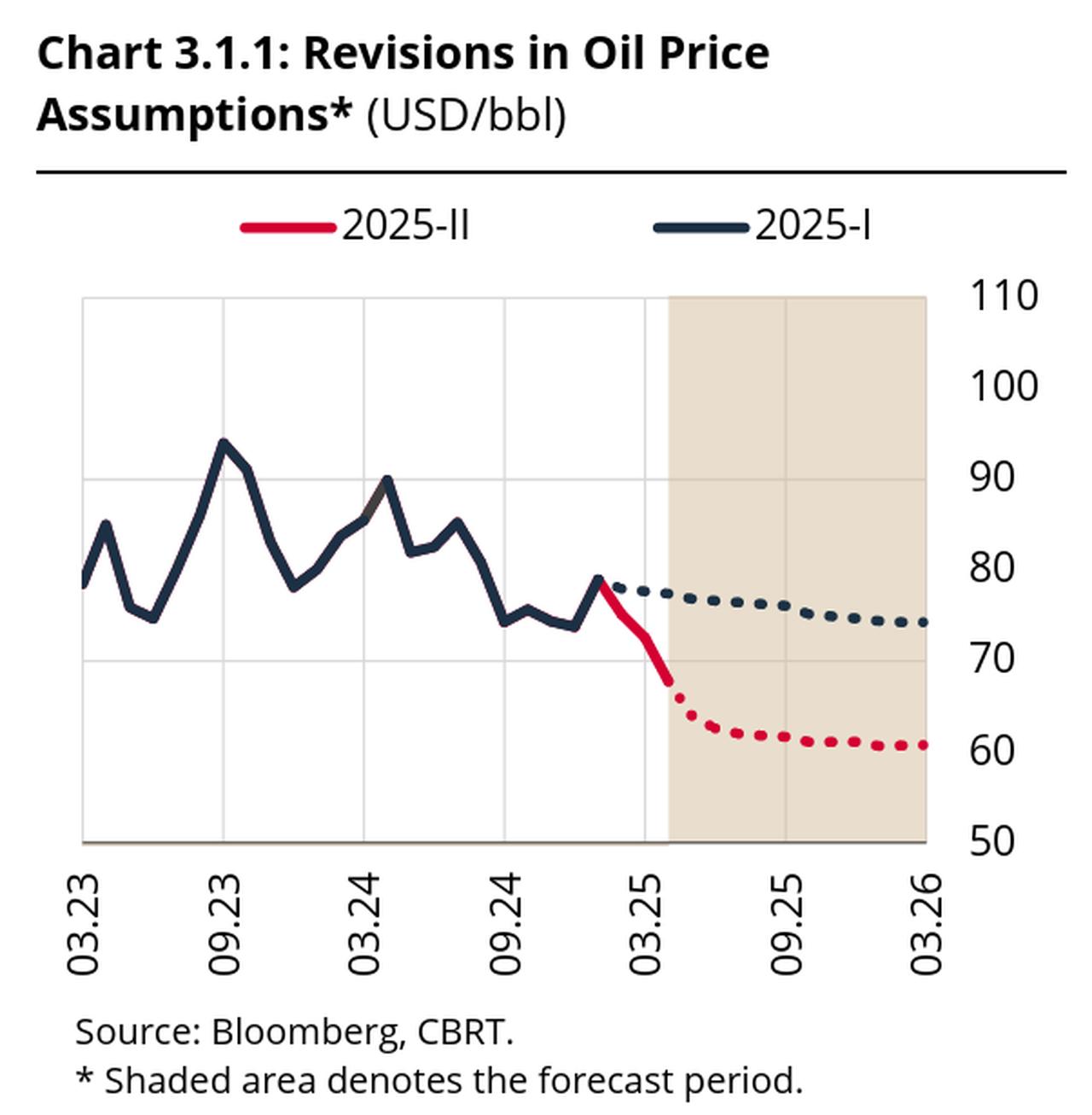

Economies reliant on energy exports are forecast to see their contribution shrink in 2026 as lower oil prices reduce revenues and dampen demand.

In this context, Türkiye is expected to see a reduced burden from energy imports on its balance sheet, as the country’s energy-excluded current account posted a $36.4 billion surplus on an annual basis as of May.

The Turkish central bank also estimated the average price of Brent crude at $65.7 per barrel for 2025 in its second inflation report, noting that lower prices would help narrow the current account gap and ease inflation.

As of Friday’s close, Brent crude was priced at $66.32 per barrel.

The WTO reduced its 2026 trade growth forecast to 1.8% from 2.5%, citing the delayed effects of new tariffs.

While a U.S.-China truce and exemptions for certain goods such as motor vehicles have softened some of the impact, higher “reciprocal” tariff rates introduced on August 7 are expected to increasingly constrain trade.

WTO Director-General Ngozi Okonjo-Iweala said global trade had demonstrated resilience despite “persistent shocks,” including tariff increases. “Frontloaded imports and improved macroeconomic conditions have provided a modest lift to the 2025 outlook,” she noted, adding that the full impact of recent tariff measures was still emerging and that uncertainty remained a disruptive force for business confidence, investment, and supply chains.

Okonjo-Iweala also stressed that a damaging cycle of retaliatory tariffs had so far been avoided and said the WTO Secretariat would continue monitoring developments and working with members to preserve stability and predictability in the global trading system.